- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (RKT): Exploring Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Rocket Companies.

Rocket Companies’ share price may have cooled off over the past month, but momentum remains strong in the bigger picture, with a standout year-to-date share price return of 52% and a remarkable three-year total shareholder return of 178%. Recent moves likely reflect investors recalibrating after a big run, rather than any dramatic change in growth prospects or company fundamentals.

If you’re weighing other breakout opportunities, now is a great time to expand your search and discover fast growing stocks with high insider ownership

The question now is whether Rocket Companies’ recent pullback offers investors a compelling entry point, or if the strong gains so far mean the market has already factored in high expectations for future growth.

Most Popular Narrative: 6.3% Undervalued

Rocket Companies' most popular narrative puts its fair value slightly above the last closing price, hinting at some remaining upside despite the recent rally. The narrative's fair value calculation is based on both optimistic growth projections and shifting financial expectations.

The market may be ascribing premium value to Rocket's data ecosystem and cross-sell capabilities from the expanded "FinTech ecosystem." However, this could prove overly optimistic if younger demographic cohorts delay home-buying due to persistent affordability problems. Such delays could dampen anticipated growth in customer lifetime value and overall revenues.

Want to know what powers this bold valuation? The real story is tucked inside some razor-sharp revenue forecasts and margin bets that break from tradition. Curious which numbers underpin the narrative’s confidence? Find out how just a few aggressive financial assumptions could redefine what Rocket Companies is ultimately worth.

Result: Fair Value of $17.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing affordability challenges or a slowdown in home-buying demand could quickly undermine the optimistic outlook and put pressure on Rocket Companies' expected growth.

Find out about the key risks to this Rocket Companies narrative.

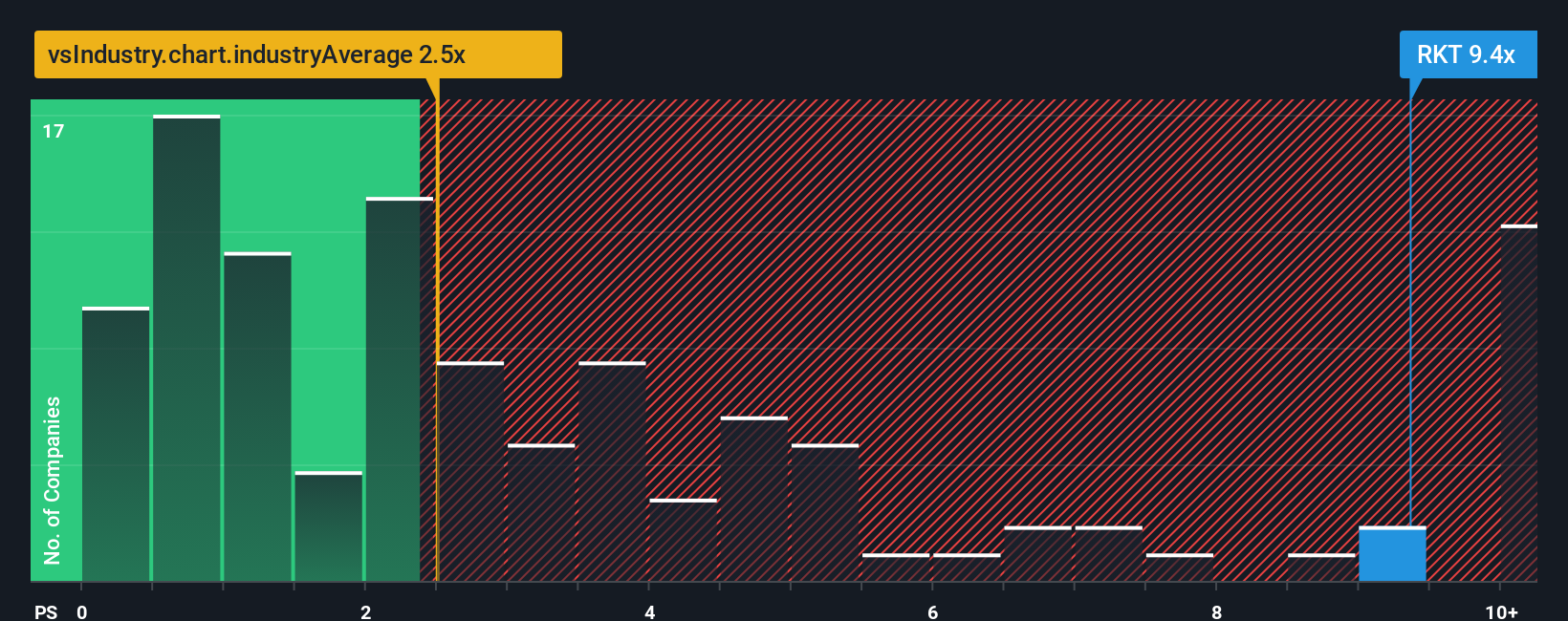

Another View: Valuing by Price-to-Sales

Looking at Rocket Companies through a price-to-sales lens delivers a very different picture. The company trades at a ratio of 9 times, which is much higher than both the industry average at 2.6 times and its peer average of just 2.2 times. While the current fair ratio is estimated at 10.3 times, this signals a narrow margin for error. A gap this wide suggests the market has already priced in substantial future growth and leaves little room for disappointment. Could this valuation prove justified, or are expectations simply running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Companies Narrative

If you're not convinced by these perspectives or prefer your own analysis, you can dive into the data and shape a narrative in just a few minutes. Do it your way.

A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors broaden their horizons. Check out handpicked opportunities you may have missed and spark your portfolio’s next move with these powerful investment themes:

- Boost your income potential by targeting companies with generous payouts using these 20 dividend stocks with yields > 3%. These options consistently deliver attractive yields above 3%.

- Uncover tomorrow’s disruptors by tapping into these 24 AI penny stocks, which are powered by artificial intelligence and positioned at the forefront of market innovation.

- Get ahead with value-driven stocks by investigating these 876 undervalued stocks based on cash flows, which trade below intrinsic value and offer strong fundamentals for your watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives