- United States

- /

- Diversified Financial

- /

- NYSE:RKT

How Investors Are Reacting To Rocket Companies (RKT) Q3 Earnings Date Amid Redfin and Mr. Cooper Integrations

Reviewed by Sasha Jovanovic

- Rocket Companies announced it will release its third quarter 2025 earnings on October 30, 2025, accompanied by a leadership conference call and webcast for investors on the same day.

- This update comes as Rocket continues its transformation into an integrated homeownership platform, following recent acquisitions of Redfin and Mr. Cooper that are broadening its business scope and presenting new integration and execution considerations.

- We'll explore how Rocket's evolving business model and acquisition integration efforts could shift its investment narrative and future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Rocket Companies Investment Narrative Recap

To be a Rocket Companies shareholder today, you need to see long-term value in its vision of becoming a comprehensive digital homeownership platform, with successful integration of recent Redfin and Mr. Cooper acquisitions as a key catalyst. The upcoming earnings release date announcement does not materially impact current short-term catalysts or the top risk, which remains the operational challenge of integrating these sizable acquisitions while managing cyclical pressures in housing and consumer credit.

Among recent announcements, Rocket’s acquisition of Mr. Cooper stands out as directly related to the business model transformation that investors are watching. This deal brings scale and expands servicing capabilities, making it a potential driver for synergies and efficiency gains, crucial elements for the near-term investment story as Rocket aims to consolidate its position as a full-spectrum provider.

But with execution risks in integrating these acquisitions lurking just beneath the surface, investors should be aware that...

Read the full narrative on Rocket Companies (it's free!)

Rocket Companies' narrative projects $8.7 billion revenue and $3.2 billion earnings by 2028. This requires 19.3% yearly revenue growth and a $3.2 billion increase in earnings from the current -$308,000.

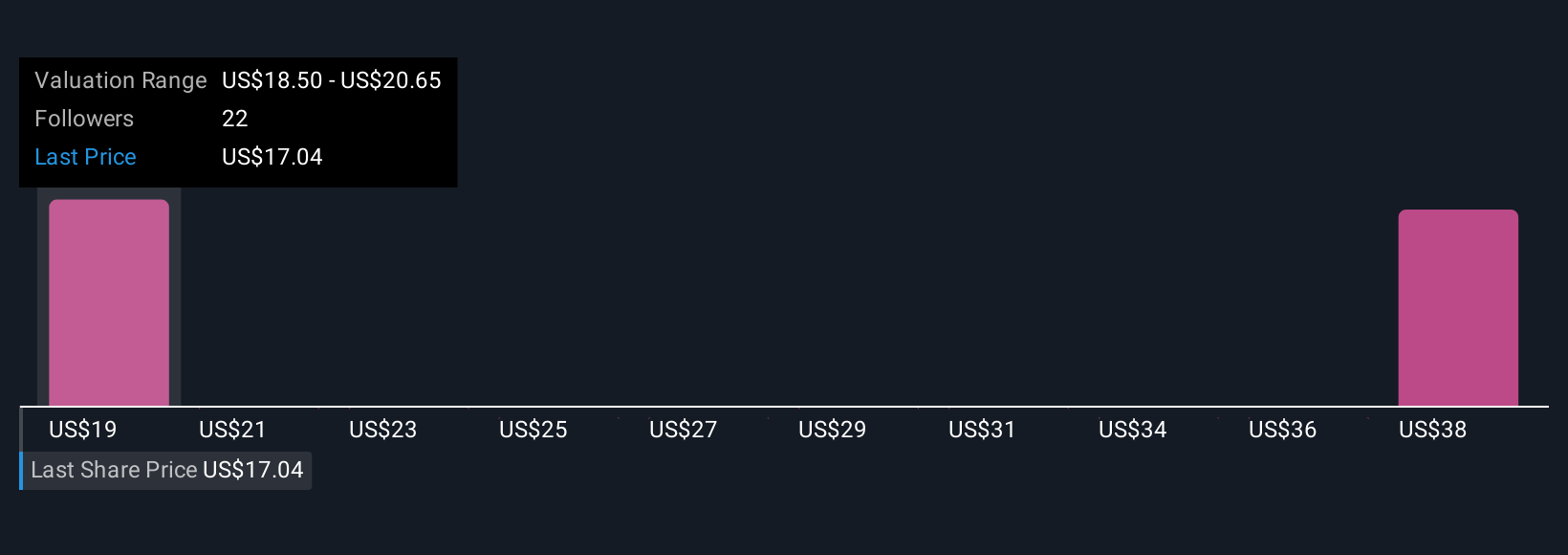

Uncover how Rocket Companies' forecasts yield a $18.50 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Seven fair value opinions from the Simply Wall St Community span US$18.50 to US$40 per share, showing wide variance in expectations. While some see opportunity, the complexity of integrating major acquisitions could shape the company’s performance in the coming quarters, so consider all these perspectives before making any decisions.

Explore 7 other fair value estimates on Rocket Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Rocket Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rocket Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rocket Companies' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives