- United States

- /

- Capital Markets

- /

- NYSE:RJF

Raymond James (RJF) Profit Margins Decline, Reinforcing Market’s Cautious Growth Narratives

Reviewed by Simply Wall St

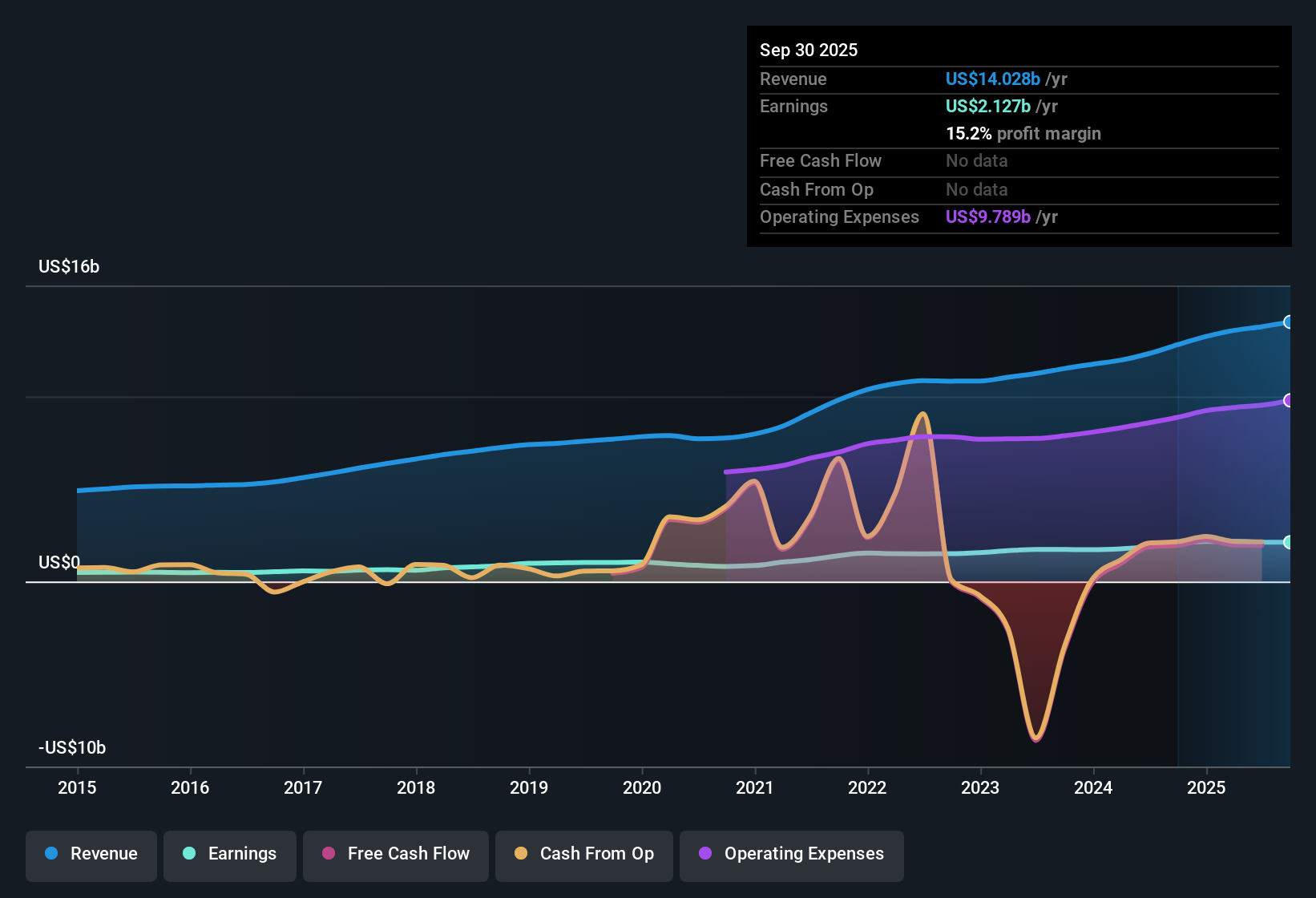

Raymond James Financial (RJF) is forecasting earnings growth of 9.04% per year, with revenue expected to climb 7.7% annually. These growth rates are behind the broader US market, where earnings are forecast to rise 15.5% per year and revenue by 10%. The company’s net profit margin stands at 15.2%, slipping from last year's margin of 16.1%. Over the past year, earnings grew 3.4% for RJF, which is noticeably lower than its five-year annual average of 15.5%. While profit growth has moderated in the most recent period, the company continues to be noted for historically high-quality earnings.

See our full analysis for Raymond James Financial.Next, we will see how these latest results stack up against the prevailing narratives in the market and within the Simply Wall St community, highlighting where expectations are being met and where surprises may be found.

See what the community is saying about Raymond James Financial

Analyst Price Target Just Above Market

- The analyst consensus price target stands at $182.67, less than 11% above Raymond James Financial's current share price of $165.08. This suggests that analysts see the stock as fairly valued in the near term.

- Consensus narrative highlights that to support this valuation, the company would need to grow revenue to $17.3 billion and earnings to $2.7 billion by 2028, while maintaining a price-to-earnings ratio of around 15.1x. This is below the 26.7x average for the US capital markets industry.

- This projection depends on steady increases in earnings per share and a continued decline in share count, with analysts assuming a 2.28% annual decrease in shares outstanding.

- The relatively narrow gap between current price and target indicates that the market already prices in much of the anticipated profit and revenue growth provided by RJF's strategy.

- Consensus signals that while the company is forecast to grow steadily, the upside is limited unless future growth or valuation multiples exceed expectations. See how RIJF’s pricing fits into the consensus view of its business trajectory and competitive standing. 📊 Read the full Raymond James Financial Consensus Narrative.

Discounted Valuation Against Peers

- Raymond James Financial’s price-to-earnings ratio is 15.4x, a sizeable discount compared to the peer average of 27x and the US capital markets industry average of 25.9x.

- Consensus narrative points to this valuation gap as a reward for current investors, as RJF trades well below its DCF fair value of $201.29. However, it also notes that the company’s slower projected earnings growth relative to its peers may justify the lower multiple.

- Investors drawn to value often highlight both the discounted P/E ratio and the gap to DCF fair value as reinforcing the case for upside if growth improves.

- At the same time, analysts argue that a lower multiple may persist if RJF’s revenue and margins continue to lag the rest of the market.

Profit Margin Resilience and Cost Pressure

- Net profit margin has slipped from 16.1% last year to 15.2% currently, a drop of 0.9 percentage points that partially offsets the company’s reputation for high-quality earnings.

- Analysts’ consensus view acknowledges that, despite this margin pressure, margin expansion could resume over the next three years, supported by investments in artificial intelligence and growth in high-net-worth client services.

- Consensus notes that AI-driven operational efficiencies and an expanding share repurchase strategy could improve net margins to 15.7% by 2028.

- However, critics point out that risks remain if technology spending runs ahead of returns or if market volatility restricts asset inflows and reduces deal activity.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Raymond James Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have an alternative angle on the numbers? Share your perspective and shape your own story in under three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Raymond James Financial.

See What Else Is Out There

Raymond James Financial’s lower earnings growth, shrinking profit margin, and muted analyst upside suggest more limited long-term momentum compared to leading growth stocks.

If you want steadier prospects, use our stable growth stocks screener (2089 results) to zero in on companies delivering reliable revenue and earnings growth across changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RJF

Raymond James Financial

A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives