- United States

- /

- Capital Markets

- /

- NYSE:RJF

Is Raymond James Financial, Inc.'s (NYSE:RJF) P/E Ratio Really That Good?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll look at Raymond James Financial, Inc.'s (NYSE:RJF) P/E ratio and reflect on what it tells us about the company's share price. Raymond James Financial has a price to earnings ratio of 13.15, based on the last twelve months. That is equivalent to an earnings yield of about 7.6%.

Check out our latest analysis for Raymond James Financial

How Do You Calculate Raymond James Financial's P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Raymond James Financial:

P/E of 13.15 = USD96.27 ÷ USD7.32 (Based on the trailing twelve months to September 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each USD1 of company earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

How Does Raymond James Financial's P/E Ratio Compare To Its Peers?

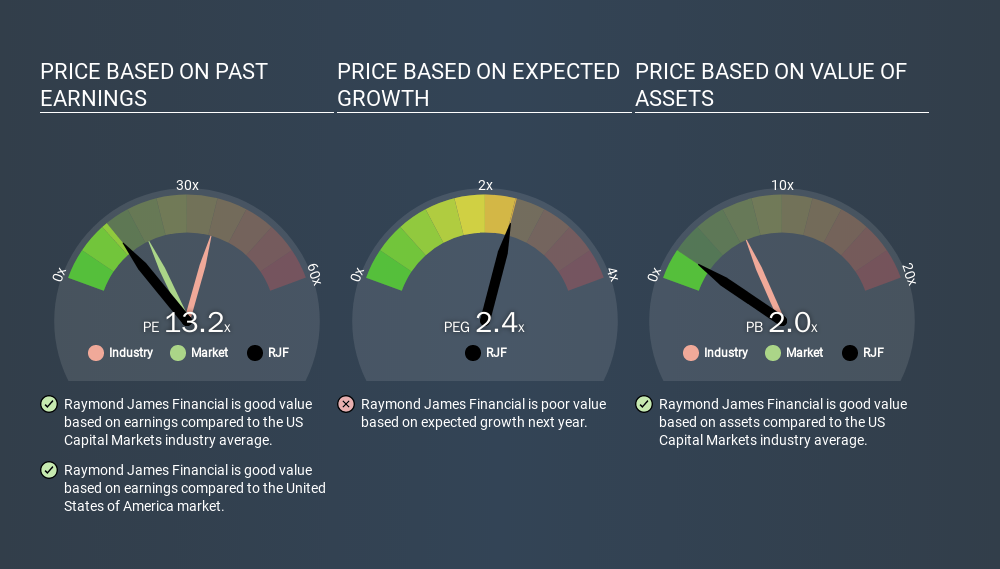

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. The image below shows that Raymond James Financial has a lower P/E than the average (36.7) P/E for companies in the capital markets industry.

This suggests that market participants think Raymond James Financial will underperform other companies in its industry. Since the market seems unimpressed with Raymond James Financial, it's quite possible it could surprise on the upside. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Raymond James Financial increased earnings per share by an impressive 24% over the last twelve months. And its annual EPS growth rate over 5 years is 17%. This could arguably justify a relatively high P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Is Debt Impacting Raymond James Financial's P/E?

With net cash of US$4.3b, Raymond James Financial has a very strong balance sheet, which may be important for its business. Having said that, at 32% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On Raymond James Financial's P/E Ratio

Raymond James Financial trades on a P/E ratio of 13.2, which is below the US market average of 19.0. It grew its EPS nicely over the last year, and the healthy balance sheet implies there is more potential for growth. The below average P/E ratio suggests that market participants don't believe the strong growth will continue.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Raymond James Financial. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:RJF

Raymond James Financial

A diversified financial services company, provides private client group, capital markets, asset management, banking, and other services to individuals, corporations, and municipalities in the United States, Canada, and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives