- United States

- /

- Diversified Financial

- /

- NYSE:RDN

Radian Group (RDN): Evaluating Whether Current Housing Demand and Analyst Views Signal Undervalued Opportunity

Reviewed by Simply Wall St

Radian Group (RDN) has been turning heads lately, even without any splashy news or big announcements. The real driver of the renewed investor focus seems to be much quieter: growing conviction that the company could be trading below its fair value. With analysts highlighting solid demand for private mortgage insurance due to tight housing supply and persistently high home prices, some investors are giving Radian Group a second look as the sector evolves.

Despite the lack of buzzworthy headlines, Radian Group’s stock has shown steady momentum, rising over the past month and delivering a positive return so far this year. While longer-term performance has been even more eye-catching, short-term gains have been supported by optimism around housing market stability. Still, questions around the company’s heavy reliance on mortgage insurance and limited diversification have not gone away. These remain central to understanding its risk profile going forward.

After these moves, the question is whether Radian Group is a value play hiding in plain sight, or if the market has already factored in all the upside. Is now the time to take a closer look, or is the stock’s growth story already priced in?

Most Popular Narrative: 5% Undervalued

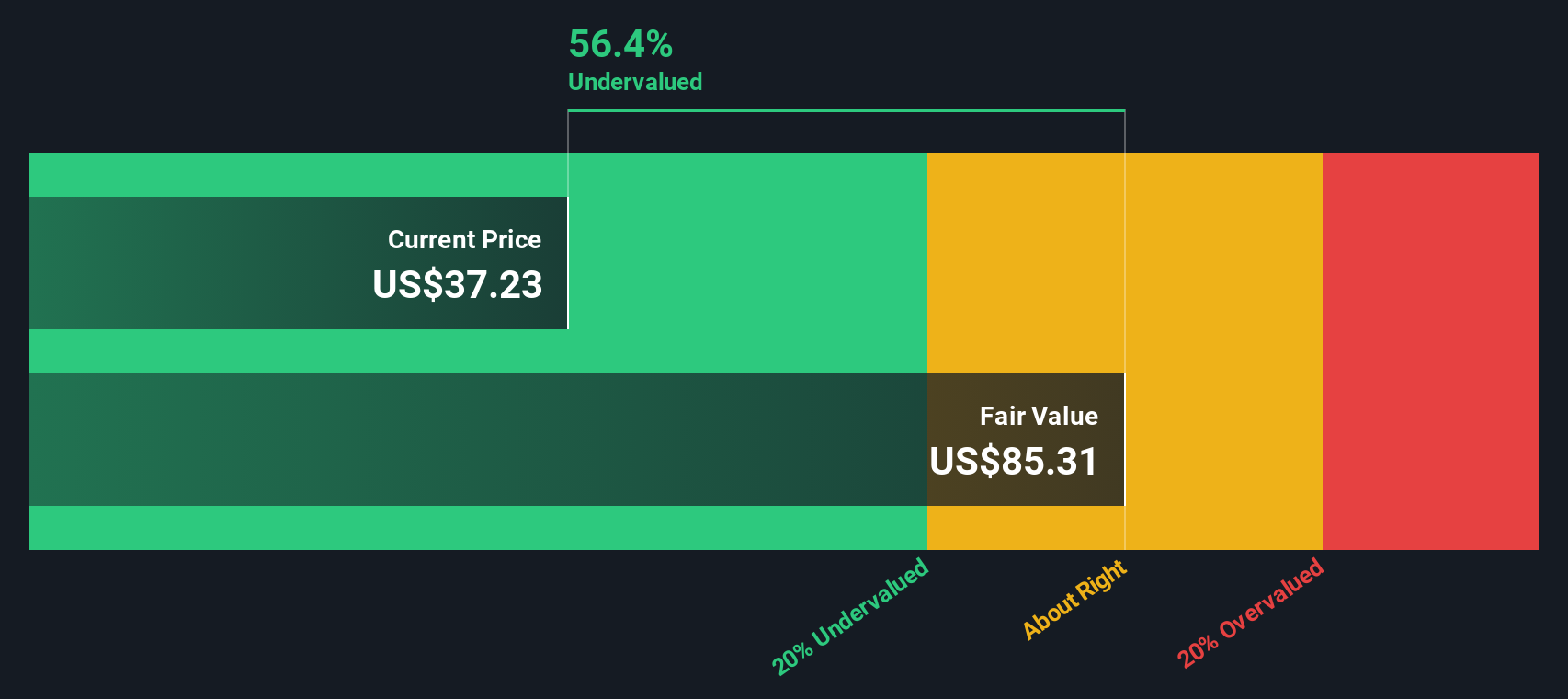

The prevailing narrative among analysts suggests Radian Group is undervalued, with a consensus fair value moderately above the current share price.

Housing supply constraints and elevated home prices are resulting in higher loan-to-value ratios. This increases the need for private mortgage insurance providers like Radian and supports the long-term stability of premium revenue and portfolio persistency. Radian's use of proprietary data analytics and risk-based pricing allows for dynamic portfolio management and efficient underwriting. This approach improves loss ratios and helps maintain or expand net margins over time.

What is the secret sauce behind Radian’s valuation verdict? The analysts’ narrative relies heavily on specific future forecasts around revenue, earnings and margins, with an expected performance profile that stands out from sector norms. Interested in the numbers and unique assumptions supporting this growth story? The underlying projections could offer new insights and indicate why the “undervalued” label might not last.

Result: Fair Value of $37.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the narrative could quickly shift if mortgage originations slow or if Radian’s diversification efforts continue to lag behind expectations.

Find out about the key risks to this Radian Group narrative.Another View: Our DCF Model Verdict

Taking a step back from analyst consensus, our SWS DCF model also suggests the market is undervaluing Radian Group. This method considers long-term cash flows instead of earnings multiples, leading to a similar outlook. But which lens gives the clearer view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Radian Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Radian Group Narrative

If you see the story playing out differently or want to do some hands-on digging yourself, you can craft a narrative of your own in just a few minutes. Do it your way

A great starting point for your Radian Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let new opportunities pass you by. Powerful tools can help you uncover stocks with the qualities you care about most. Check out these hand-picked ways to find outstanding companies with potential:

- Target reliable payouts that go beyond the basics by checking out companies offering dividend stocks with yields > 3% for consistent income streams.

- Tap into the future of healthcare by spotting pioneers at the intersection of medicine and artificial intelligence with our healthcare AI stocks selection.

- Spot emerging talent among tomorrow’s market leaders when you size up the best undervalued stocks based on cash flows packed with hidden growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDN

Radian Group

Engages in the mortgage and real estate services business in the United States.

Undervalued average dividend payer.

Market Insights

Community Narratives