- United States

- /

- Capital Markets

- /

- NYSE:PX

3 US Growth Stocks With High Insider Ownership And Up To 78% Earnings Growth

Reviewed by Simply Wall St

As major U.S. stock indexes like the Dow Jones Industrial Average and S&P 500 hover near record highs, investors are keenly observing economic data releases and Federal Reserve comments for signs of continued growth. In this robust market environment, identifying growth companies with high insider ownership can be particularly appealing, as it often signals strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Let's dive into some prime choices out of the screener.

Franklin Covey (NYSE:FC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franklin Covey Co. offers training and consulting services focused on execution, sales performance, productivity, customer loyalty, and educational improvement for organizations and individuals globally, with a market cap of $542.50 million.

Operations: The company's revenue segments include Education Practice ($73.51 million), Corporate and Eliminations ($4.80 million), Enterprise Division - Direct Offices ($191.34 million), and Enterprise Division - International Licensees ($11.42 million).

Insider Ownership: 15.5%

Earnings Growth Forecast: 30.2% p.a.

Franklin Covey demonstrates strong growth potential with forecasted annual earnings growth of 30.23%, significantly outpacing the US market's 15.2%. Despite slower revenue growth at 10.7% per year, it still surpasses the market average of 8.7%. Recent initiatives like the FranklinCovey Mobile App and a robust buyback program underscore its commitment to innovation and shareholder value. The stock trades at a substantial discount to estimated fair value, enhancing its appeal among growth companies with high insider ownership in the United States.

- Dive into the specifics of Franklin Covey here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Franklin Covey shares in the market.

P10 (NYSE:PX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P10, Inc. (NYSE:PX), with a market cap of $1.21 billion, operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States.

Operations: The company's revenue from asset management is $259.20 million.

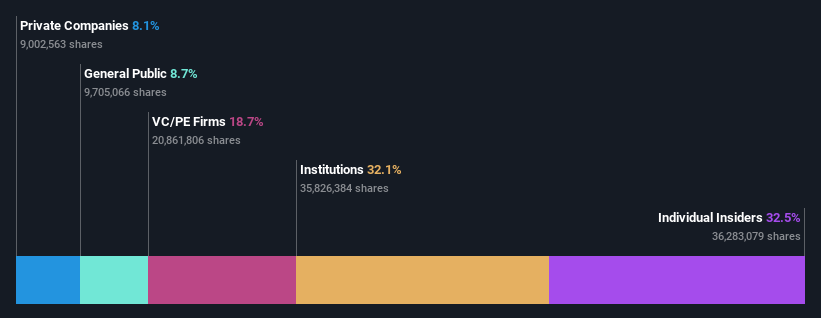

Insider Ownership: 32.1%

Earnings Growth Forecast: 78.1% p.a.

P10, Inc. is actively seeking acquisitions to bolster its growth strategy, supported by efficient conversion of FRE to cash flow due to embedded tax assets and minimal CapEx requirements. Recent financials show significant earnings growth with net income rising from US$1.76 million to US$6.99 million year-over-year for Q2 2024, despite a decline in profit margins from 5.5% to 1%. The company has also enhanced its buyback plan and secured new credit facilities totaling US$500 million for future expansions.

- Get an in-depth perspective on P10's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of P10 shares in the market.

Vitesse Energy (NYSE:VTS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitesse Energy, Inc. and its subsidiaries focus on acquiring, developing, and producing non-operated oil and natural gas properties in the United States, with a market cap of $733.49 million.

Operations: Revenue from oil and gas exploration and production amounts to $251.10 million.

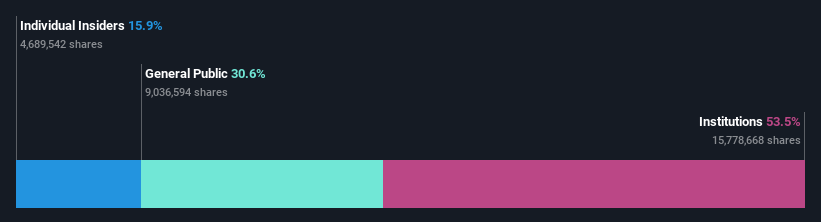

Insider Ownership: 15.9%

Earnings Growth Forecast: 47.8% p.a.

Vitesse Energy has shown significant insider buying over the past three months, indicating strong internal confidence. The company reported Q2 2024 revenue of US$66.6 million, up from US$51.59 million a year ago, and net income of US$10.93 million compared to US$9.62 million previously. Earnings are forecast to grow at 47.77% annually over the next three years, outpacing market expectations, though its dividend sustainability remains questionable due to coverage issues by earnings or free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Vitesse Energy.

- According our valuation report, there's an indication that Vitesse Energy's share price might be on the expensive side.

Make It Happen

- Gain an insight into the universe of 179 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PX

P10

Operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States.

Reasonable growth potential slight.