- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

PennyMac Mortgage Investment Trust (PMT): Evaluating Valuation After Credit Sector Concerns and Earnings Miss

Reviewed by Kshitija Bhandaru

PennyMac Mortgage Investment Trust (PMT) has come under pressure as concerns about credit quality ripple through the lending sector. Recent revelations from industry peers about loan losses and collateral problems have contributed to the cautious mood around the stock.

See our latest analysis for PennyMac Mortgage Investment Trust.

PennyMac Mortgage Investment Trust’s share price has steadily lost ground in recent months, reflecting persistent uncertainty around the sector. Despite a series of executive shakeups and cautious earnings, the 1-year total shareholder return stands at -5.3%. Longer-term holders saw gains of over 40% across three years. Momentum has cooled lately as investors weigh sector risks and slowing growth prospects.

If you’re keeping an eye on shifting sector trends, now is an ideal time to broaden your search and tap into discovery opportunities with fast growing stocks with high insider ownership

With shares trading at a meaningful discount to analyst price targets after a string of negative catalysts, investors are left asking whether PennyMac Mortgage Investment Trust is undervalued or if the market is already pricing in the expected slowdown in growth.

Most Popular Narrative: 12.7% Undervalued

PennyMac Mortgage Investment Trust’s latest consensus narrative points to a fair value target meaningfully above its last close, suggesting room for upside if expectations are met. This evaluation draws on a combination of strategic, operational, and sector-based catalysts that could drive future performance.

The continued growth in U.S. household formation and the steady demand for residential mortgages, combined with PennyMac's robust vertically integrated origination and servicing platform, position PMT to access a consistent pipeline of high-quality loans. This supports future revenue and earnings growth. Ongoing digital transformation and the ability to organically create securitizations through technology-enabled processes are enabling PMT to efficiently structure and retain higher-yielding credit-sensitive non-agency MBS and CRT assets. This could drive net margin expansion as operational efficiencies scale.

Curious what numbers are fueling this bullish target? The supporting narrative is driven by bold revenue and profit margin projections, along with an aggressive lean into technology. Want to see how analysts believe all these moving parts shape fair value? Dive into the details that connect these strategic catalysts to a specific price projection. Some underlying assumptions might surprise you.

Result: Fair Value of $13.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to interest rate swings or mounting credit risk could quickly challenge the optimistic outlook for PennyMac Mortgage Investment Trust.

Find out about the key risks to this PennyMac Mortgage Investment Trust narrative.

Another View: Multiples Tell a Different Story

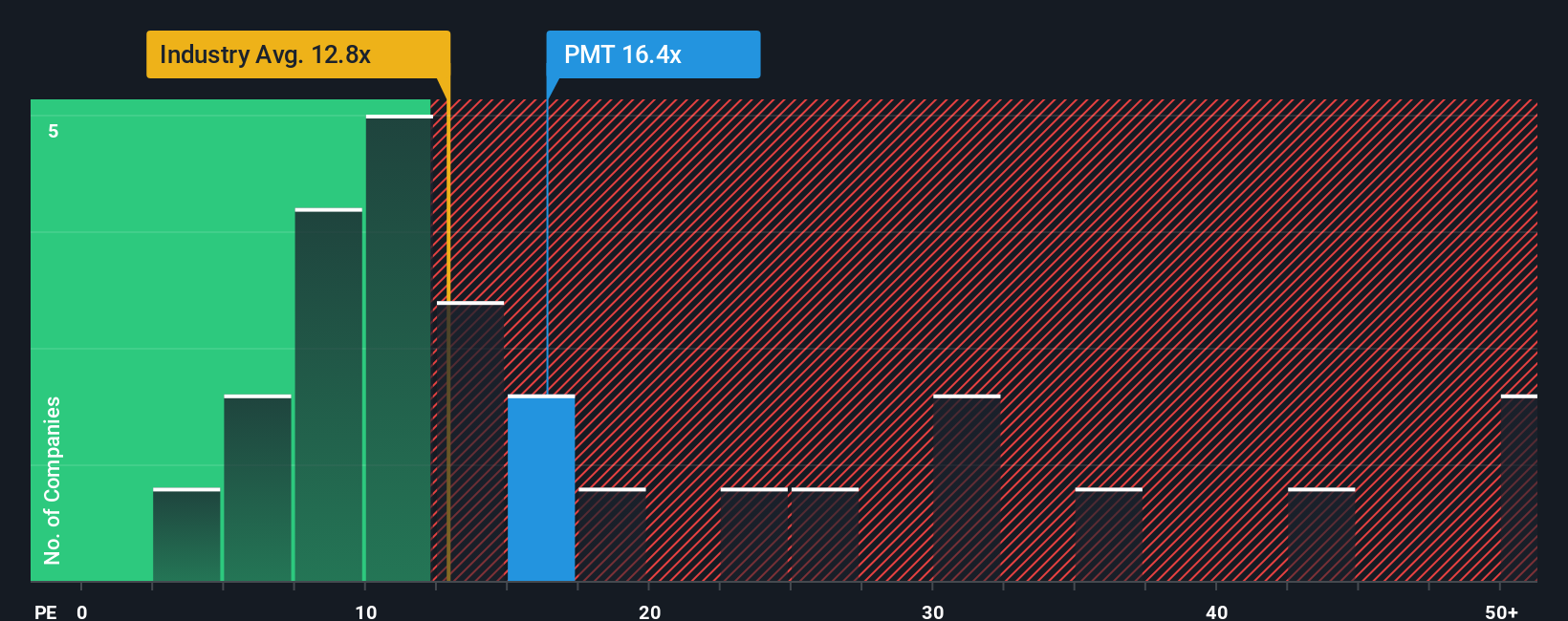

Looking at valuation from another angle, PennyMac Mortgage Investment Trust’s current price-to-earnings ratio of 16.2x is higher than both the US Mortgage REITs industry average of 12.8x and its own low return on equity. Even compared to a fair ratio of 18x, this suggests limited upside and signals valuation risk if sector trends worsen. Is the stock's premium justified, or is the market too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PennyMac Mortgage Investment Trust Narrative

Don’t see your perspective reflected above, or want to run the numbers yourself? Building your own view takes just minutes and is truly simple, so Do it your way.

A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t stick with the usual picks; your next big winner could be just a click away. Use these standout screens to uncover stocks with serious potential before the crowd.

- Boost your income by tapping into the potential of strong-yield plays with these 18 dividend stocks with yields > 3% at your fingertips.

- Fuel your portfolio’s growth by seeking out innovative leaders in AI. Start your hunt with these 24 AI penny stocks for standout opportunities.

- Unlock value few investors see by zeroing in on these 878 undervalued stocks based on cash flows and snap up bargains others overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives