- United States

- /

- Capital Markets

- /

- NYSE:PEO

Just Four Days Till Adams Natural Resources Fund, Inc. (NYSE:PEO) Will Be Trading Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Adams Natural Resources Fund, Inc. (NYSE:PEO) is about to trade ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 11th of February will not receive this dividend, which will be paid on the 26th of February.

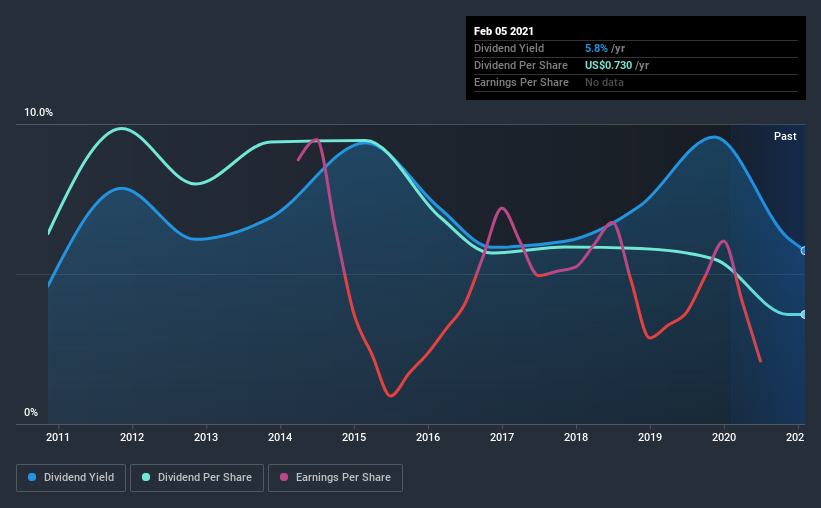

Adams Natural Resources Fund's next dividend payment will be US$0.10 per share, on the back of last year when the company paid a total of US$0.73 to shareholders. Last year's total dividend payments show that Adams Natural Resources Fund has a trailing yield of 5.8% on the current share price of $12.63. If you buy this business for its dividend, you should have an idea of whether Adams Natural Resources Fund's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Adams Natural Resources Fund

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Adams Natural Resources Fund reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term.

Click here to see how much of its profit Adams Natural Resources Fund paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. Adams Natural Resources Fund was unprofitable last year, but at least the general trend suggests its earnings have been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Adams Natural Resources Fund's dividend payments per share have declined at 5.4% per year on average over the past 10 years, which is uninspiring.

We update our analysis on Adams Natural Resources Fund every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

Is Adams Natural Resources Fund worth buying for its dividend? It's not great to see the company paying a dividend despite being loss-making over the last year. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're on the fence about its dividend prospects.

With that being said, if dividends aren't your biggest concern with Adams Natural Resources Fund, you should know about the other risks facing this business. Every company has risks, and we've spotted 3 warning signs for Adams Natural Resources Fund you should know about.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Adams Natural Resources Fund or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Adams Natural Resources Fund, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:PEO

Excellent balance sheet and good value.

Market Insights

Community Narratives