- United States

- /

- Food

- /

- NasdaqGM:VITL

October 2025's High-Ownership Growth Stocks

Reviewed by Simply Wall St

As the Dow Jones, S&P 500, and Nasdaq reach new all-time highs despite a government shutdown, investors are increasingly optimistic about the resilience of the U.S. market. In this buoyant environment, growth companies with high insider ownership can be particularly attractive due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| Hippo Holdings (HIPO) | 14.0% | 41.2% |

| Hesai Group (HSAI) | 14.9% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.3% | 33.7% |

| Celsius Holdings (CELH) | 10.8% | 32% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

We're going to check out a few of the best picks from our screener tool.

Vital Farms (VITL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vital Farms, Inc. is a food company that packages, markets, and distributes shell eggs, butter, and other products in the United States with a market cap of approximately $1.82 billion.

Operations: The company's revenue is primarily derived from its eggs and butter segment, amounting to $657.95 million.

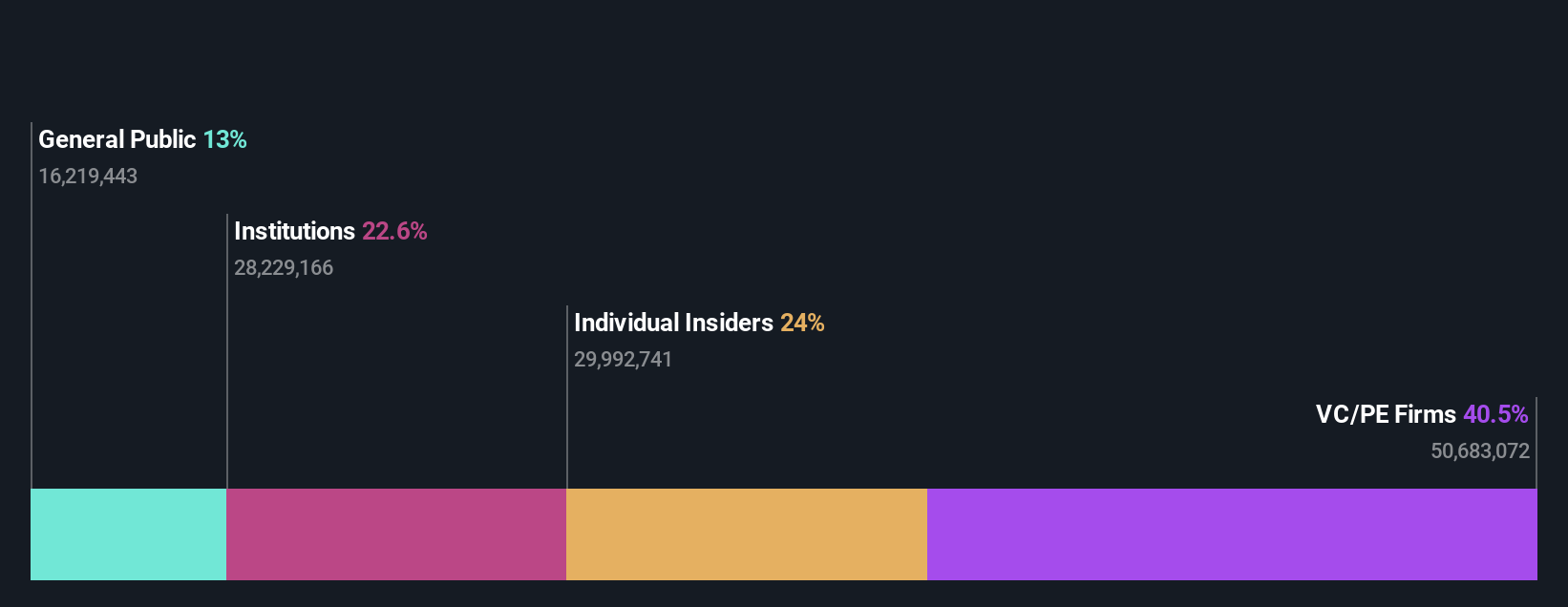

Insider Ownership: 17%

Earnings Growth Forecast: 21.8% p.a.

Vital Farms is experiencing strong revenue growth, with forecasts of 19.9% annually, outpacing the US market. Despite recent insider selling, the company maintains high insider ownership and has revised its 2025 revenue guidance upwards to at least US$770 million. Recent initiatives include expanding its farm network to over 500 family farms and launching a limited-edition dog treat line, showcasing innovative product strategies. Earnings are projected to grow significantly at 21.8% annually over the next three years.

- Take a closer look at Vital Farms' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Vital Farms is trading beyond its estimated value.

Youdao (DAO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company that offers online services in content, community, communication, and commerce across China with a market cap of approximately $1.16 billion.

Operations: The company's revenue is primarily derived from Learning Services (CN¥2.65 billion), followed by Online Marketing Services (CN¥2.11 billion) and Smart Devices (CN¥873.07 million).

Insider Ownership: 20.4%

Earnings Growth Forecast: 29.0% p.a.

Youdao's recent inclusion in the S&P Global BMI Index highlights its growing prominence. The company reported a reduced net loss for Q2 2025, with revenue increasing to CNY 1.42 billion. Earnings are expected to grow significantly at 29% annually over the next three years, outpacing the US market average. Despite no insider trading activity recently, high insider ownership remains a key feature. However, debt coverage by operating cash flow is inadequate, posing financial challenges.

- Get an in-depth perspective on Youdao's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Youdao shares in the market.

Paymentus Holdings (PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $3.84 billion.

Operations: The company generates revenue through its cloud-based bill payment solutions, with services to financial companies contributing $1.04 billion.

Insider Ownership: 27.7%

Earnings Growth Forecast: 28.5% p.a.

Paymentus Holdings has demonstrated strong growth, with earnings increasing by 73.3% over the past year and revenue expected to grow at 18% annually, outpacing the US market average. Despite forecasts of a low return on equity in three years, its earnings are projected to grow significantly at 28.5% per year. Recent financial results show increased sales and net income for Q2 2025, while high insider ownership remains a key feature without recent trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Paymentus Holdings.

- The valuation report we've compiled suggests that Paymentus Holdings' current price could be inflated.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 199 more companies for you to explore.Click here to unveil our expertly curated list of 202 Fast Growing US Companies With High Insider Ownership.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives