In a market environment where major stock indexes have recently closed sharply lower, with tech stocks leading the declines, investors are increasingly looking for stability and potential growth amid uncertainty. Companies with high insider ownership often signal confidence from those closest to the business, making them appealing choices for those seeking growth opportunities in turbulent times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Bitdeer Technologies Group (BTDR) | 37.3% | 94.3% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 31.1% |

| AppLovin (APP) | 27.5% | 25.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Xometry (XMTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xometry, Inc. operates an AI-powered online manufacturing marketplace serving both the United States and international markets, with a market cap of $2.47 billion.

Operations: The company generates its revenue through an AI-driven online platform that connects manufacturers with customers across domestic and international markets.

Insider Ownership: 12.5%

Xometry, Inc. demonstrates the potential of growth companies with high insider ownership in the U.S., as it continues to expand its capabilities and market reach. The company recently raised its full-year revenue guidance to US$676 million-US$678 million, reflecting strong sales momentum despite reporting a net loss of US$11.6 million for Q3 2025. Xometry's innovative offerings, like auto-quotes for injection molding and the Workcenter Mobile App, enhance operational efficiency and customer engagement, supporting future growth prospects.

- Click to explore a detailed breakdown of our findings in Xometry's earnings growth report.

- According our valuation report, there's an indication that Xometry's share price might be on the expensive side.

MediaAlpha (MAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of approximately $864.18 million.

Operations: The company generates revenue of approximately $1.12 billion from its Internet Information Providers segment.

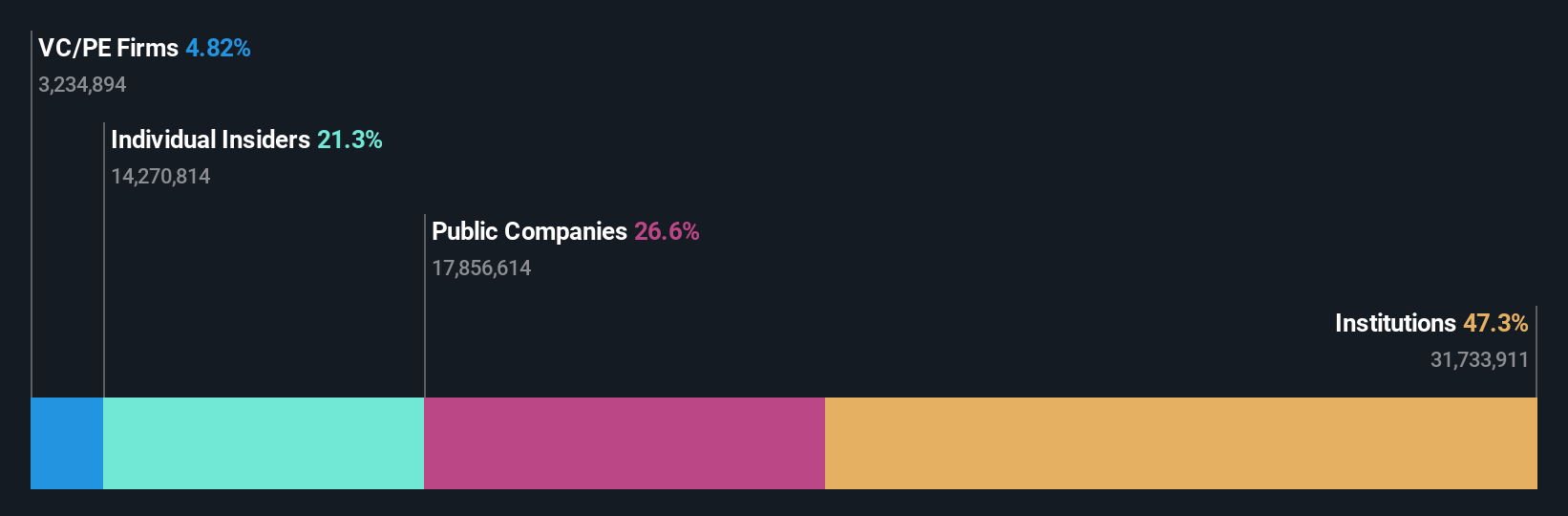

Insider Ownership: 21.7%

MediaAlpha exemplifies growth potential with high insider ownership, as evidenced by its strategic initiatives and financial performance. The company reported Q3 2025 sales of US$306.51 million, up from US$259.13 million a year ago, alongside a net income increase to US$14.91 million. Despite forecasting a slight revenue dip for Q4 2025, MediaAlpha's share repurchase program and settlement with the FTC underscore its commitment to shareholder value and operational compliance while insiders have been buying more shares recently.

- Take a closer look at MediaAlpha's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that MediaAlpha is trading behind its estimated value.

Paymentus Holdings (PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $3.58 billion.

Operations: Paymentus Holdings generates revenue through its cloud-based bill payment technology and solutions offered domestically and internationally.

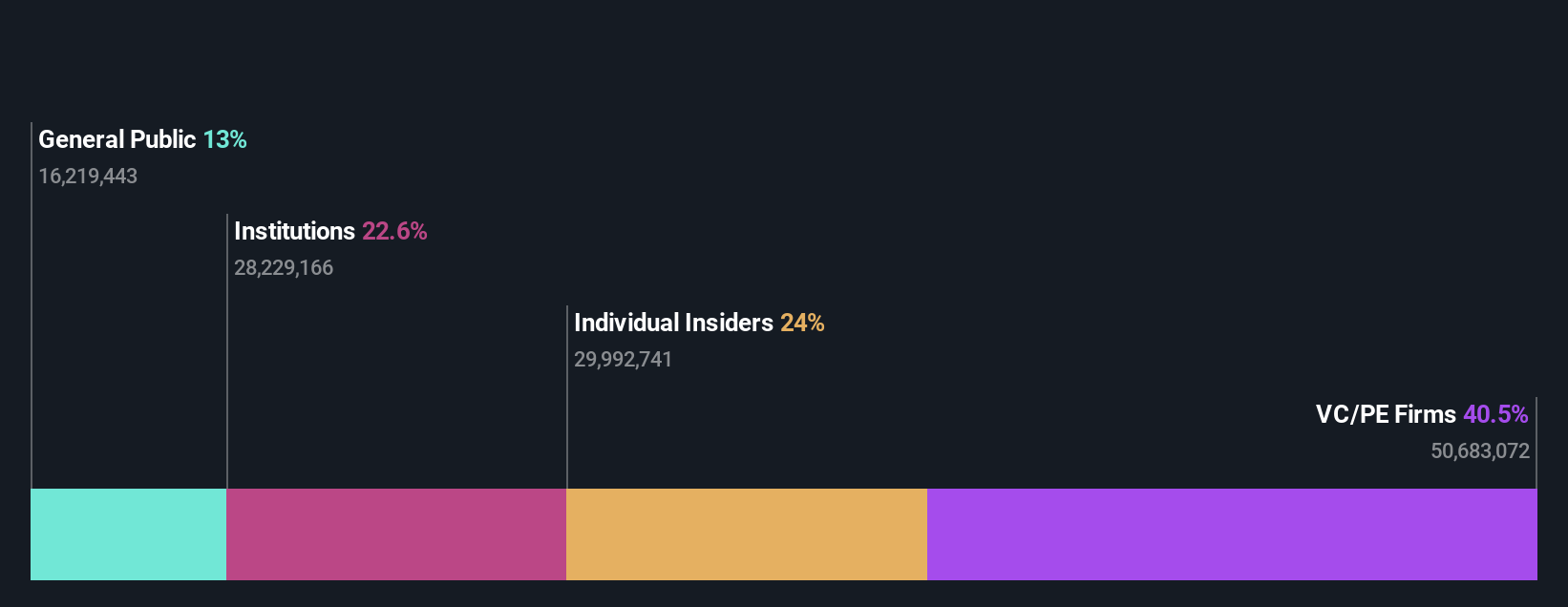

Insider Ownership: 27.7%

Paymentus Holdings demonstrates robust growth with significant insider ownership, as reflected in its Q3 2025 performance. The company reported US$310.74 million in sales, up from US$231.57 million the previous year, and net income increased to US$17.74 million. Despite a forecasted revenue growth of 19.6% per year, which is slower than some high-growth peers, earnings are expected to grow significantly at 28.1% annually over the next three years without substantial recent insider trading activity.

- Unlock comprehensive insights into our analysis of Paymentus Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Paymentus Holdings shares in the market.

Next Steps

- Unlock our comprehensive list of 206 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAX

MediaAlpha

Through its subsidiaries, operates an insurance customer acquisition platform in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives