- United States

- /

- Capital Markets

- /

- NYSE:OWL

Is Blue Owl Capital's (OWL) PayPal Collaboration a Turning Point for Its Alternative Credit Ambitions?

Reviewed by Sasha Jovanovic

- In late September, PayPal Holdings announced a two-year agreement under which funds managed by Blue Owl Capital will purchase about US$7 billion of US Buy Now, Pay Later receivables, while PayPal continues to handle customer-facing activities for these loans.

- This move further positions Blue Owl Capital as a prominent participant in the alternative credit sector, emphasizing its growth in innovative, fee-generating financial products.

- We'll explore how the PayPal partnership broadens Blue Owl Capital's exposure to the consumer finance market and its evolving investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Blue Owl Capital Investment Narrative Recap

For anyone considering Blue Owl Capital, the key investment premise centers around its ability to leverage structural shifts in private credit and alternative assets, translating strong demand for asset-backed finance into recurring fee revenue and long-term earnings growth. The recent US$7 billion PayPal BNPL deal underscores Blue Owl’s growing influence in alternative lending but does not materially alter the company’s short-term catalysts, which remain focused on building permanent capital vehicles. However, execution and integration risks from aggressive expansion, both organic and via acquisitions, are still the main headwinds in the near term.

Among Blue Owl Capital's recent announcements, the launch of the Blue Owl Alternative Credit Fund (OWLCX) in September points to the company’s strategy of extending its private credit offerings to individual investors, directly supporting its efforts to scale permanent capital vehicles and diversify fee streams. This development complements the headline PayPal transaction by reinforcing Blue Owl’s push for sustainable, fee-based revenue growth across multiple investor channels.

But with all the excitement, investors should be aware that competition from both traditional and private market peers could pressure margins if...

Read the full narrative on Blue Owl Capital (it's free!)

Blue Owl Capital's outlook anticipates $4.2 billion in revenue and $5.1 billion in earnings by 2028. This scenario assumes annual revenue growth of 17.5% and an earnings increase of roughly $5.0 billion from current earnings of $75.4 million.

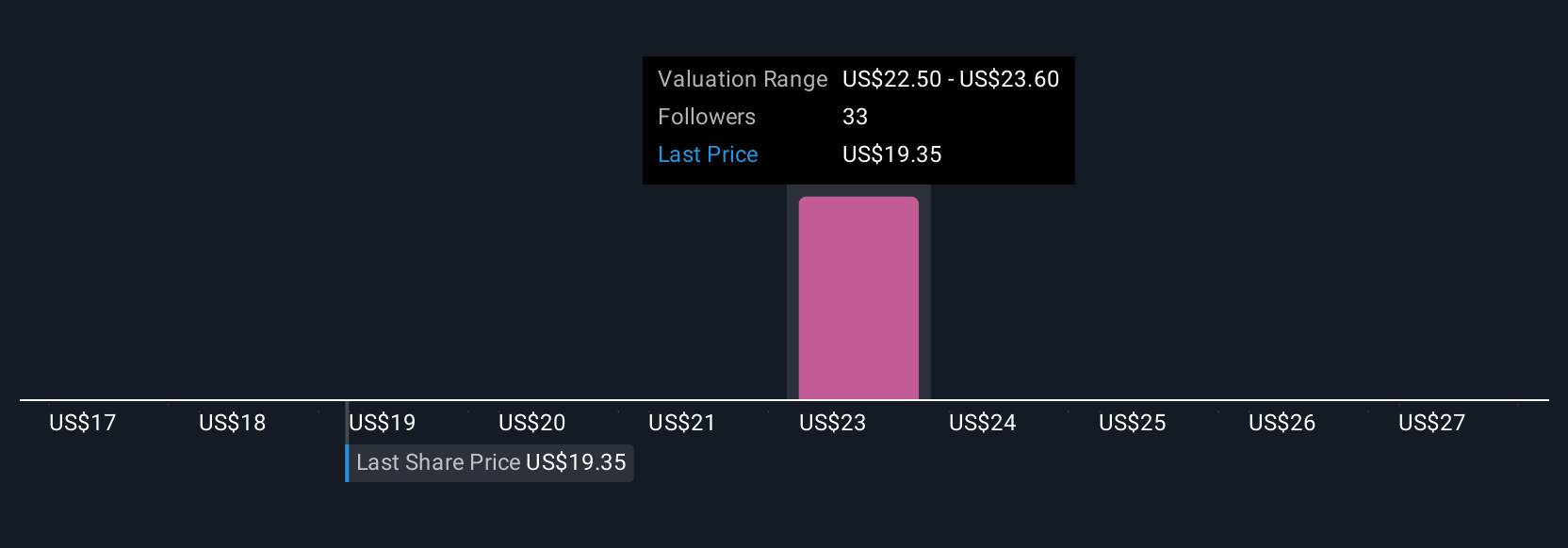

Uncover how Blue Owl Capital's forecasts yield a $23.92 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span from as low as US$0.59 to US$28 per share. As you weigh these opinions, consider that Blue Owl's expansion in permanent capital and fee-based products is viewed as a driver of stable, recurring revenue but could amplify integration challenges if not managed carefully, adding important context for your own analysis.

Explore 5 other fair value estimates on Blue Owl Capital - why the stock might be worth less than half the current price!

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives