- United States

- /

- Consumer Finance

- /

- NYSE:OMF

OneMain Holdings (OMF): Evaluating Valuation After a 40% One-Year Share Price Rally

Reviewed by Simply Wall St

OneMain Holdings (OMF) has quietly put together a strong run, with the stock up about 17% over the past month and more than 40% in the past year, outpacing many consumer lenders.

See our latest analysis for OneMain Holdings.

With the share price now around $68.30 and a robust 1 year total shareholder return of roughly 42 percent, momentum still looks constructive even though the very short term share price returns have cooled slightly after a strong 30 day share price gain.

If OneMain has caught your attention as a momentum and income story, it could be worth exploring other financial names using fast growing stocks with high insider ownership to see which businesses combine growth potential with aligned insider incentives.

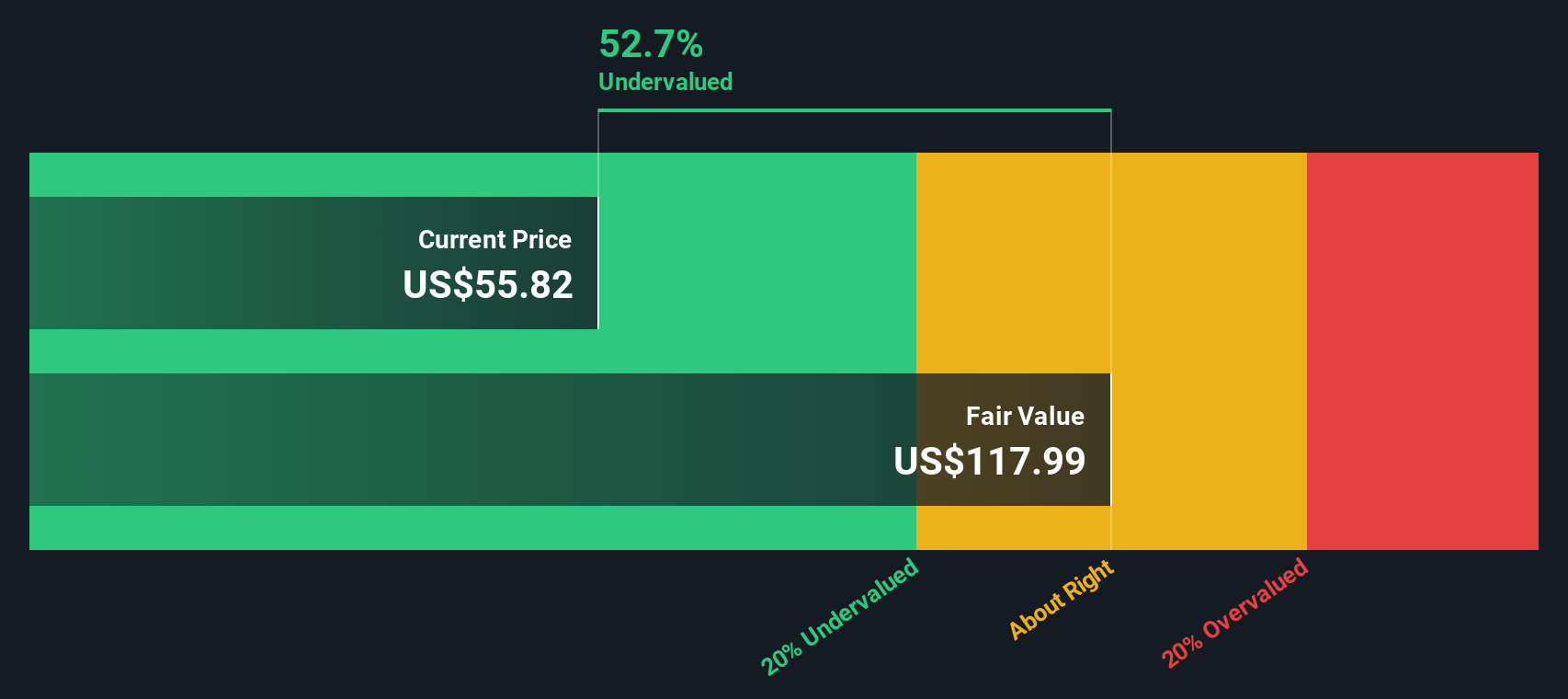

Yet with the shares now hovering near analyst targets but still trading at a hefty discount to some intrinsic value estimates, the key question is whether OneMain remains undervalued or if the market is already pricing in its growth potential.

Most Popular Narrative Narrative: 3% Overvalued

With OneMain's fair value estimate sitting just below the current $68.30 share price, the most followed narrative suggests the market is now slightly ahead of itself.

Management's commitment to robust shareholder capital returns via a 7% dividend yield and escalating buybacks, now ahead of the prior year, provides a catalyst for EPS growth and may attract additional yield focused investors if the stock remains undervalued.

Want to see what kind of revenue surge, margin reset, and future earnings multiple could justify this price target drift higher? The detailed narrative lays out an aggressive growth arc, shrinking profitability, and a lower forward valuation bar that still implies meaningful upside if execution holds. Curious which moving piece matters most to that fair value math? Read on to see what is really driving this call.

Result: Fair Value of $66.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if higher funding costs squeeze margins or a weaker macro backdrop drives charge offs above already elevated expectations.

Find out about the key risks to this OneMain Holdings narrative.

Another Angle on Value

Analysts see OneMain as about 3 percent overvalued at roughly $66 per share, yet our DCF model is more optimistic and suggests fair value closer to $113. With such a wide gap in conviction, which view do you trust when real money is on the line?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OneMain Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OneMain Holdings Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in just minutes: Do it your way.

A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with just one idea. Use the Simply Wall Street Screener to uncover focused opportunities that match your strategy before other investors catch on.

- Capture overlooked value by targeting quality companies trading below their estimated worth through these 914 undervalued stocks based on cash flows before sentiment catches up.

- Explore powerful themes in artificial intelligence by zeroing in on fast movers across these 25 AI penny stocks with scalable technology and accelerating adoption.

- Seek potential income and stability by filtering for reliable payers among these 13 dividend stocks with yields > 3% that may help strengthen your portfolio through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Exceptional growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion