- United States

- /

- Consumer Finance

- /

- NYSE:NNI

How Propelr’s AI-Powered Launch at Nelnet (NNI) Has Changed Its Workforce Development Investment Story

Reviewed by Simply Wall St

- Nelnet Business Services recently launched Propelr, an AI-enhanced learning platform designed to streamline onboarding, compliance, and professional development with a human-centered approach for workforce training and retention.

- This expansion draws on Nelnet’s education technology experience to offer scalable automation and gamification features that aim to boost productivity and engagement from day one.

- We’ll examine how Propelr’s AI-powered automation may shape Nelnet’s investment narrative and broaden its reach in workforce development solutions.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Nelnet's Investment Narrative?

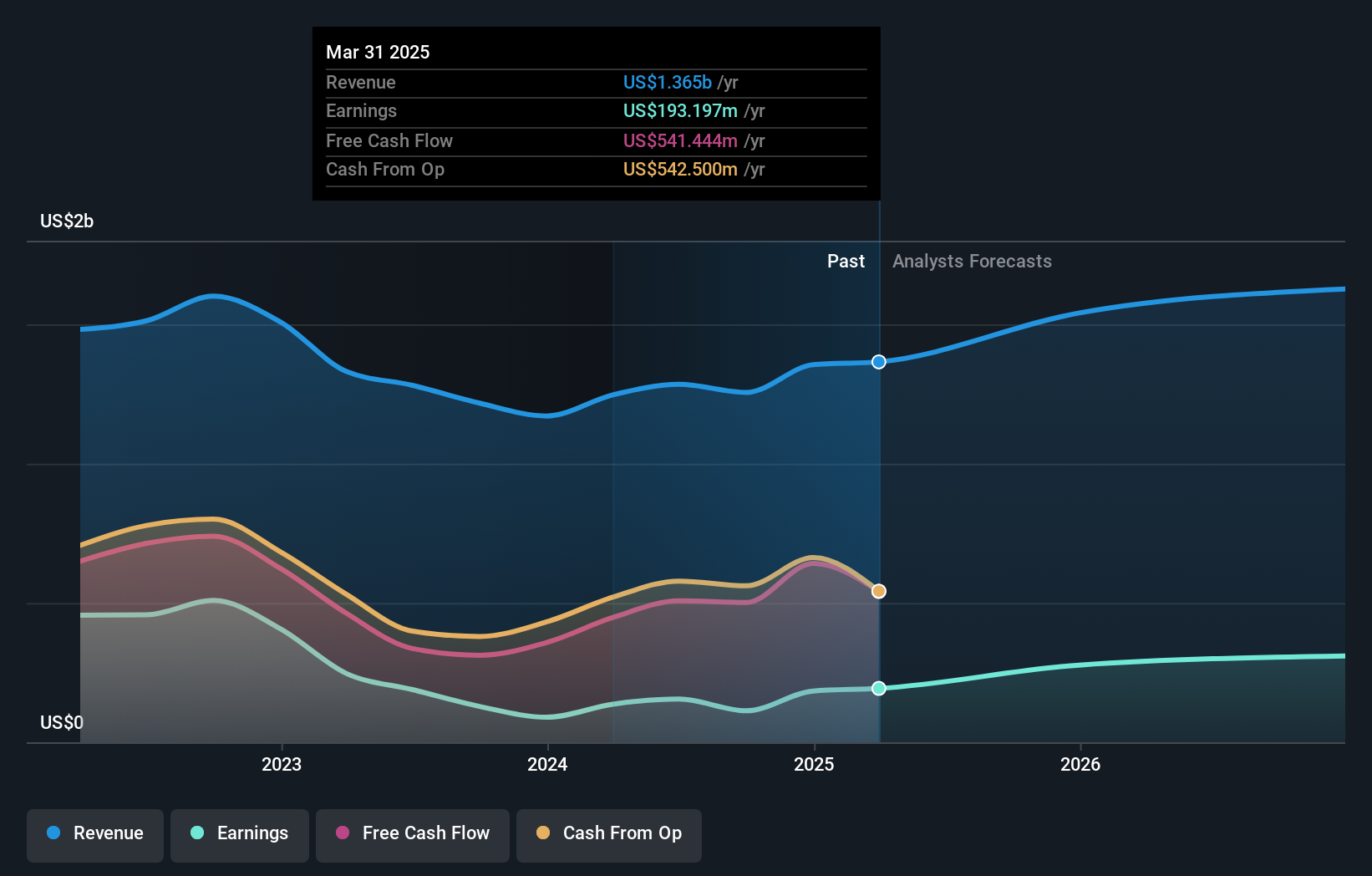

Nalnet’s big-picture story rests on exposure to ongoing demand for diversified education and financial services, paired with a management team and board known for stability but slow refresh. The recent Propelr launch adds a more pronounced technology-driven angle, which could reposition the company as a frontrunner in AI-enhanced learning and workforce solutions. While Propelr fits Nelnet’s push for scalable business expansion, it’s too soon to say it will materially impact near-term earnings or move the dial on key financial catalysts, such as profit growth or share price appreciation. Ongoing share buybacks and dividends remain the company’s tools to return value, but Propelr is a way Nelnet could address its historic earnings variability and bring new momentum to the story, though the risks of integration and industry competition can’t be ignored.

But while Propelr aims to accelerate growth, execution risks remain significant for future returns. Nelnet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nelnet - why the stock might be worth less than half the current price!

Build Your Own Nelnet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nelnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nelnet's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nelnet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNI

Nelnet

Engages in loan servicing, education technology services, and payment businesses worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives