- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

Assessing Annaly Capital After Latest Fed Interest Rate Comments and Recent Share Price Gains

Reviewed by Bailey Pemberton

If you’ve been wondering what to do next with Annaly Capital Management’s stock, you’re not alone. With so many shifting parts in the market these days, it’s normal to pause and consider your options. Annaly has certainly given investors a few talking points lately. In just the past week, the share price ticked up 1.9%, even though it’s still down 6.7% over the past month. For those who’ve held on longer, that patience has paid off, with the stock notching gains of 12.1% year-to-date, 20.5% over the past 12 months, and an impressive 84.5% over the last three years.

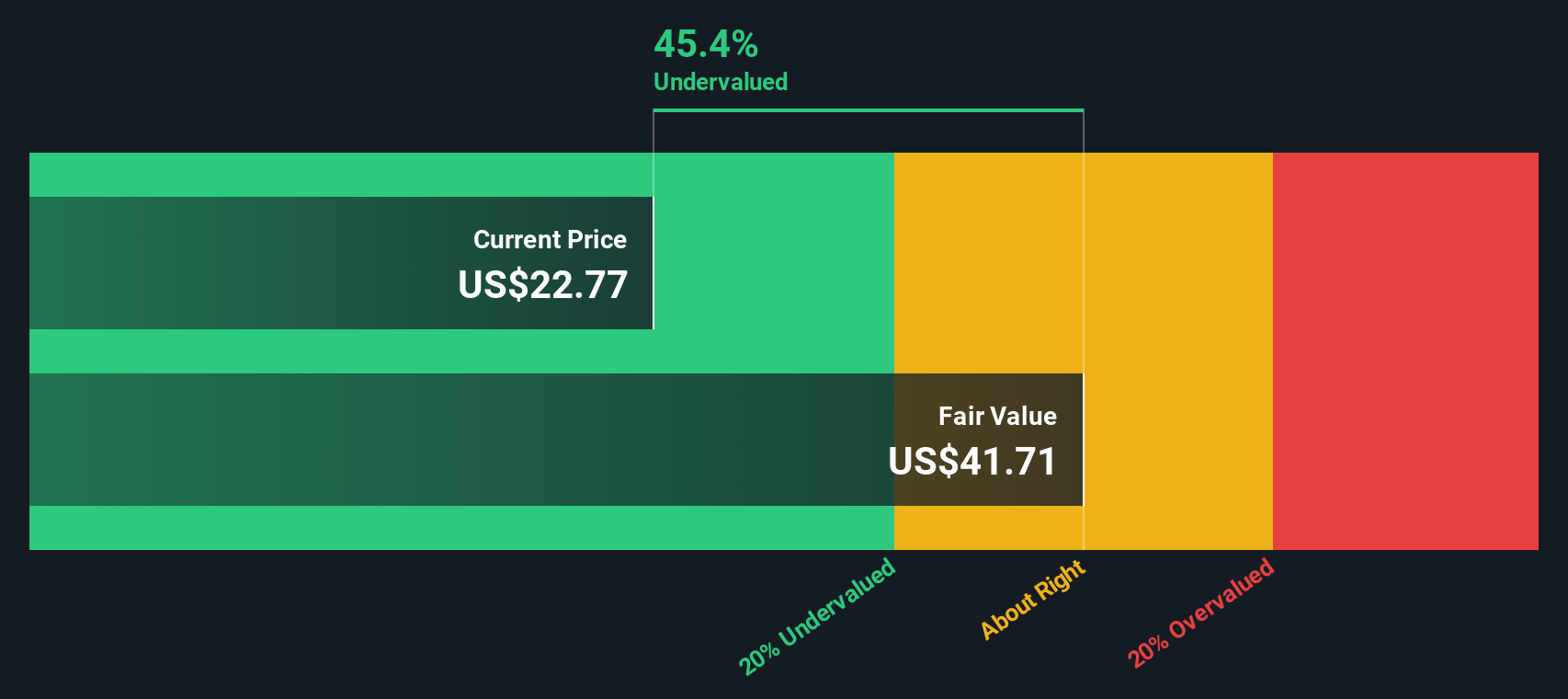

Those moves hint at shifting perceptions of risk and opportunity, especially as broader economic signals have nudged investors out of cash and back toward income-focused names like Annaly. Despite some short-term turbulence, long-term holders have been rewarded. However, new buyers are right to wonder if the value is still there. That’s where the numbers get revealing: looking at six valuation checks, Annaly comes up undervalued in three, giving it a valuation score of 3. Not bad, but not a screaming buy on the surface. There’s nuance to unpack here.

Let’s walk through each of the most common valuation approaches investors use, then take things one step further at the end to arrive at a deeper understanding of what this score really means for your portfolio decisions.

Approach 1: Annaly Capital Management Excess Returns Analysis

The Excess Returns model analyzes how much Annaly Capital Management earns above the required cost of shareholder equity, spotlighting the company's true value creation for investors. By focusing on return on invested capital, this approach reveals whether management is generating healthy profits over what it costs them to raise and employ equity capital.

For Annaly, the average return on equity stands at 16.20%, comfortably above the estimated equity cost of $2.00 per share. The model estimates a stable earnings per share (EPS) of $3.09, supported by consensus forecasts from five analysts, and a stable book value of $19.07, derived from projections by six analysts. Annaly's current book value per share is $18.45, underscoring the company's steady capital base.

The excess return generated, $1.08 per share, signals annual profits above the cost of capital. This calculation produces an estimated intrinsic value of $33.66 per share. With the market price currently sitting 38.8% below this figure, the Excess Returns model points to Annaly as significantly undervalued on a risk-adjusted basis.

Result: UNDERVALUED

Our Excess Returns analysis suggests Annaly Capital Management is undervalued by 38.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Annaly Capital Management Price vs Earnings

The price-to-earnings (PE) ratio is widely used to value profitable companies like Annaly Capital Management, as it connects the current share price to a company's annual earnings. For firms with stable profits, the PE ratio provides a quick sense of how much investors are paying for each dollar of earnings. It is popular because it can highlight how growth prospects and risk profiles influence what multiple the market is willing to pay. Faster-growing or less risky companies usually command higher PE ratios.

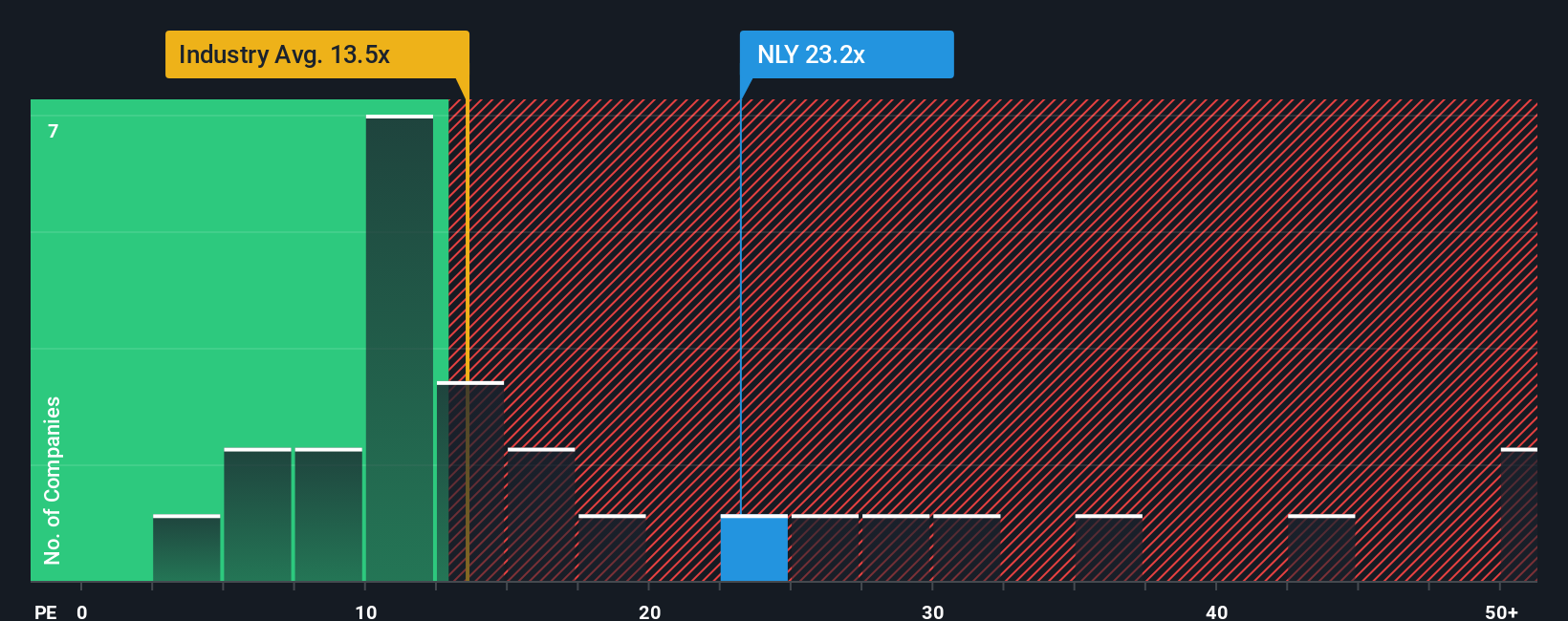

Annaly currently trades at a PE ratio of 23x, which stands out in several ways. Compared to the mortgage REITs industry average of 13.1x, and its peer group average of 17.6x, Annaly’s multiple is noticeably higher. This could suggest the market has lofty expectations, or it may reflect Annaly’s unique advantages or risk profile. However, using just industry or peer comparisons can be misleading, as those numbers do not take into account the company’s earnings growth, profit margins, risk levels, or market capitalization.

This is where Simply Wall St's "Fair Ratio" metric comes in. The Fair Ratio for Annaly is 26.0x, representing the PE multiple that would be expected given all the company-specific and market factors, such as historical and expected earnings growth, risk, profitability, and its place within the industry. This holistic approach offers a much clearer picture of what is justified, instead of just relying on generic peer group data.

Comparing Annaly’s actual PE ratio of 23x to its Fair Ratio of 26.0x, the stock appears slightly undervalued on a risk-adjusted basis. It is trading below what would be expected given all the variables in play.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Annaly Capital Management Narrative

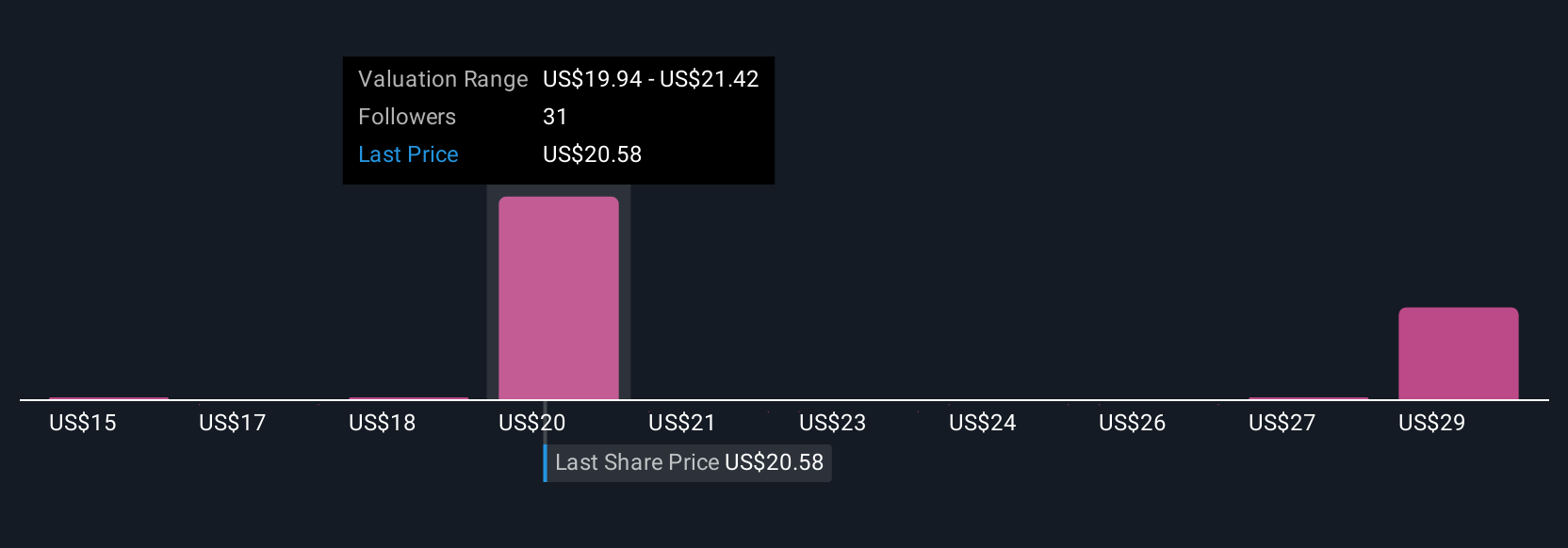

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative combines the story you believe about Annaly Capital Management, such as its growth drivers, risks, or market position, with your financial assumptions such as future revenues, margins, and fair value. Narratives connect these beliefs to a clear forecast and ultimately to an actionable fair value, making your investment thesis both personal and practical.

With Narratives, investors can easily see if their outlook justifies buying, holding, or selling by comparing their calculated Fair Value to Annaly’s current price. These stories are dynamic and are updated in real time as new data, earnings, or news is released, so your decisions always reflect the latest landscape. Narratives are accessible to everyone within the Community page on Simply Wall St, used by millions of investors.

For example, some Annaly Capital Management Narratives might be highly optimistic, assuming robust revenue growth and strong profit margins, resulting in a Fair Value above $33 per share. Others may be more cautious about rising competition or rate risks, producing Fair Values closer to the $21 analyst consensus target. This allows every investor to see how different perspectives can lead to different price targets and helps you decide what makes sense for your own strategy.

Do you think there's more to the story for Annaly Capital Management? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives