- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (MS): Evaluating Valuation Following Strategic Push Into Private Markets and EquityZen Acquisition

Reviewed by Simply Wall St

Morgan Stanley (MS) has taken a visible step into the private markets by debuting a research hub focused on high-growth private firms and sealing an agreement to acquire EquityZen, a private shares platform. This combination reflects the growing interest from investors in unlisted companies and signals how Morgan Stanley is adapting its strategy to tap into this demand.

See our latest analysis for Morgan Stanley.

Morgan Stanley’s push into private markets and a flurry of new initiatives have caught investors’ attention, with the stock showing strong momentum. Its share price is up 32.7% year-to-date and it boasts a 28.6% total shareholder return over the past year, underscoring building confidence in its strategy and growth prospects.

If Morgan Stanley’s moves into new markets have you thinking about what else is on the rise, now’s a great time to see what’s happening among fast growing stocks with high insider ownership.

With shares already up more than 30% this year and trading just below the consensus analyst price target, investors may wonder whether Morgan Stanley will offer further upside or if the market has already priced in its future growth potential.

Most Popular Narrative: 1.5% Undervalued

Morgan Stanley's most widely tracked narrative sees the fair value just over 1% higher than the current share price. This suggests the stock could have a slight upside if key assumptions play out. The narrative is based on multi-year growth projections and improvements to profit margins, giving investors a potential window into what may drive future performance.

The ongoing increase in global wealth, combined with the accelerating intergenerational transfer of assets, is boosting demand for comprehensive advisory and wealth management solutions, evidenced by record net new assets and a growing client base, which should drive higher recurring fee-based revenue and long-term earnings growth.

Want to know what’s fueling Morgan Stanley’s valuation? The answer may lie in ambitious revenue forecasts, margin targets, and powerful profit assumptions that set it apart from rivals. Wondering which future numbers are behind that price estimate? Find out how much growth backs up this narrative.

Result: Fair Value of $168.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as increasing regulatory scrutiny and growing competition from low-fee investment products could challenge Morgan Stanley’s growth outlook in the years ahead.

Find out about the key risks to this Morgan Stanley narrative.

Another View: Contrasting the Valuation

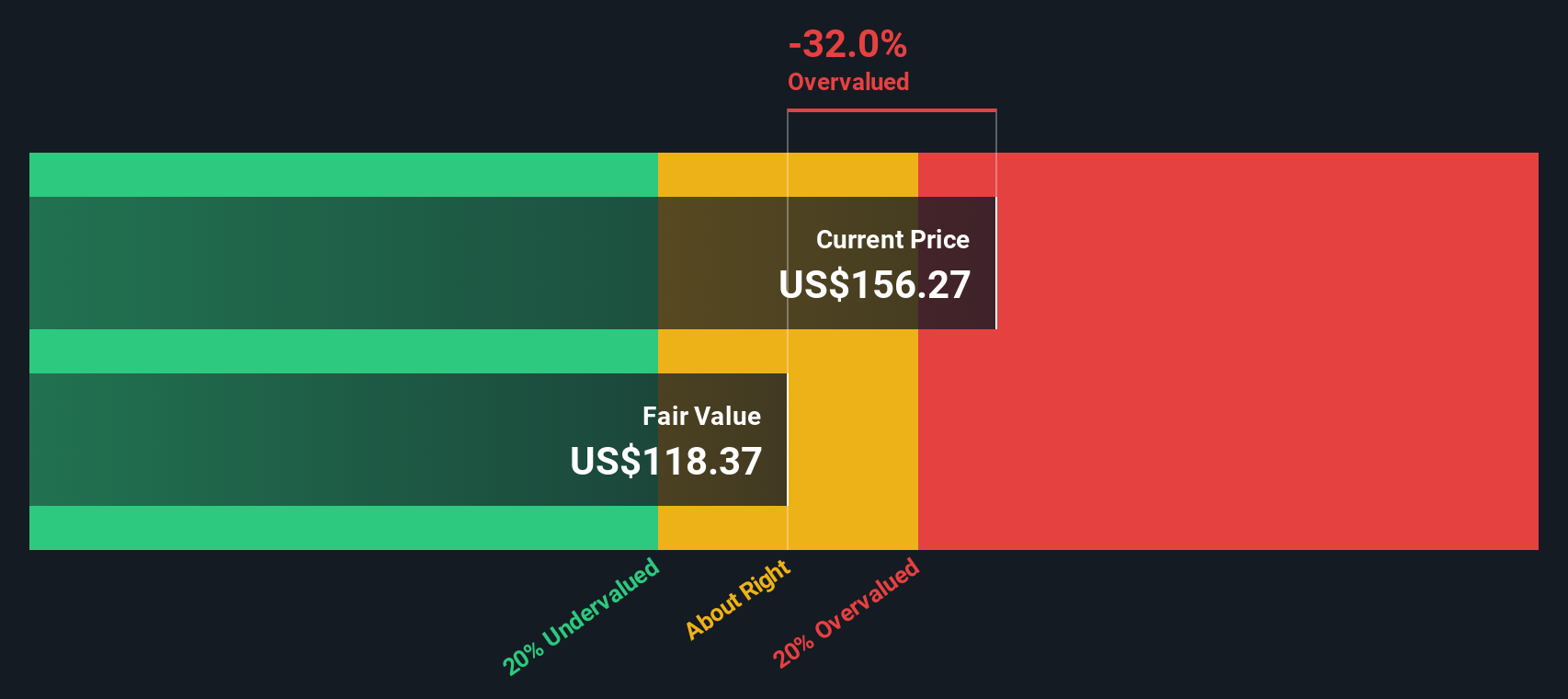

While analysts see Morgan Stanley as having slight upside based on future growth projections, our DCF model takes a different view. The SWS DCF model estimates the stock is trading above its fair value. This suggests market optimism might be running ahead of fundamentals. Does the market see something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morgan Stanley for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morgan Stanley Narrative

If you see the story differently or want to dig deeper into the numbers, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your next investing step with confidence by checking out other potential winners on Simply Wall Street. These hand-picked shortlists can spark your next move and give you an edge on standout opportunities before they hit the mainstream.

- Unlock passive income potential as you scan these 15 dividend stocks with yields > 3% offering attractive yields above 3% and steady returns for income-focused investors.

- Capitalize on innovations by tapping into these 27 AI penny stocks, which feature companies poised to shape the future of artificial intelligence with strong growth and visionary leadership.

- Supercharge your portfolio by targeting these 882 undervalued stocks based on cash flows opportunities, where market pricing has not caught up with solid fundamentals and real upside remains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives