- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (MS): Assessing Valuation After Bold Gold Market Expansion in London

Reviewed by Simply Wall St

Morgan Stanley (MS) is making headlines for stepping up its presence in London’s precious metals market, teaming up with Citigroup to challenge JPMorgan’s lead in gold vaulting and clearing services. This marks the biggest realignment of the city’s clearing system in almost 10 years and may reshape how institutional players access and manage gold.

See our latest analysis for Morgan Stanley.

Morgan Stanley’s push into London’s gold clearing market follows a busy quarter, which included a series of corporate bond offerings and a recently affirmed $1.00 quarterly dividend. Behind these developments, the share price has shown impressive momentum, posting a 32.40% year-to-date share price return, while total shareholder return has climbed 42.62% over the past year. Longer-term holders have seen even greater gains, with three-year total shareholder return above 117% and five-year returns exceeding 276%.

If Morgan Stanley’s activity in gold is catching your attention, now could be the right time to broaden your perspective and discover fast growing stocks with high insider ownership

With all eyes on Morgan Stanley’s bold positioning and robust returns, the real question is whether its stock remains undervalued today, or if recent performance means the market has already priced in future growth. Is there still a buying opportunity?

Most Popular Narrative: 1.3% Undervalued

Based on the latest fair value from the most widely followed narrative, Morgan Stanley's price target sits just above the most recent closing price. This close alignment with the market price increases the focus on key business drivers and future assumptions informing the models behind this fair value.

The ongoing increase in global wealth, combined with the accelerating intergenerational transfer of assets, is boosting demand for comprehensive advisory and wealth management solutions. This is evidenced by record net new assets and a growing client base, which should drive higher recurring fee-based revenue and long-term earnings growth.

Curious what ambitious revenue growth and profitability targets are embedded within this narrative? Want to see how future expansion projects and margin leverage translate into a justified share price? Uncover which projections are powering this fair value and decide if they can be achieved.

Result: Fair Value of $167.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as regulatory uncertainty or a shift toward low-fee investment products could quickly erode Morgan Stanley's current earnings momentum.

Find out about the key risks to this Morgan Stanley narrative.

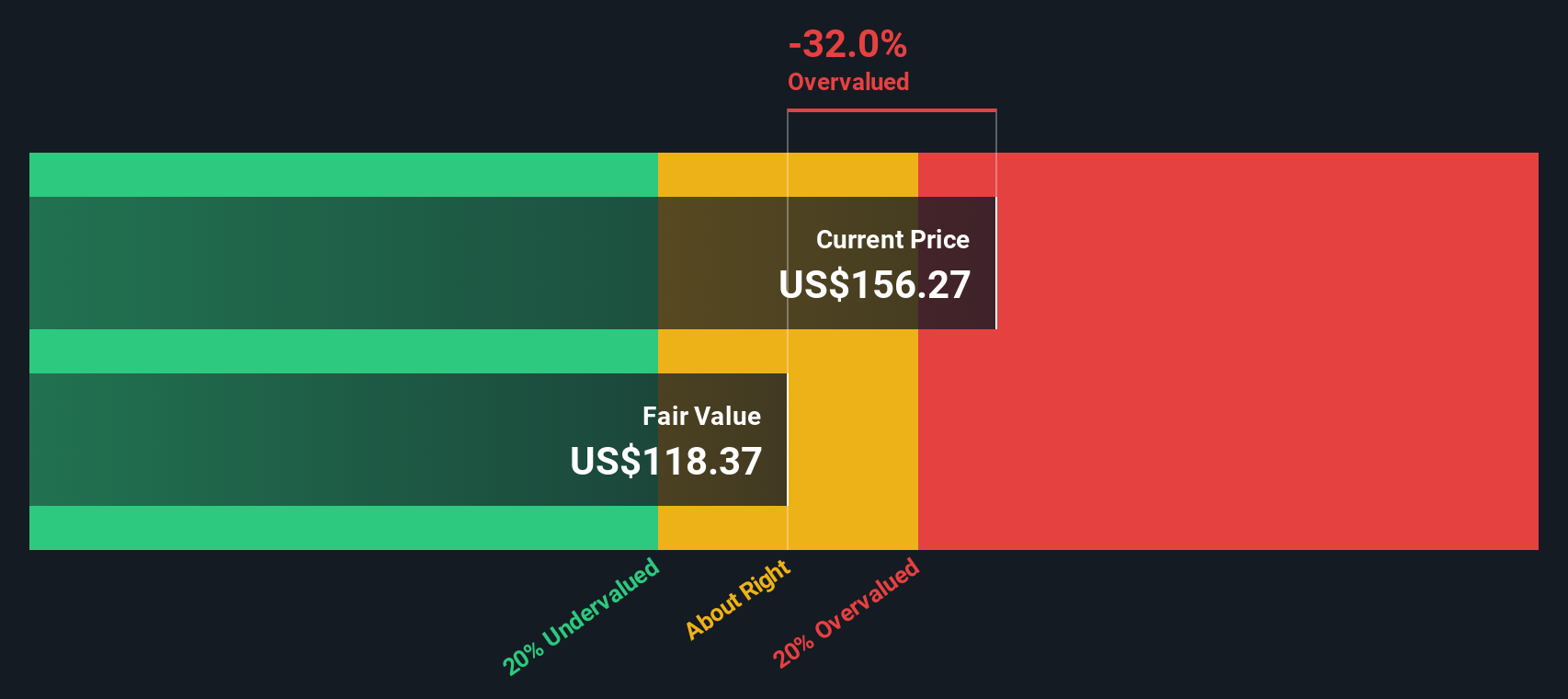

Another View: Discounted Cash Flow Model

Looking at Morgan Stanley from another angle, our DCF model suggests a different story. Instead of seeing shares as undervalued, the DCF model estimates a fair value that is below today’s trading price. This highlights how varying assumptions about cash generation and cost of capital can change the picture. Is one method better than the other, or do investors need to question them both?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morgan Stanley for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morgan Stanley Narrative

If you want to see the numbers for yourself or have a different take on Morgan Stanley's future, you can quickly analyse the data and develop your own perspective in just a few minutes. Do it your way

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You don’t want to miss out on smart opportunities others are tracking. Uncover stocks that fit different strategies and keep your edge in the market.

- Tap into companies aiming for significant payouts by reviewing these 20 dividend stocks with yields > 3% to see which stocks boast yields above 3%.

- Get ahead of tomorrow’s tech wave using these 26 AI penny stocks, driving innovation across multiple industries.

- Strengthen your search for value by checking out these 867 undervalued stocks based on cash flows and spot quality stocks whose cash flows suggest real upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives