- United States

- /

- Capital Markets

- /

- NYSE:MS

Is Morgan Stanley Stock Still a Bargain After 34.6% Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Morgan Stanley stock is worth its current price tag? You’re not alone. Figuring out a reasonable value for this financial powerhouse is top of mind for many investors right now.

- Recently, Morgan Stanley has seen plenty of action, with the shares up 3.5% over the week and a significant 34.6% year-to-date. These movements suggest a combination of growth sentiment and changes in risk outlook among investors.

- Some of these upward moves have been influenced by news about Morgan Stanley’s expanded wealth management division and a wave of analyst upgrades, which have further contributed to investor optimism. There is also ongoing discussion in the market about how the company's strategic investments may be enhancing its position within the industry.

- When it comes to valuation, Morgan Stanley lands a score of 3 out of 6 based on key value checks. Let’s break down what those numbers really mean. Stay tuned, because at the end we’ll introduce a more effective way to gauge whether the current price is reasonable.

Approach 1: Morgan Stanley Excess Returns Analysis

The Excess Returns model focuses on how much profit Morgan Stanley is able to generate above the cost of equity capital invested by shareholders. This approach evaluates whether the company's returns justify the risk and resources shareholders have put in.

For Morgan Stanley, the current Book Value is $62.98 per share, while analysts expect a stable Book Value of $68.11 in the future. The company’s stable Earnings Per Share (EPS) is projected at $11.15, based on weighted future Return on Equity (ROE) estimates from 13 analysts. With a Cost of Equity at $6.65 per share, the model calculates an Excess Return of $4.50 per share. Notably, Morgan Stanley’s average Return on Equity stands at 16.37%, a healthy indicator compared to many peers.

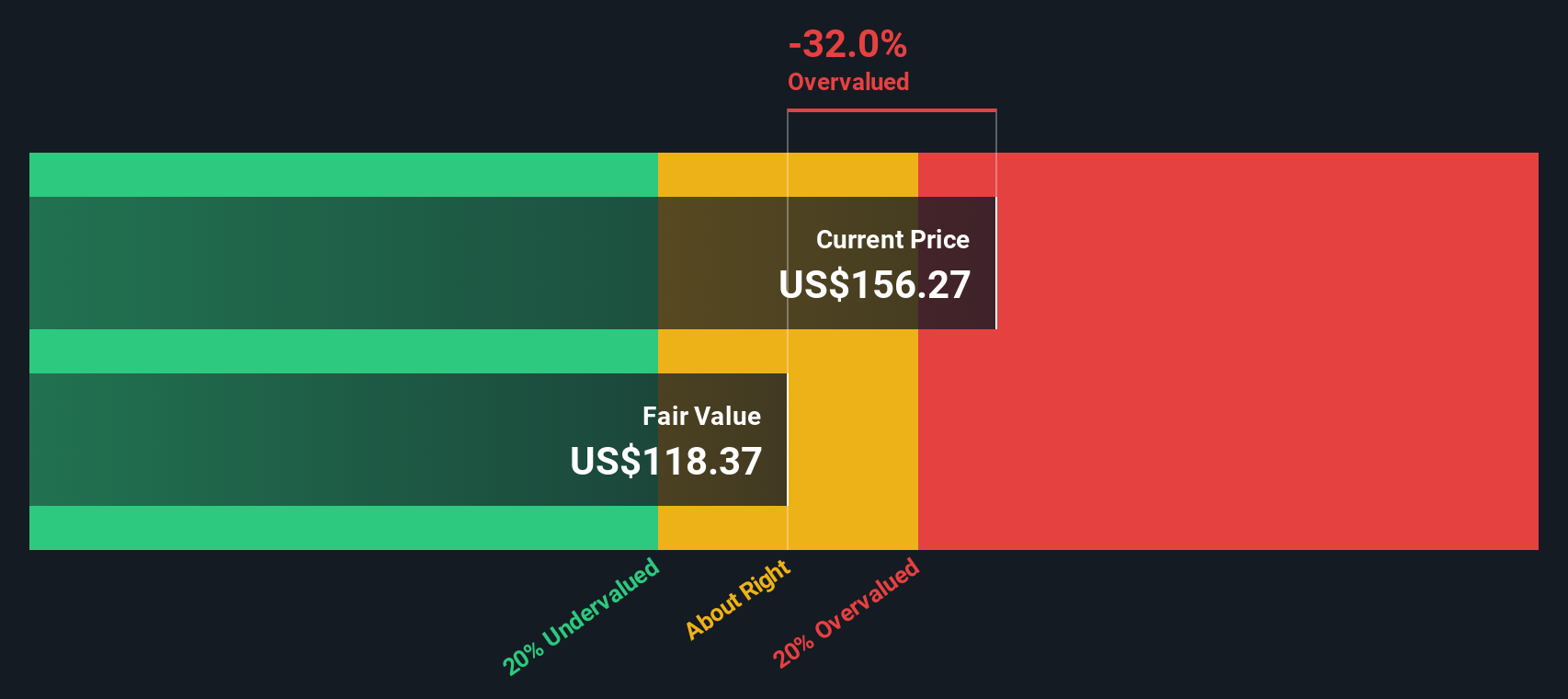

Despite these strengths, the Excess Returns valuation analysis concludes that Morgan Stanley is currently trading at a 22.4% premium to its estimated intrinsic value. In other words, the current share price is higher than what the underlying fundamentals would warrant according to this model.

Result: OVERVALUED

Our Excess Returns analysis suggests Morgan Stanley may be overvalued by 22.4%. Discover 933 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Morgan Stanley Price vs Earnings

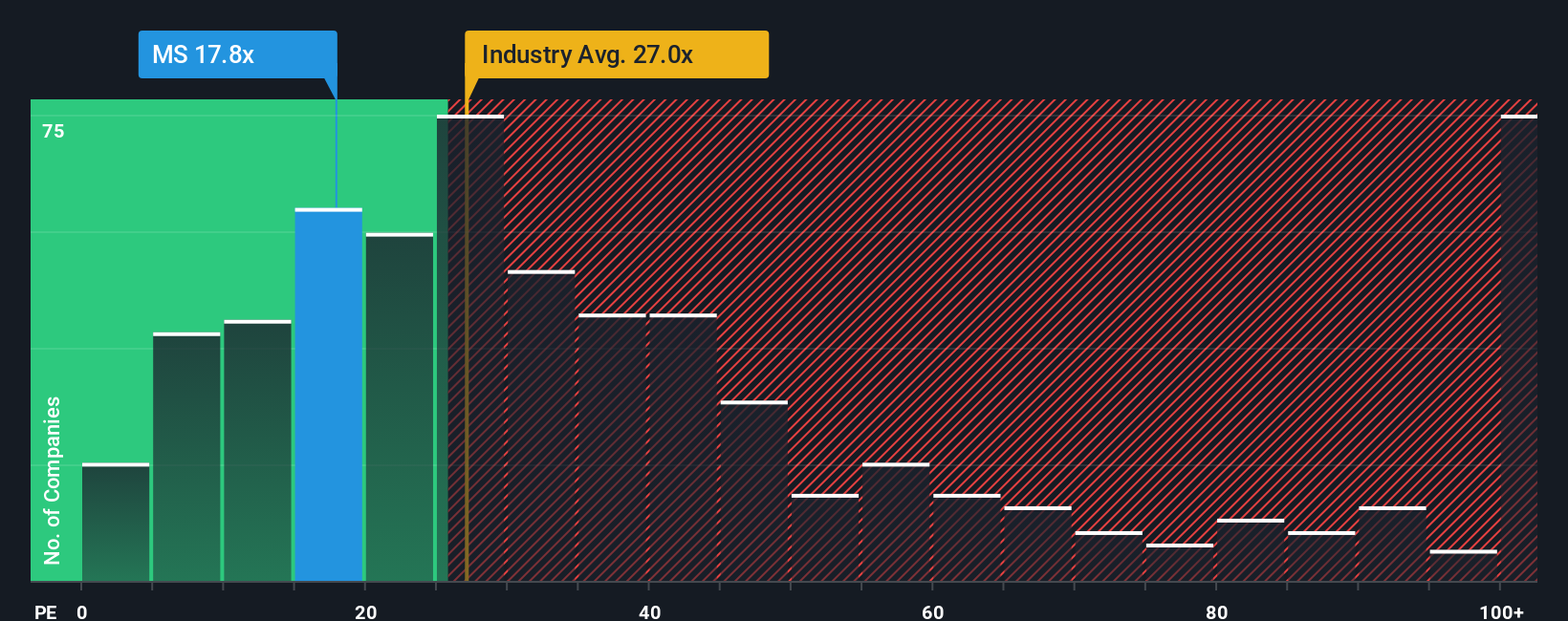

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Morgan Stanley. It allows investors to assess how much they are paying for each dollar of the company’s earnings, making it especially suitable for firms with steady profits and transparent income streams.

Interpreting PE ratios is not just about the number itself. A higher ratio can reflect expectations of strong future growth, while a lower one might signal perceived risks or slowdowns. Typically, a “normal” or “fair” PE ratio depends on how investors feel about a company’s prospects and stability relative to its sector.

Morgan Stanley currently trades at a PE ratio of 17.15x. This is below both the Capital Markets industry average of 23.54x and the average among close peers at 30.23x. This may suggest that investors are pricing in a more cautious outlook for the company.

To gain a more refined view, we look at Simply Wall St's proprietary “Fair Ratio,” which in this case stands at 18.87x. Unlike industry or peer comparisons, the Fair Ratio accounts for Morgan Stanley’s specific earnings growth, profitability, risk profile, market cap, and sector. This approach provides a more tailored benchmark for judging whether the current valuation is reasonable.

Comparing Morgan Stanley’s actual PE of 17.15x to the Fair Ratio of 18.87x, the difference suggests the stock is trading at a slight discount given its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Morgan Stanley Narrative

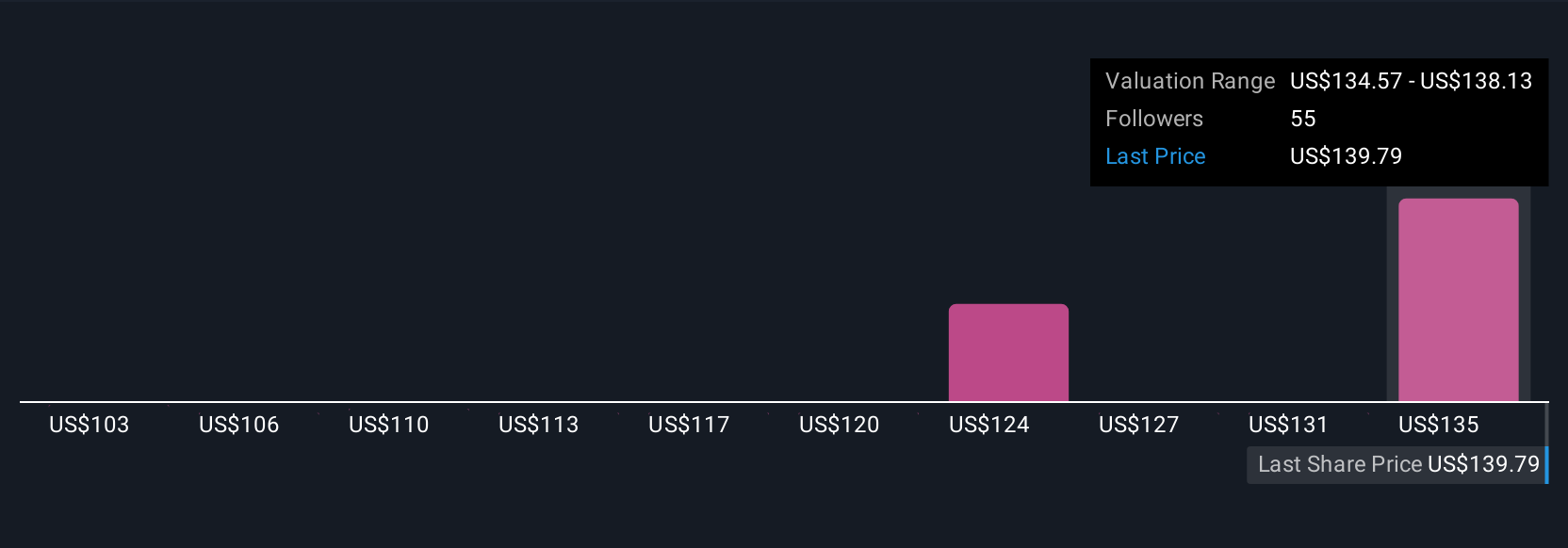

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company; it combines your beliefs about its future (like how revenue, earnings, and margins may change) with specific numbers to create a personal financial forecast and estimate a fair value. Narratives link what you expect for the business to actual financial outcomes, making valuation less about mysterious models and more about your informed perspective.

Simply Wall St’s Community page makes Narratives easy and accessible for everyone, letting millions of investors compare stories, test their assumptions, and see estimates update live as news or data changes. Narratives show you exactly when your view says to buy or sell, by comparing your personalized Fair Value to the current market price. For Morgan Stanley, one Narrative might assume strong global demand and improving margins, leading to an optimistic future PE and a price target above $160. Another Narrative might highlight risks from passive investing or regulation, justifying a lower margin forecast and a $122 price target. By exploring a range of Narratives, you see how real-world events and changing forecasts drive your investment decisions, and gain the tools to act confidently on your own view.

Do you think there's more to the story for Morgan Stanley? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success