- United States

- /

- Capital Markets

- /

- NYSE:MS

Could Morgan Stanley (MS)'s Private Markets Push Signal a Shift in Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- In recent weeks, Morgan Stanley has made a series of moves to expand its presence in private markets, including acquiring private shares platform EquityZen, introducing a research hub dedicated to high-growth private companies, and integrating technology like Corastone to enhance its wealth management services.

- These developments reflect Morgan Stanley's intent to broaden investor access to private market insights and streamline alternative asset transactions, positioning the firm to respond to changing client demands and industry trends.

- We'll explore how Morgan Stanley's new private market research platform could influence its investment narrative and future business outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Morgan Stanley Investment Narrative Recap

To own Morgan Stanley shares, you need to believe in the firm's ability to grow its wealth management and alternative assets businesses, even as fee pressures and digital competitors intensify. While the flurry of recent private markets initiatives is attracting attention, the main near-term catalyst remains ongoing net new asset growth, supported by strong recent earnings; however, mounting competition from passive products and fintech innovation still poses the most significant risk to sustainable margins. Based on current developments, the recent news does not materially shift these drivers in the short term.

Among the latest announcements, Morgan Stanley's acquisition of private shares platform EquityZen is especially relevant, as it could help broaden alternative investment offerings for clients and enhance access to high-growth private companies, directly supporting client demand and potential fee growth, both key near-term catalysts for the business. Other recent updates, such as technology integrations and research platforms for private firms, complement this direction and reinforce the overall investment case.

Yet, contrasting today’s momentum, investors should keep an eye on the rapid rise of passive investment products and ETF flows, as these represent risks to Morgan Stanley’s traditional fee-based business model that...

Read the full narrative on Morgan Stanley (it's free!)

Morgan Stanley's narrative projects $76.0 billion revenue and $17.2 billion earnings by 2028. This requires 5.0% yearly revenue growth and an increase of $3.1 billion in earnings from $14.1 billion today.

Uncover how Morgan Stanley's forecasts yield a $168.15 fair value, in line with its current price.

Exploring Other Perspectives

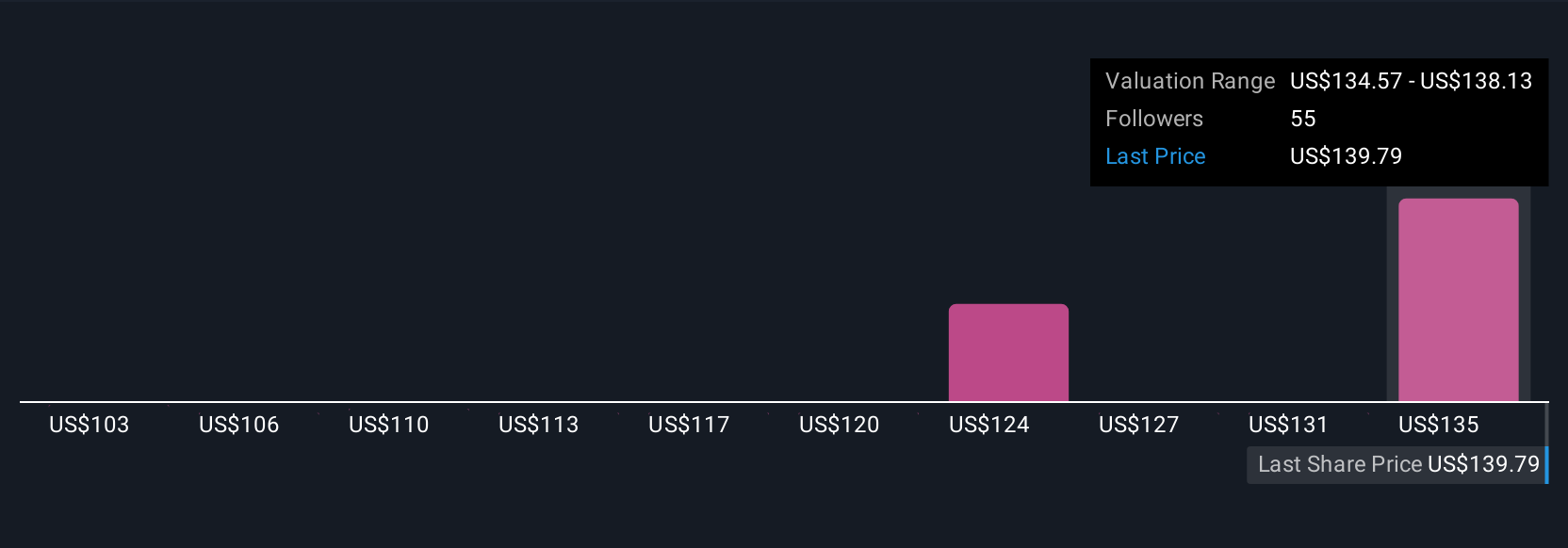

Six Simply Wall St Community members estimate fair values for Morgan Stanley ranging from US$102.53 to US$168.15 per share. Amid these differing views, competition from passive investing remains a key factor shaping future profit growth, explore how these perspectives could affect your own outlook.

Explore 6 other fair value estimates on Morgan Stanley - why the stock might be worth as much as $168.15!

Build Your Own Morgan Stanley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Morgan Stanley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morgan Stanley's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives