- United States

- /

- Capital Markets

- /

- NYSE:MC

Is Now the Right Time to Reassess Moelis After Its Global Expansion News?

Reviewed by Bailey Pemberton

- Thinking about whether Moelis is a bargain or overpriced? You are not alone, and there are a few ways to look at its underlying value before making your next move.

- Moelis shares have recently swung higher, up 4.8% over the last week, but still sit down 11.8% over the past year and 13.4% year-to-date. This makes for a mixed recent performance story.

- News that Moelis is expanding its advisory presence in new markets has caught investor attention and could be a factor in the recent price bounce. Some coverage has also pointed to upbeat deal pipelines in the banking sector, providing broader industry context for the stock’s volatility.

- Currently, Moelis scores a 1 out of 6 on our valuation checks. Here is what this means, how different valuation models assess Moelis, and why the full picture goes beyond just the numbers.

Moelis scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Moelis Excess Returns Analysis

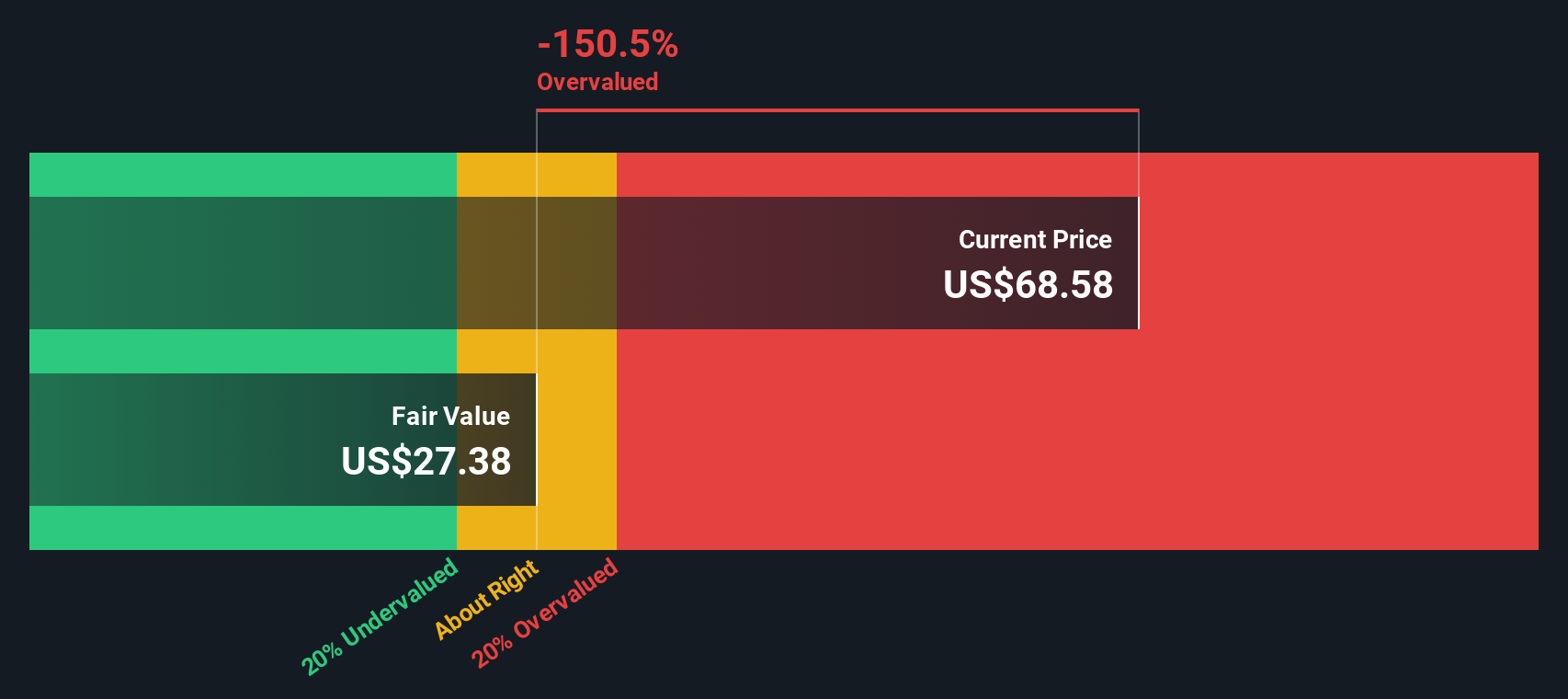

The Excess Returns Model helps investors estimate a company’s intrinsic value by looking at the returns it generates above the required cost of equity. In other words, it assesses how much more Moelis earns from investing its capital than it needs to compensate shareholders for their risk.

For Moelis, the model uses a Book Value of $7.23 per share and a Stable EPS of $1.62 per share, based on the median return on equity from the past five years. The cost of equity stands at $0.69 per share, which means the company produces an Excess Return of $0.92 per share. The average Return on Equity is 22.83%, with a Stable Book Value estimate of $7.08 per share. These figures reflect both Moelis’ historic strength and analysts’ expectations for its financial health going forward.

Despite these solid figures, the current stock price is significantly higher than the fair value implied by the Excess Returns Model, with an implied overvaluation of 201.8%. This suggests that the market is pricing in far more optimistic outcomes than the model supports.

Result: OVERVALUED

Our Excess Returns analysis suggests Moelis may be overvalued by 201.8%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

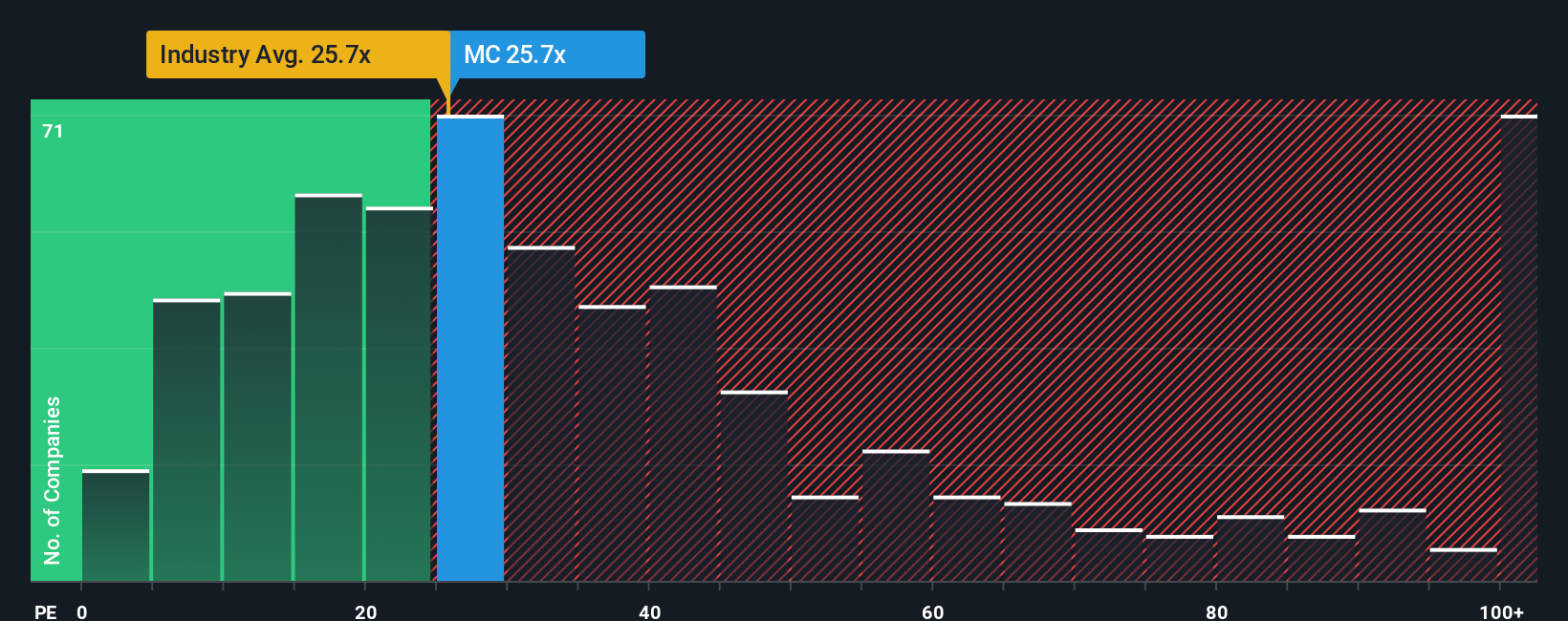

Approach 2: Moelis Price vs Earnings

The price-to-earnings (PE) ratio is often the metric of choice when valuing profitable companies, as it connects the stock price directly to the company’s actual bottom-line results. For established firms with steady earnings, the PE ratio offers a familiar snapshot of what investors are willing to pay for each dollar of profit.

What counts as a “normal” PE ratio depends on a company’s growth prospects and risk profile. Faster-growing or less risky businesses tend to command higher PE multiples. Slower or more volatile ones usually trade at lower ratios.

Moelis currently trades at a PE ratio of 20.3x. This is slightly below the broader Capital Markets industry average of 23.5x, but it is well above the peer group’s average of 8.5x. However, benchmarks like industry and peer averages can overlook the unique strengths or risks facing a specific company. This is where Simply Wall St’s Fair Ratio comes in. For Moelis, the Fair Ratio is estimated at 18.2x, based on factors such as its earnings growth outlook, profit margin, and market capitalization, as well as broader industry and risk factors.

The Fair Ratio gives a more personalized estimate of what would be an equitable market multiple for Moelis. It balances the company’s specific risks and opportunities rather than relying solely on generalized comparisons. Comparing the current PE of 20.3x to the Fair Ratio of 18.2x signals that Moelis shares are priced somewhat above what would typically be justified, even once all those custom factors are considered.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Moelis Narrative

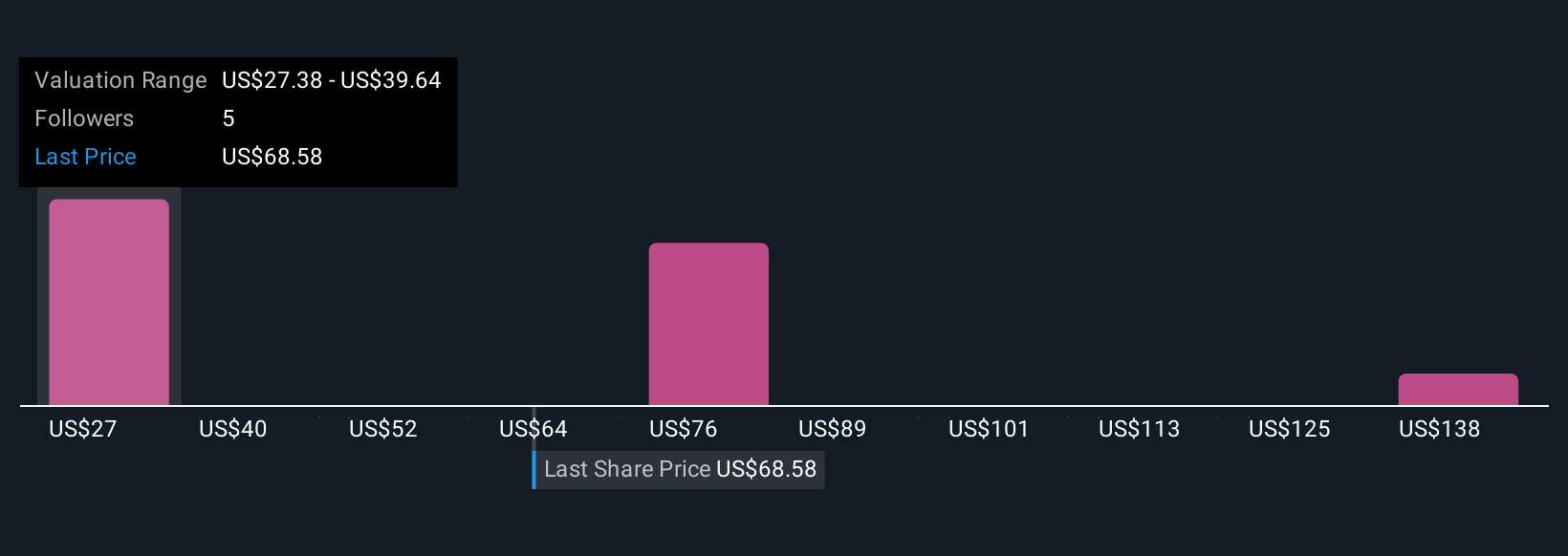

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives, a dynamic tool that lets you define your own story for a company like Moelis and turn it into a financial forecast and fair value.

Unlike traditional analysis that focuses solely on the numbers, a Narrative allows you to connect the company’s strategy, risks, and outlook with your own estimates for future revenue, earnings, and profit margins. Think of it as framing your investment thesis in a way that links directly to what you think Moelis is truly worth, combining the “why” behind the business with the “how much” it might deliver.

Narratives on Simply Wall St’s Community page are easy to use and are updated automatically as new information, such as earnings or news, becomes available. This helps your view of fair value stay relevant. Millions of investors use this to spot when a stock is undervalued or overvalued by comparing their Narrative-driven Fair Value against the current price, enabling smarter buy or sell decisions as the market shifts.

For example, some investors believe Moelis’ expansion into private capital advisory and technology will justify a Fair Value as high as $90.00 per share, while others who are focused on margin risks see a Fair Value closer to $65.00. This is a great reminder that your investment story really does drive your numbers.

Do you think there's more to the story for Moelis? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MC

Moelis

Operates as an investment banking advisory company in North and South America, Europe, the Middle East, Asia, and Australia.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success