- United States

- /

- Capital Markets

- /

- NYSE:MC

Fed Rate Cut and M&A Optimism Could Be a Game Changer For Moelis (MC)

Reviewed by Simply Wall St

- In recent months, Moelis & Company has benefited from increased investor interest, driven by expectations of stronger M&A activity following a Federal Reserve interest rate cut and continued progress in business diversification and capital returns.

- Analyst commentary has underscored that Moelis’ synergies from M&A advisory services and robust organic growth, along with an active approach to returning capital, are fueling greater optimism about its longer-term growth outlook.

- We’ll explore how renewed optimism for future M&A deal activity, sparked by the rate cut, may influence Moelis’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Moelis Investment Narrative Recap

To own shares in Moelis & Company, you need to believe in the potential for structural growth in the global M&A and capital markets business. The recent news of a Federal Reserve rate cut has reinforced optimism around the most important short-term catalyst: a pickup in M&A activity. However, the biggest risk remains high earnings volatility due to Moelis’ event-driven revenue model, which could resurface if broader deal flow weakens. The impact of the latest developments meaningfully supports the current catalyst, but ongoing cyclical risks cannot be ignored.

Among recent company announcements, the July 2025 earnings report stands out: Moelis reported net income of US$41.54 million in Q2, up significantly from a year earlier. This result aligns closely with expectations for stronger top-line growth, reflecting the firm’s ability to capture increased deal activity and return capital to shareholders as market conditions improve.

Yet, in contrast to the current optimism, investors should be aware that earnings at Moelis can remain highly unpredictable if capital markets activity suddenly slows...

Read the full narrative on Moelis (it's free!)

Moelis is projected to reach $2.1 billion in revenue and $381.7 million in earnings by 2028. This outlook assumes a 15.3% annual revenue growth rate and an earnings increase of $183.6 million from the current earnings of $198.1 million.

Uncover how Moelis' forecasts yield a $78.60 fair value, a 4% upside to its current price.

Exploring Other Perspectives

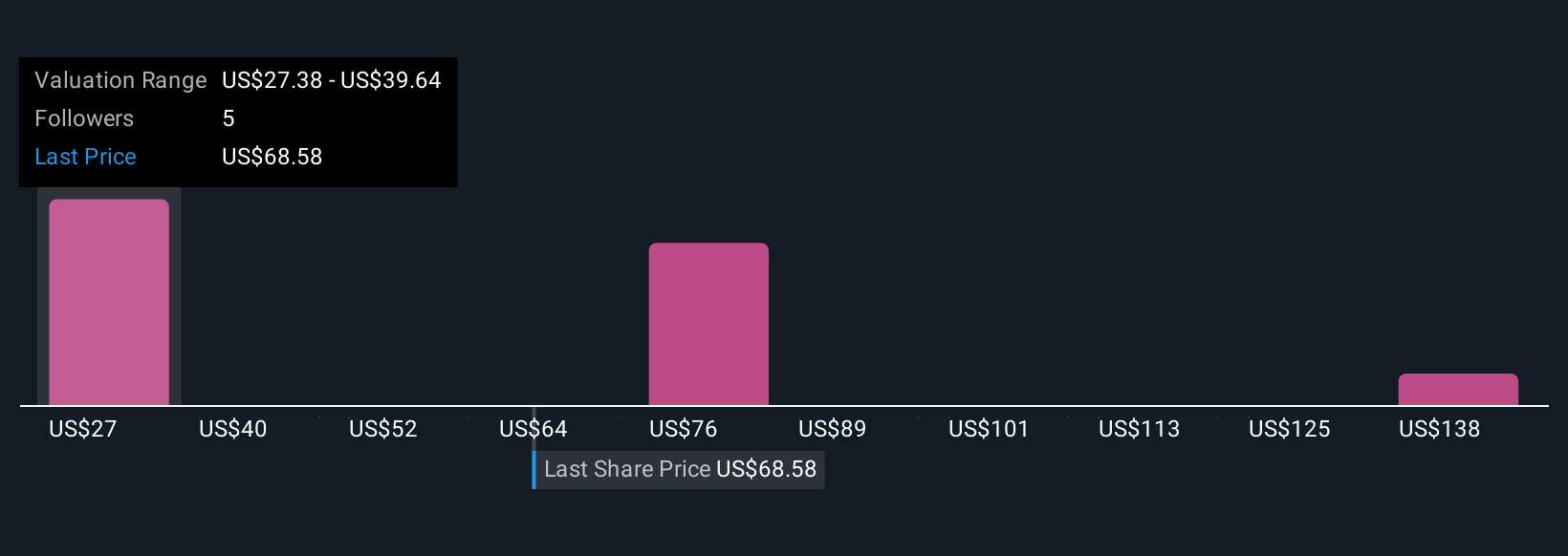

Simply Wall St Community members have shared three fair value estimates for Moelis, ranging widely from US$26.70 to US$150. With M&A-driven catalysts in focus, these diverging views highlight how market expectations could shift if the capital markets weaken. Review several perspectives to inform your next steps.

Explore 3 other fair value estimates on Moelis - why the stock might be worth less than half the current price!

Build Your Own Moelis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moelis research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Moelis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moelis' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MC

Moelis

Operates as an investment banking advisory company in North and South America, Europe, the Middle East, Asia, and Australia.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion