- United States

- /

- Diversified Financial

- /

- NYSE:MA

Should You Add Mastercard to Your Portfolio After Its 18.5% Rally in 2024?

Reviewed by Bailey Pemberton

Trying to figure out if Mastercard deserves a spot in your portfolio right now? You are not alone. With so many headline-making moves in payments, it is no surprise that investors are looking closely at where prices, risks, and opportunities stand for giants like Mastercard. Over the past few years, Mastercard shares have charted a path that mixes long-term growth with a few recent bumps. The stock is up a healthy 18.5% over the past year and has soared 101.6% in three years, but the last 30 days saw a slight dip of 0.9%, proving that even market leaders can see their momentum pause as broader market expectations shift.

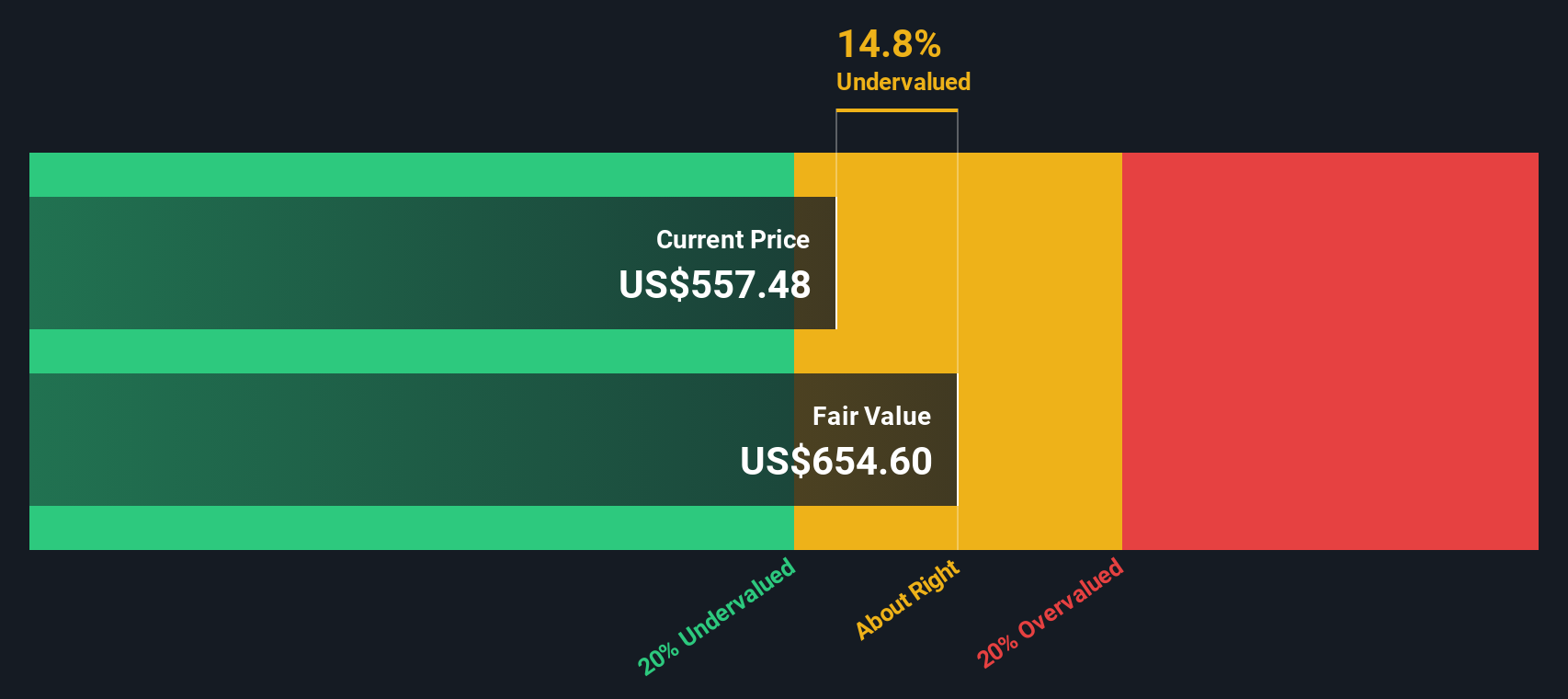

There is a ton of speculation about how changes in global consumer spending and evolving digital payment trends are impacting Mastercard's future prospects, but one thing is clear: the market still sees Mastercard as a dominant force in its industry. However, looking at a valuation score, the company currently passes just 1 out of 6 key checks for being undervalued. That means most standard valuation methods see it as fairly or possibly even richly priced, at least for now.

But are traditional valuation checks telling us the whole story? Let us dig into exactly how these valuations work, what they really reveal, and, most importantly, explore if there is an even better way to size up Mastercard’s true worth at the end.

Mastercard scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mastercard Excess Returns Analysis

The Excess Returns model evaluates how much profit Mastercard generates above and beyond what shareholders would need to fairly compensate them for their investment. This approach looks closely at return on equity and the company’s ability to reinvest profitably over time.

For Mastercard, analysts estimate a stable Earnings Per Share (EPS) of $28.96, based on future Return on Equity projections from 12 analysts. The cost of equity, or the amount shareholders expect in return, is currently $1.10 per share. Mastercard’s excess return per share is an impressive $27.85. With a stable book value of $14.83 per share (sourced from 8 analysts), Mastercard’s average return on equity is a striking 195.26 percent, indicating exceptional profitability relative to what shareholders require.

Applying these figures, the Excess Returns model estimates Mastercard’s intrinsic value at $652.69 per share. Since the implied discount is 11.3 percent, Mastercard stock is considered undervalued by this measure at today’s prices, despite its premium valuation multiples compared to peers and the industry average.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mastercard is undervalued by 11.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Mastercard Price vs Earnings

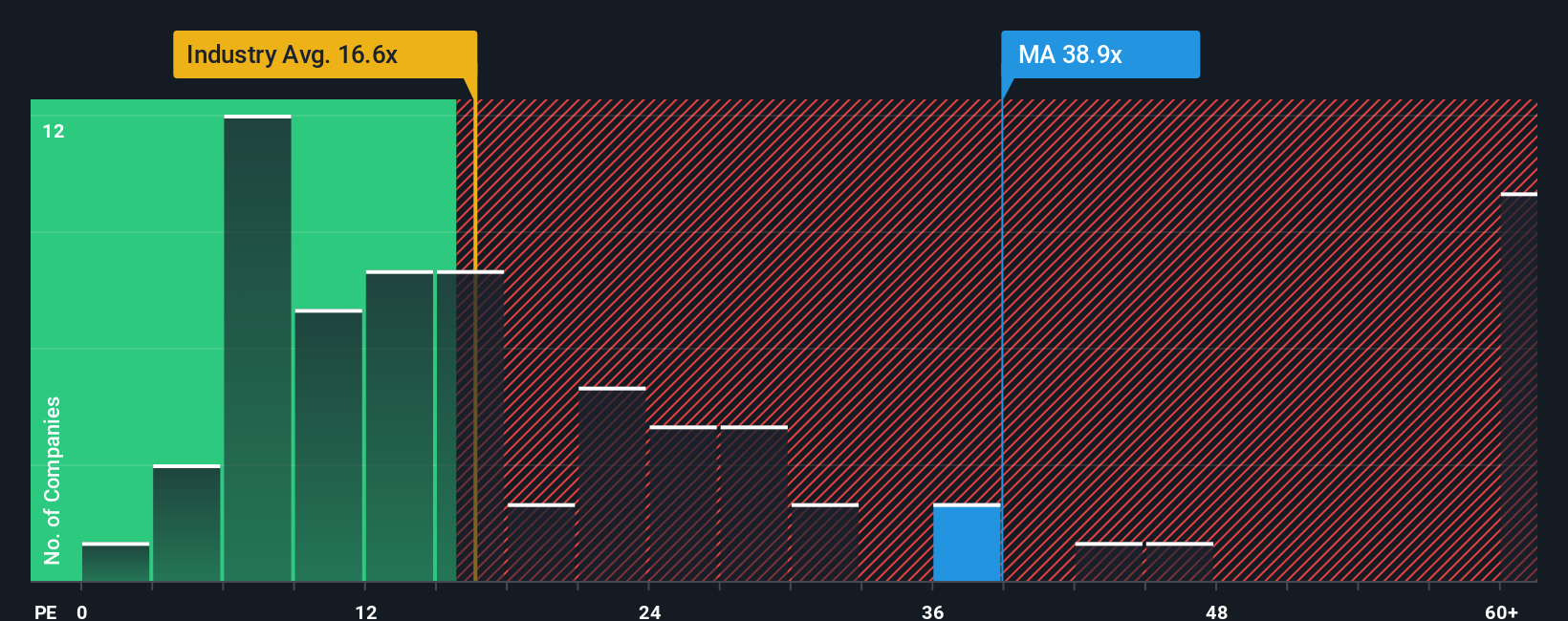

Price-to-Earnings (PE) is a preferred valuation multiple for established, profitable companies like Mastercard because it directly relates the current market price to what the company is actually earning. For companies generating reliable profits, the PE ratio helps investors gauge how much they are paying for each dollar of current earnings.

The "right" PE multiple can vary widely depending on expectations for future growth and the perceived risks in a business or industry. Companies with higher expected growth and lower risk typically command higher PE ratios, while those with slower prospects or higher risk are expected to trade at lower multiples.

Currently, Mastercard trades at a PE ratio of 38.51x. This is significantly higher than both the Diversified Financial industry average of 16.09x and the peer average of 21.08x. Such a high multiple suggests that the market expects Mastercard to continue delivering strong growth, robust profitability, or both.

This is where Simply Wall St’s Fair Ratio offers a more nuanced perspective. The Fair Ratio for Mastercard is 22.95x, reflecting what investors should reasonably pay given the company’s unique mix of expected earnings growth, industry dynamics, profit margins, scale, and risk profile. Unlike a simple comparison to peers or the broad industry, this custom benchmark factors in the actual drivers of value specific to Mastercard. This is important for companies with unique strengths or weaknesses.

Since Mastercard’s current PE of 38.51x is notably above its Fair Ratio of 22.95x, the analysis suggests the stock is overvalued based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mastercard Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind the numbers; it is how you connect your personal view on Mastercard’s future (like its revenue growth, margins, risks, and opportunities) to hard data such as fair value and financial forecasts. Narratives help bring together the company’s big picture, the numbers, and your own assumptions, allowing you to determine what you think the company is really worth and why.

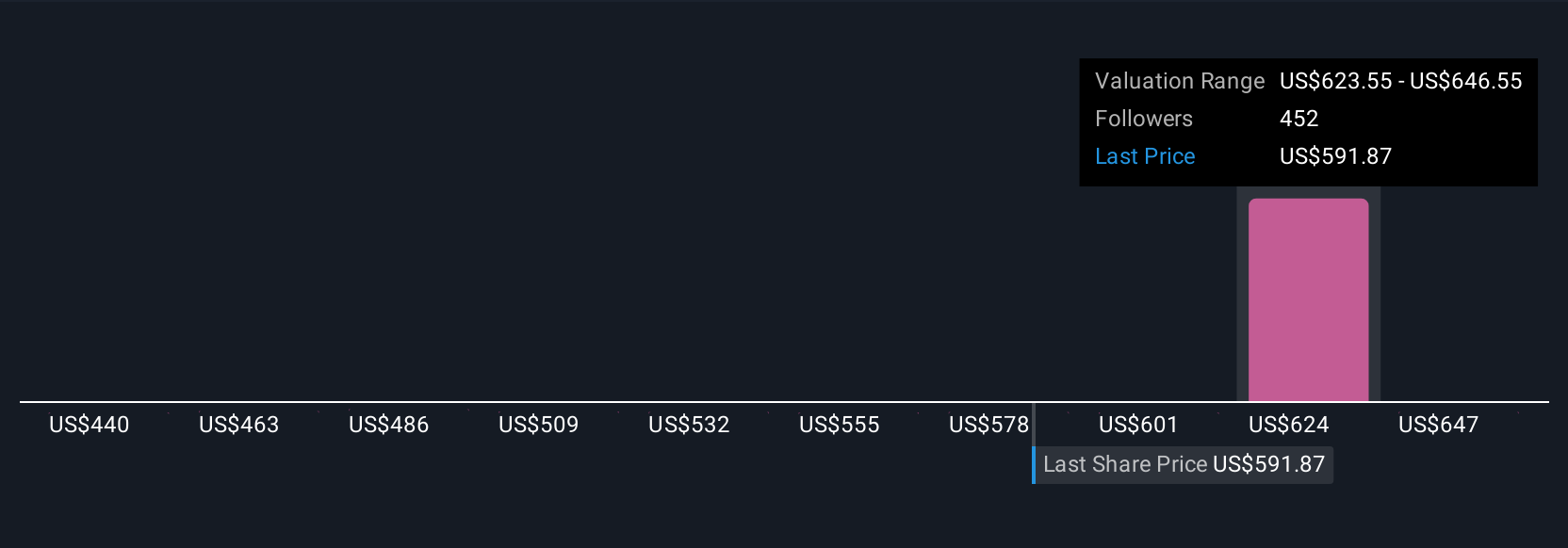

On Simply Wall St’s Community page, millions of investors are already using Narratives as an easy and accessible tool to articulate and update their investment perspective. With Narratives, you are not just following the crowd; you are able to map your reasoning, compare your fair value directly to the market price, and see what would make Mastercard a buy, hold, or sell for you. Because Narratives update dynamically with new news and company results, you always have the most relevant context for decision making. For example, some investors believe Mastercard’s digital expansion and market leadership justify a fair value as high as $690, while others focus on rising competition and see fair value closer to $520, so your Narrative directly connects your viewpoint to actionable insights.

Do you think there's more to the story for Mastercard? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives