- United States

- /

- Consumer Finance

- /

- NYSE:LC

LendingClub (LC): Valuation Insights Following Strong Earnings, Upbeat Guidance, and Analyst Upgrade

Reviewed by Simply Wall St

LendingClub saw its stock price climb following the release of its third-quarter results, which surpassed expectations on both earnings and revenue. The company’s fresh guidance for the next quarter fueled additional optimism among investors.

See our latest analysis for LendingClub.

LendingClub's upbeat quarterly earnings and confident forward guidance lit a fuse under the stock, which surged as much as 20% recently before settling at $18.02. A string of positive catalysts, including a key analyst upgrade and strong sector momentum, has fueled investor optimism. As a result, the stock has enjoyed an 8.95% 1-month share price return and an impressive 27.35% total shareholder return over the past year. This suggests momentum is building in both the short and long term.

If LendingClub's rebound got your attention, it's the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares rallying hard on upbeat results and Wall Street endorsement, investors might wonder if LendingClub remains undervalued or if the recent surge already reflects all of its future growth prospects.

Most Popular Narrative: 11% Undervalued

LendingClub’s most widely-followed narrative sets its fair value at $20.25, compared to the last close of $18.02. The gap between these figures highlights investor conviction in LendingClub’s earnings power, and the model behind this target points to meaningful upside if assumptions hold up.

*The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.*

Think there’s a catch? The fair value rests on a bold combination of surging profit margins, reimagined earnings projections, and future market multiples not seen in today’s sector. Wondering how rising revenues and powerful margin assumptions translate into this eye-catching target? The full narrative holds the figures and their dramatic implications.

Result: Fair Value of $20.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on personal loans and growing competition could pose significant challenges to LendingClub’s growth and future profit margins.

Find out about the key risks to this LendingClub narrative.

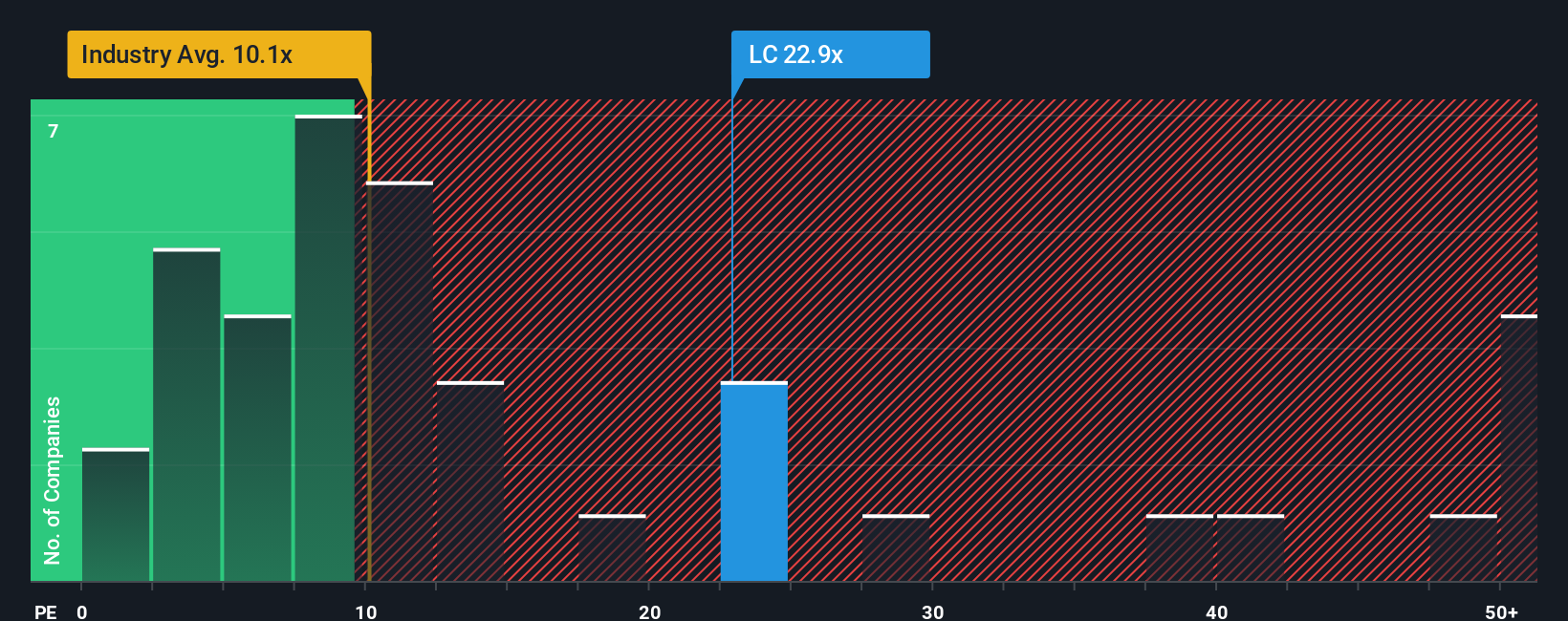

Another View: Multiples Tell a Different Story

While our narrative points to substantial upside, a closer look at LendingClub’s price-to-earnings ratio reveals a caution flag. The stock trades at 20x earnings, nearly double the sector average of 10.3x and well above its peer average of 5.1x. However, this is close to its fair ratio of 21.4x. This suggests the market may be pricing in future growth already. That spread poses both risk and opportunity, depending on which direction sentiment takes next. Which approach will prove right as new numbers come in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you see things differently or have your own take on LendingClub's story, jump in and craft your own perspective in just a few minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LendingClub.

Looking for More Smart Investment Ideas?

Expand your portfolio with new opportunities handpicked by the Simply Wall Street Screener. Don’t hesitate, as these fast-moving trends are already shaping the next wave of winners.

- Boost your income and stability by checking out these 21 dividend stocks with yields > 3%, packed with companies offering yields above 3% for reliable returns.

- Act on the AI revolution before everyone else does by seeking out future leaders through these 26 AI penny stocks, where tomorrow’s technology giants are taking shape.

- Capitalize on untapped potential by researching these 864 undervalued stocks based on cash flows, highlighting stocks currently trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives