- United States

- /

- Consumer Finance

- /

- NYSE:LC

LendingClub (LC) Sets $100M Buyback—A Fresh Look at Valuation and Future Potential

Reviewed by Simply Wall St

LendingClub (LC) has unveiled plans to repurchase up to $100 million of its common stock following board approval of a new buyback program. The repurchase window extends through the end of 2026.

See our latest analysis for LendingClub.

The buyback announcement comes as LendingClub’s momentum has picked up. After a brief dip, its 1-month share price return stands at nearly 9%, and the stock boasts an impressive 16% total shareholder return over the last year. Long-term investors have seen robust gains, with the 5-year total return topping 170% and indicating sustained growth ahead.

If LendingClub's latest move has you looking for what else could be on the rise, take the opportunity to discover fast growing stocks with high insider ownership.

But with LendingClub shares already posting solid multi-year gains and still trading at a noticeable discount to analyst targets, the question remains: Is there real value left for new investors, or has the market already priced in future growth?

Most Popular Narrative: 20.2% Undervalued

LendingClub's widely followed narrative points to a fair value estimate of $21.91, which is substantially above the last close of $17.48. The gap between price and narrative valuation highlights ongoing market debates about whether the current rally can continue.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.

What’s the secret fueling this bullish view? The core assumptions center on significant jumps in future profits and a margin expansion narrative tied to new digital product rollouts. The market may not be pricing in just how sharp these projected financial gains could be. Curious what it takes, by the numbers, to hit that coveted target? Explore the full narrative and judge for yourself.

Result: Fair Value of $21.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and reliance on personal loans could pressure LendingClub’s growth. These factors could pose real challenges to the bullish narrative if trends shift.

Find out about the key risks to this LendingClub narrative.

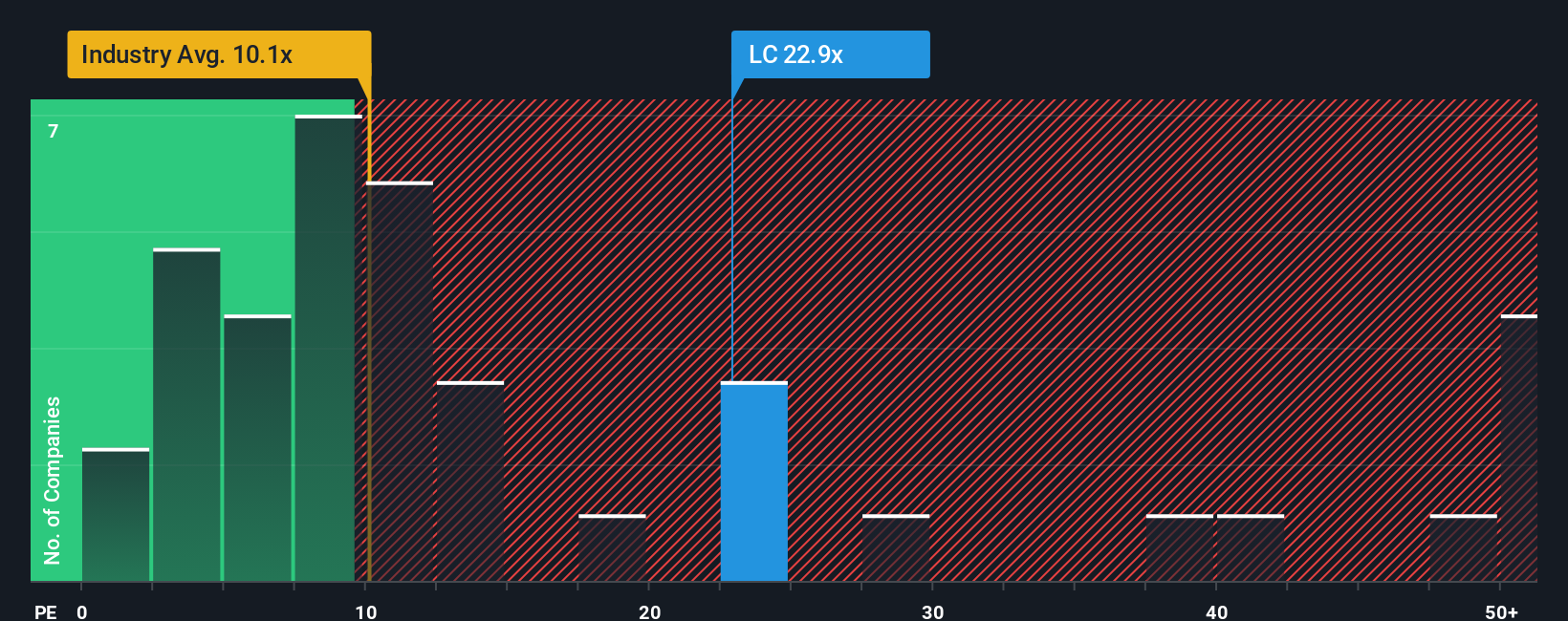

Another View: Multiples Paint a Different Picture

Looking at valuation through earnings multiples, LendingClub is trading at 19.4 times its recent earnings, which is well above both industry peers (averaging 10.6x) and its own fair ratio of 23x. This suggests the market may be assigning a premium, but is it warranted or risky given future earnings growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you think the story looks different or want to chart your own perspective, you can easily dive into the data and craft a LendingClub outlook yourself in just a few minutes, so why not Do it your way.

A great starting point for your LendingClub research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing toolkit and give yourself an edge by checking out these handpicked opportunities before the rest of the market catches on:

- Start earning the income you deserve by reviewing these 15 dividend stocks with yields > 3% with impressive yields that help your portfolio work harder.

- Fuel your curiosity for innovation and catch early movers in artificial intelligence with these 27 AI penny stocks that are reshaping tomorrow’s industries today.

- Unlock hidden value and find tomorrow’s bargains among these 882 undervalued stocks based on cash flows that are primed to deliver strong returns based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives