- United States

- /

- Consumer Finance

- /

- NYSE:LC

LendingClub (LC) Profit Margins Double, Challenging Concerns About Premium Valuation

Reviewed by Simply Wall St

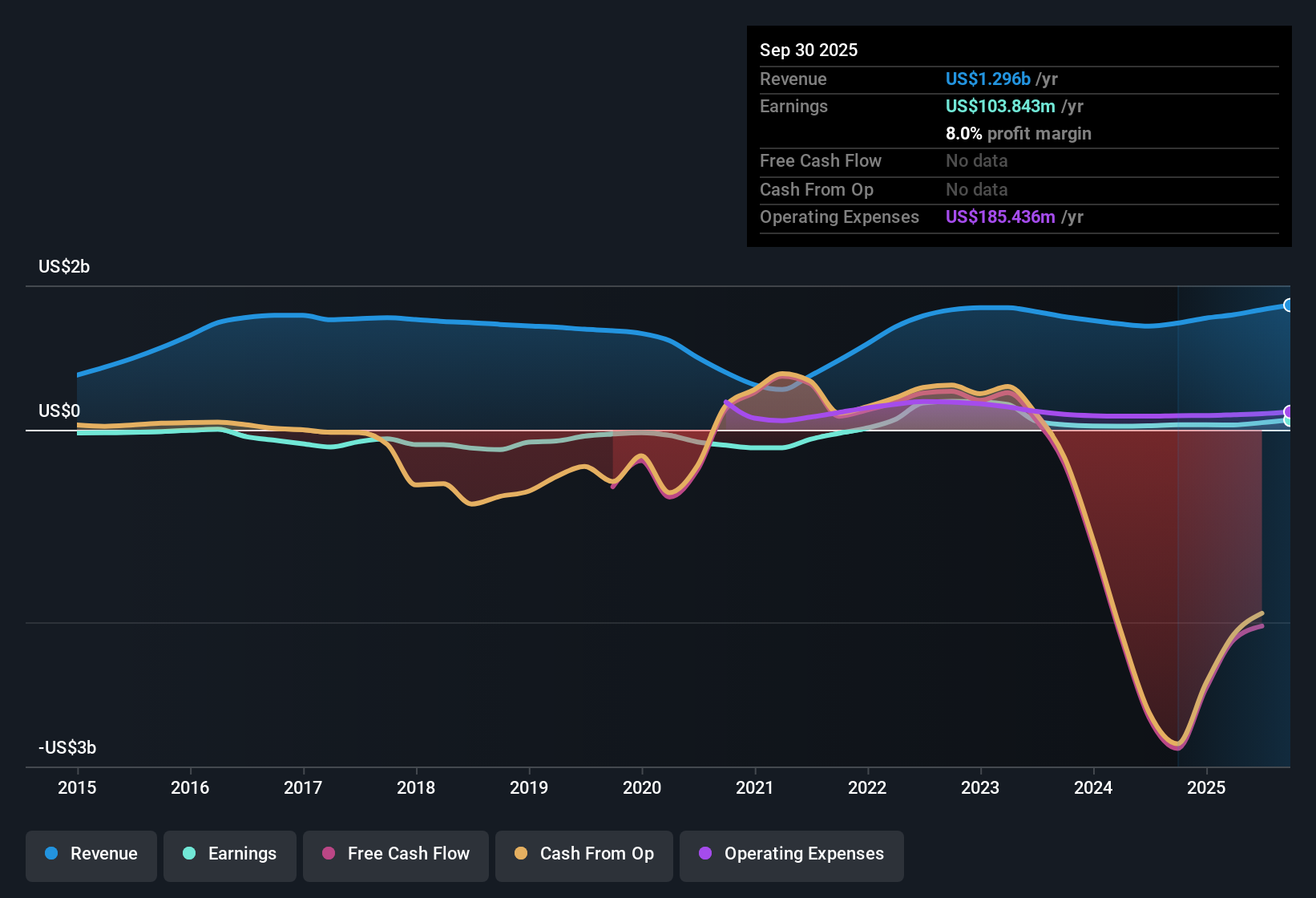

LendingClub (LC) posted net profit margins of 8%, up from 4.7% in the previous period, while earnings soared by 100.6% over the past year, far outpacing its five-year compound annual growth rate of 30%. The company’s stock, trading at $18.25 per share, appears undervalued versus a discounted cash flow fair value estimate of $25.94, even as its price-to-earnings ratio remains above industry averages. With forecast annual earnings growth of 38.1% and an improved profitability profile, investors will weigh impressive momentum against a premium valuation multiple.

See our full analysis for LendingClub.The next section puts these headline numbers in context, comparing them to the big narratives that investors and analysts have been following for LendingClub.

See what the community is saying about LendingClub

Margins Poised for Upswing

- Analysts project profit margins rising from 5.9% today to 21.2% over the next three years. This suggests a significant improvement in underlying profitability beyond near-term headline growth.

- Analysts' consensus view expects LendingClub's combination of ongoing digital product launches and proprietary AI credit modeling to structurally boost net margins as consumer demand for mobile-first banking grows.

- Consensus narrative highlights that new digital products, such as LevelUp Checking and anticipated tools like DebtIQ, are designed to drive customer engagement and cross-selling, supporting higher revenue per user.

- What stands out is the company’s dual revenue engine: capital-light marketplace originations fueling short-term gains, along with a balance sheet lending arm that builds recurring net interest income to underpin future margin expansion.

See how analysts think LendingClub’s profit surge sets up its long-term narrative and future risks. 📊 Read the full LendingClub Consensus Narrative.

Revenue Growth Lags Market Trend

- LendingClub is expected to increase annual revenue by just 4.4%, trailing behind the broader US market's 10% forecast and highlighting a relative slowdown compared to industry averages.

- Analysts' consensus narrative cautions that heavy reliance on personal loan demand, rising competitive pressures, and potentially higher customer acquisition costs could further constrain top-line growth even as new products roll out.

- Bears argue the dependence on debt consolidation trends makes future growth vulnerable to consumer credit cycles and regulatory changes.

- Consensus narrative points to a likely increase in marketing spend needed to sustain originations, at the potential cost of compressing profit margins over time if revenue expansion remains sluggish.

Premium Valuation Despite Fair Value Gap

- LendingClub’s price-to-earnings ratio of 20.3x is nearly double the industry average of 10.3x, even as its $18.25 share price stands below a DCF fair value of $25.94. This creates a tension between premium multiples and discounted cash flow fundamentals.

- Analysts' consensus view notes that the analyst price target of $20.05 now sits just 9.9% above the current share price, signaling that most believe the stock is roughly fairly valued despite robust bottom-line momentum.

- This narrower price target gap, combined with a below-fair-value trading level, challenges the bullish thesis that rapid earnings growth alone can justify current valuation multiples.

- The consensus anchors on the expectation that multiple expansion is unlikely unless revenue growth accelerates to match sector leaders.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LendingClub on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want a fresh perspective on the latest results? Shape your own take in just a few minutes and share your view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LendingClub.

See What Else Is Out There

LendingClub’s solid profit growth stands in contrast to its sluggish revenue expansion, raising questions about long-term top-line momentum and sector leadership.

If you want growth that matches both earnings and revenues, uncover steadier opportunities with stable growth stocks screener (2088 results) that deliver reliable performance through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives