- United States

- /

- Consumer Finance

- /

- NYSE:LC

Does LendingClub’s 19.8% Price Surge Signal Opportunity in 2025?

Reviewed by Bailey Pemberton

Wondering what to do with LendingClub stock right now? You are not alone, and the answer is not as easy as a simple yes or no. LendingClub’s shares have been catching the eye of investors lately, bouncing up a remarkable 19.8% in just the last week and notching a 10.4% gain over the past month. Over the long term, the returns get even more impressive, climbing 294.6% over five years. Momentum like this does not happen in a vacuum.

A good chunk of LendingClub’s renewed interest comes as a result of headlines spotlighting its continued push into digital banking and peer-to-peer lending, as well as positive industry discussions around responsible fintech innovation. This broader context has some investors rethinking the risks and rewards tied to LendingClub’s evolving business model. Markets can change their mind quickly about a company once it starts showing clear progress or signs of renewed competitiveness, and LendingClub’s latest moves are finally being reflected in its stock price.

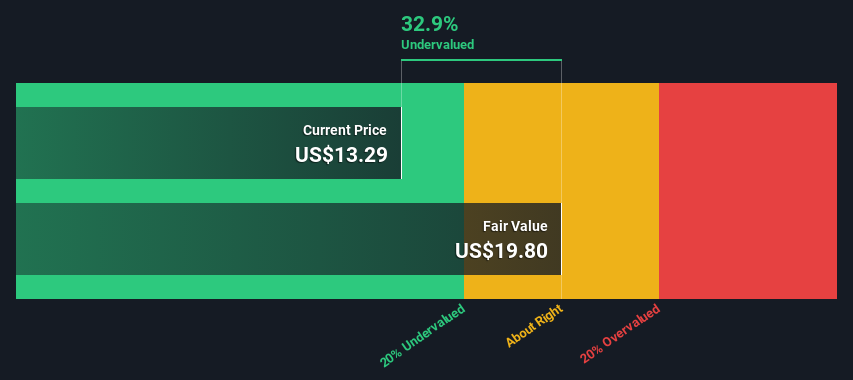

But let’s get to the heart of what most people are really asking: what is this stock actually worth compared to its current price? According to our valuation checks, LendingClub meets three out of six criteria for being undervalued, giving it a value score of 3. Of course, those are just the traditional checks. In the next section, we will break down exactly how each of these valuation methods stacks up and hint at an even more insightful approach to understanding LendingClub’s true value by the end of this article.

Approach 1: LendingClub Excess Returns Analysis

The Excess Returns valuation approach estimates a company’s intrinsic value by examining how much profit the business generates above its cost of equity. In summary, this model looks at how effectively LendingClub puts its capital to work and how much "excess" value it can create for shareholders from its investments, once the necessary returns to equity holders are covered.

For LendingClub, the key Excess Returns data points are as follows:

- Book Value: $12.68 per share

- Stable EPS: $1.66 per share (Source: Weighted future Return on Equity estimates from 6 analysts.)

- Cost of Equity: $1.12 per share

- Excess Return: $0.54 per share

- Average Return on Equity: 11.55%

- Stable Book Value: $14.37 per share (Source: Weighted future Book Value estimates from 5 analysts.)

Based on these inputs, the Excess Returns model calculates LendingClub’s intrinsic value per share at $25.67. Comparing this to the current share price, the model suggests LendingClub is about 28% undervalued. This substantial margin implies the market may be underestimating the company’s ability to generate value above its cost of capital as it expands in digital banking and peer-to-peer lending.

Result: UNDERVALUED

Our Excess Returns analysis suggests LendingClub is undervalued by 28.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

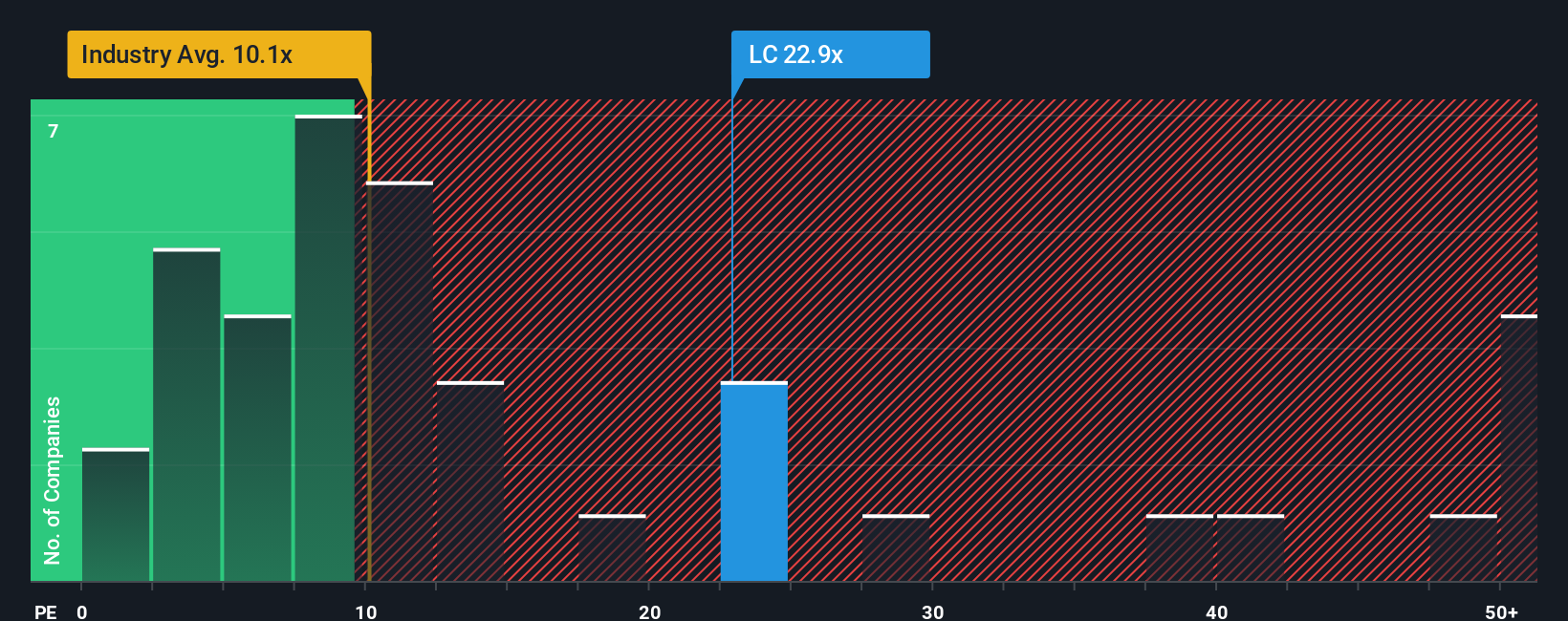

Approach 2: LendingClub Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred multiple when analyzing established, profitable companies because it makes it easy to compare what investors are willing to pay for each dollar of a business’s earnings. When a company is consistently generating profits, the PE ratio neatly summarizes the relationship between its share price and its bottom-line results.

Growth expectations and risk play a big part in determining what is considered a “normal” or “fair” PE ratio. Fast-growing companies that are expanding their earnings quickly, or those in stable, low-risk industries, often command higher PE ratios. In contrast, companies facing higher risks or slower growth tend to trade at lower PE multiples.

LendingClub currently trades at a PE ratio of 20.46x. That is noticeably higher than the average PE ratio of peers at 7.15x and the Consumer Finance industry average of 10.31x. However, there is more nuance to valuation than simple comparisons can capture. That is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, sitting at 21.41x for LendingClub, adjusts for factors such as its future earnings growth, profit margins, market cap, risk profile, and industry context. This makes it a more comprehensive benchmark than peer or industry averages, ensuring apples-to-apples comparison tailored to LendingClub’s specifics.

With LendingClub’s current PE ratio of 20.46x virtually matching its Fair Ratio of 21.41x, the stock looks fairly valued on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LendingClub Narrative

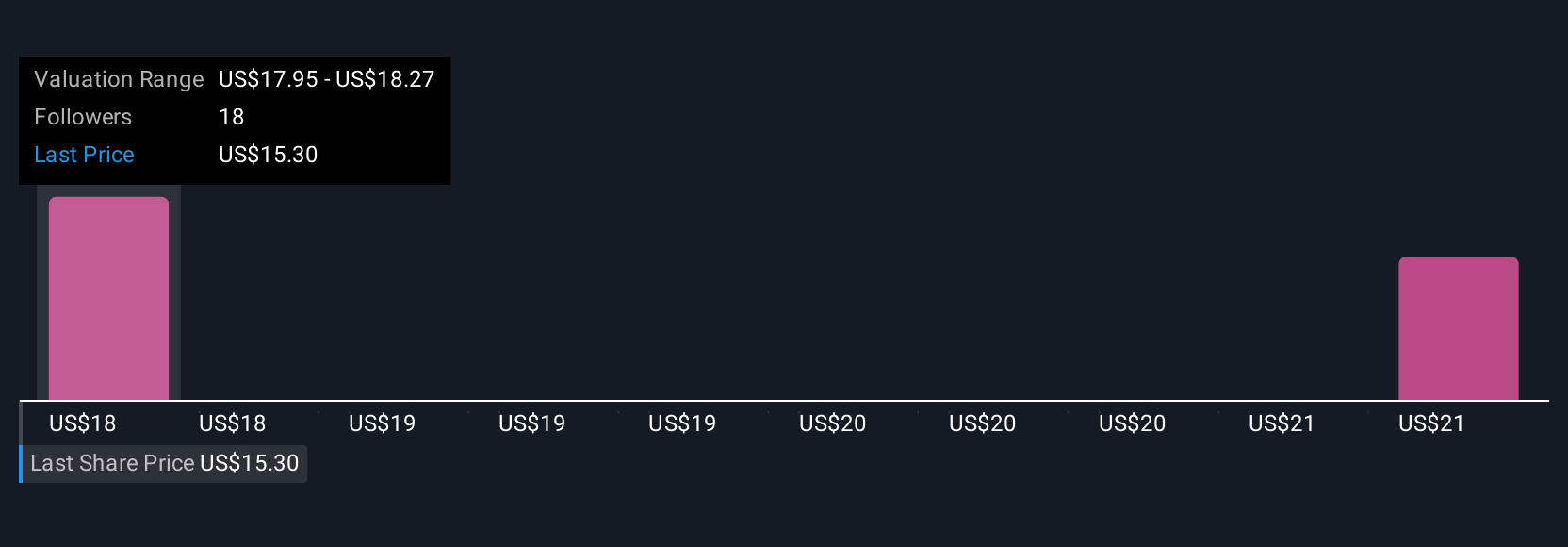

Earlier we mentioned that there is an even better way to understand what a stock is really worth. Let’s introduce you to Narratives. A Narrative is more than just a set of numbers; it is your story and perspective about a company’s future, translated directly into transparent forecasts for revenue, earnings, and margins, and ultimately, a Fair Value for the stock.

With Narratives, you can link your own understanding of LendingClub, whether you believe its digital banking innovation will lead to market-beating growth, or that heavy competition will cap its profitability, straight to financial forecasts. This makes your investment view clear, actionable, and directly comparable to the current share price, so you can see instantly if the stock looks undervalued, overvalued, or about right for your scenario.

Available on Simply Wall St’s Community page (where millions of investors share their analyses), Narratives are easy to set up and update dynamically whenever new news or earnings reports are released, keeping your decision-making fresh and relevant.

For example, recent Narratives on LendingClub show that some investors estimate a Fair Value as high as $21.00 if profit margins keep expanding and product launches succeed, while others are more cautious, projecting just $15.50 based on rising competition and regulatory risks.

Do you think there's more to the story for LendingClub? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives