- United States

- /

- Capital Markets

- /

- NYSE:LAZ

Lazard, Inc. (NYSE:LAZ) Stock Rockets 29% But Many Are Still Ignoring The Company

Those holding Lazard, Inc. (NYSE:LAZ) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 10% is also fairly reasonable.

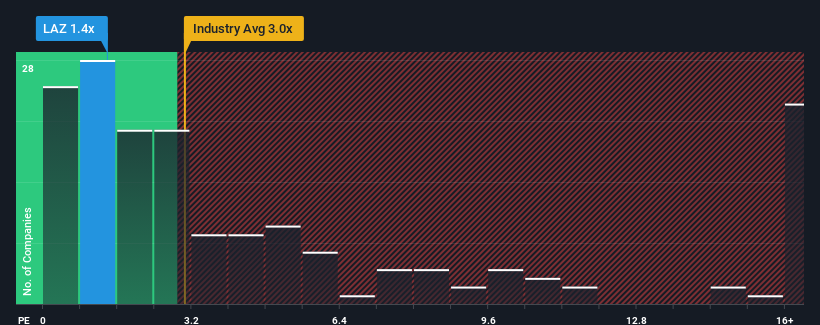

Even after such a large jump in price, Lazard's price-to-sales (or "P/S") ratio of 1.4x might still make it look like a buy right now compared to the Capital Markets industry in the United States, where around half of the companies have P/S ratios above 3x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Lazard

How Has Lazard Performed Recently?

Recent times haven't been great for Lazard as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Lazard's future stacks up against the industry? In that case, our free report is a great place to start.How Is Lazard's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Lazard's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 9.1% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 2.5% during the coming year according to the eight analysts following the company. That's shaping up to be similar to the 1.7% growth forecast for the broader industry.

With this information, we find it odd that Lazard is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Lazard's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Lazard's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Lazard that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LAZ

Lazard

Operates as a financial advisory and asset management firm in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives