- United States

- /

- Capital Markets

- /

- NYSE:KKR

KKR’s Valuation Under the Spotlight After Major TotalEnergies Solar Portfolio Stake and Expansion Moves

Reviewed by Kshitija Bhandaru

KKR (NYSE:KKR) has just made headlines by acquiring a 50% stake in TotalEnergies’ sizable North American solar portfolio. This signals a major step into renewable infrastructure and fits with KKR’s ongoing strategy of expansion and sector diversification.

See our latest analysis for KKR.

Even as KKR pushes deeper into renewables and executes several major deals, including the acquisition of a stake in TotalEnergies’ solar assets, pipeline asset moves, and board changes, the short-term share price has held steady near $124.63, without major swings. The company’s long-term total shareholder return has risen by 2.62% over five years, signaling durable momentum despite recent flat price performance and ongoing portfolio shifts.

If KKR’s latest renewable energy investment has you thinking bigger, this could be a smart moment to explore fast growing stocks with high insider ownership.

With shares flat in the short term and KKR posting only modest long-term gains, the key question for investors now is whether Wall Street is overlooking value, or if the recent deals and expansion are already reflected in the current price.

Most Popular Narrative: 24.2% Undervalued

KKR's narrative-backed fair value estimate sits notably higher than the recent close, suggesting meaningful upside in the eyes of analysts and observers. This outlook positions KKR as a company expected to outperform if it delivers on current financial assumptions.

Expansion of credit and asset-based finance platforms, with KKR now a leader in a $6 trillion+ market poised for further growth, provides a broader and more durable base of fee-related earnings while also increasing the potential for performance fees as these businesses scale. This diversification reduces earnings volatility and supports long-term earnings growth.

Want to see what underpins this bullish view? The secret sauce lies in ambitious revenue growth targets and a profit margin transformation most investors won’t expect. Curious about what powers these confidence-fueled projections? Dive in for the real story behind the headline valuation.

Result: Fair Value of $164.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that rapid expansion into private credit and reliance on performance income could introduce volatility if market trends reverse.

Find out about the key risks to this KKR narrative.

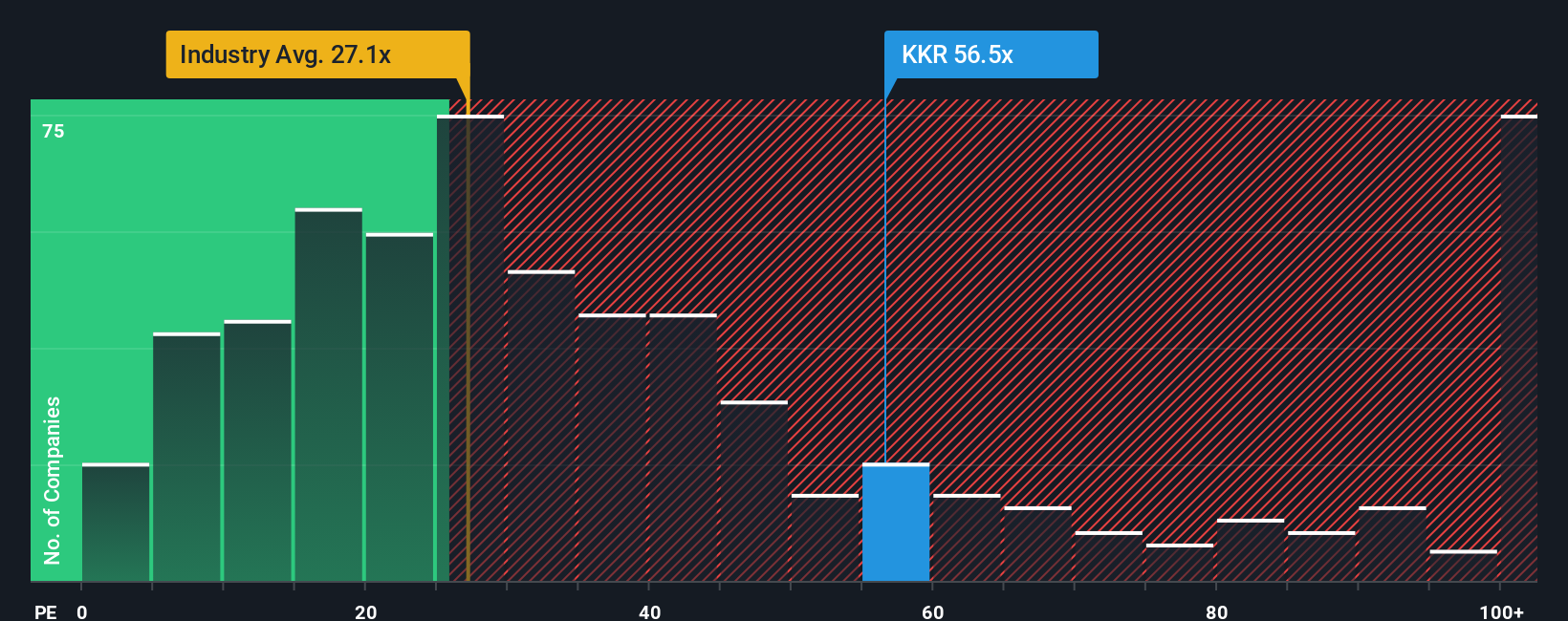

Another View: Relatively Expensive on Earnings

While the narrative-backed fair value signals potential upside, a look at KKR's current price-to-earnings ratio tells a different story. KKR trades at 55.5 times its earnings, a hefty premium compared to both its industry average of 26.2 and a peer average of 40.4, and even above the fair ratio of 27.5. This could indicate a valuation risk if the market moves toward lower multiples. Can high expectations alone sustain this steep premium, or is a reset due?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KKR Narrative

If you want to dig deeper or think there's another story hidden in the numbers, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your KKR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Fresh Investment Ideas?

Smart investors never settle for just one opportunity. Don’t risk missing standout stocks in sectors poised for growth. Tap into new possibilities with these powerful ideas:

- Boost your portfolio’s growth potential by uncovering high-yield opportunities among these 19 dividend stocks with yields > 3% that consistently deliver strong payouts above 3%.

- Keep ahead of technological disruption and join early-stage momentum with these 24 AI penny stocks shaping the artificial intelligence landscape.

- Strengthen your strategy by targeting value, tracking these 900 undervalued stocks based on cash flows that offer attractive prices based on solid underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives