- United States

- /

- Capital Markets

- /

- NYSE:KKR

KKR (KKR): Evaluating Valuation as Global Container Platform Expands Asset-Based Finance Reach

Reviewed by Simply Wall St

KKR (NYSE:KKR) has launched Galaxy Container Solutions, a new global marine container platform backed by $500 million in capital. This move strengthens KKR’s asset-based finance strategy and provides access to the growing maritime leasing market.

See our latest analysis for KKR.

While KKR continues to make headlines with its new container leasing platform and a number of notable acquisitions and initiatives, the stock itself has retreated in recent months, with a 30-day share price return of -17.85% and year-to-date decline near 19%. Despite this, long-term holders have still enjoyed a remarkable 154% total shareholder return over three years, which highlights KKR’s ability to generate value even through market cycles.

If recent developments have you thinking bigger-picture, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With analyst targets still well above the current share price and KKR investing aggressively in new platforms, investors are left to wonder if the recent selloff signals an undervalued opportunity or if the market is already factoring in the firm’s future growth.

Most Popular Narrative: 24.7% Undervalued

With the narrative’s fair value estimate of $160.59 well above KKR’s last close of $120.96, there is a notable valuation gap that has caught analysts’ attention and could drive debate on the company’s future trajectory.

Expansion of credit and asset-based finance platforms, with KKR now a leader in a $6 trillion+ market poised for further growth, provides a broader and more durable base of fee-related earnings while also increasing the potential for performance fees as these businesses scale. This diversification reduces earnings volatility and supports long-term earnings growth.

Want to uncover what powers this bullish price target? The secret lies in bold profit margin forecasts and a profit multiple that outpaces the industry. Curious which assumptions fuel such a difference between narrative and market price? Find out what’s really driving this valuation debate.

Result: Fair Value of $160.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if competition or fee pressures intensify, or if KKR’s rapid growth in asset-based finance backfires, the bullish valuation narrative could quickly unravel.

Find out about the key risks to this KKR narrative.

Another View: Multiple-Based Valuation Raises Caution

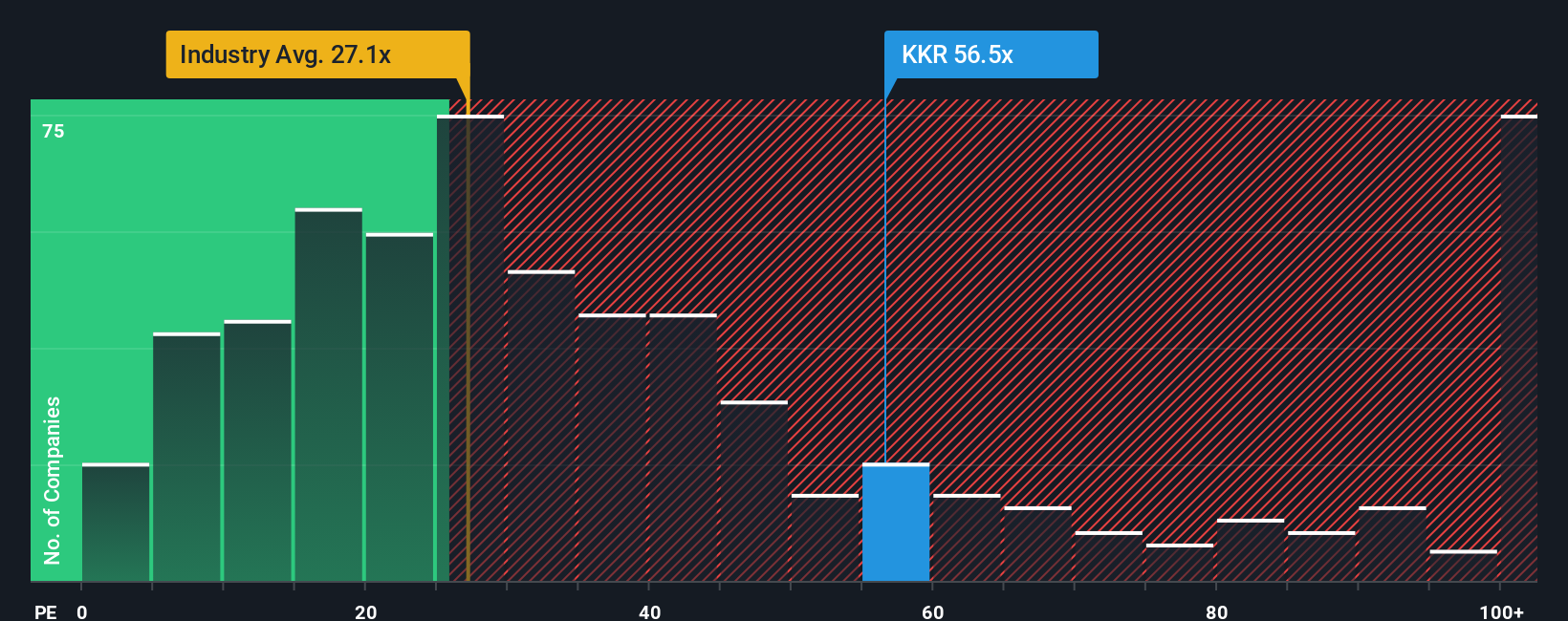

Looking through the lens of the commonly used price-to-earnings ratio, KKR appears expensive. Its P/E sits at 53.9x compared to 25.9x for the industry and 39.5x for its peers. Even the fair ratio estimate is just 27.5x. This sizeable gap means that, despite growth prospects, investors face a higher valuation risk if market sentiment shifts. Could the market recalibrate KKR’s premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KKR Narrative

If you see things differently or want to dive into the numbers yourself, it’s simple to craft your own view of KKR in just a few minutes. Do it your way.

A great starting point for your KKR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let fresh opportunities pass you by when top investment themes could be just a click away. Search beyond the obvious and seize smart choices now.

- Boost your portfolio’s yield and stability by reviewing these 17 dividend stocks with yields > 3%, which offers robust returns and consistent payouts.

- Tap into the AI revolution by scanning these 27 AI penny stocks, driving growth in machine learning, automation, and the future of tech.

- Get ahead of the crowd by selecting these 878 undervalued stocks based on cash flows, which is positioned for value-driven gains based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives