- United States

- /

- Capital Markets

- /

- NYSE:JEF

Will Jefferies Financial Group’s (JEF) New Long-Term Bonds Reshape Its Funding Flexibility Narrative?

Reviewed by Simply Wall St

- Jefferies Financial Group recently announced the issuance of two senior unsecured fixed-rate notes: a 6.00% bond maturing in 2035 and a 6.25% bond maturing in 2045, both priced at 100% of face value and featuring callable characteristics.

- This move underscores Jefferies’ approach to strengthening its capital base and diversifying funding sources through long-term fixed-income offerings.

- We’ll explore how these new senior notes could influence Jefferies’ investment narrative, especially regarding its capital structure and funding flexibility.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Jefferies Financial Group's Investment Narrative?

To own shares of Jefferies Financial Group, you need to believe in its ability to balance steady capital management against periods of variable earnings. The company’s recent fixed-rate note issuances signal a clear intent to bolster liquidity and secure funding on favorable terms, even as its recent reports show weaker revenue and net income compared to the prior year. In the short term, this added capital flexibility may not dramatically shift the main catalysts driving Jefferies, which remain centered around core earnings momentum, effective cost control, and progress in its investment banking alliances. The new bonds may help reduce refinancing risk or strengthen the balance sheet, but given the modest share price reaction and the scale of the offering relative to the business, it’s unlikely to significantly alter the immediate risk profile. However, investors should keep an eye on how increased leverage could affect future profitability. In contrast, the company’s slower revenue growth is something investors should keep in mind.

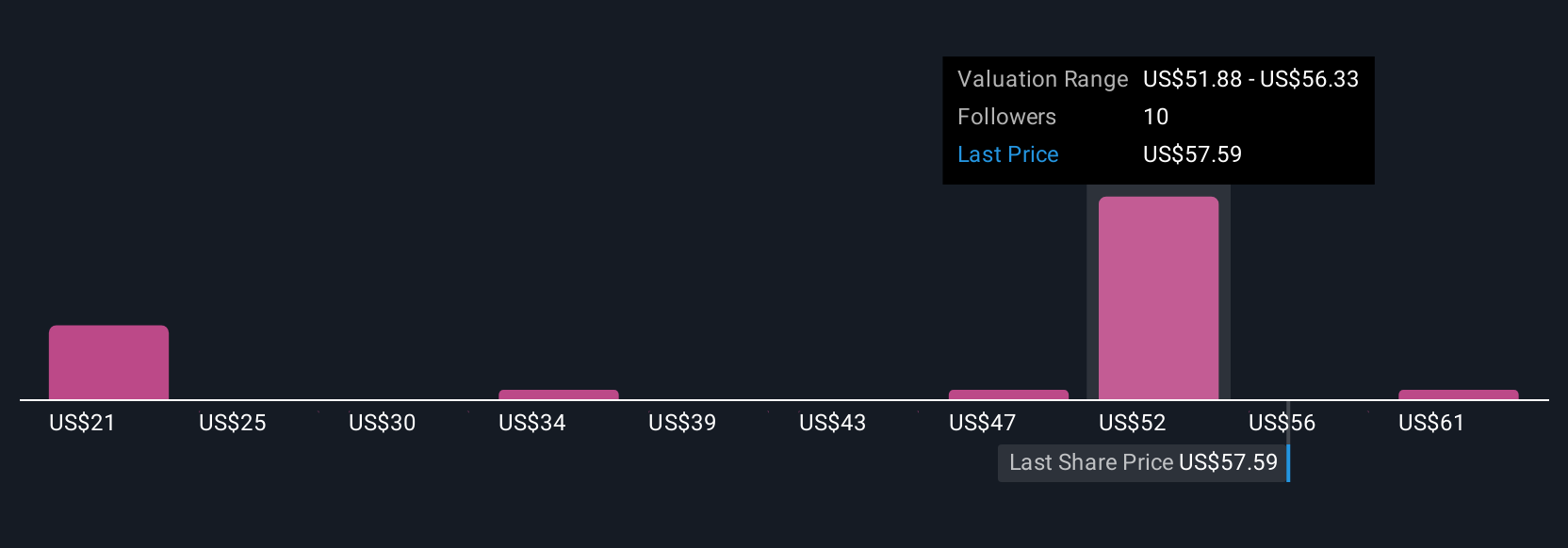

Jefferies Financial Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth as much as 12% more than the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives