- United States

- /

- Capital Markets

- /

- NYSE:JEF

Should SEC Probe Into Point Bonita Exposure and New Bond Issuance Require Action From Jefferies (JEF) Investors?

Reviewed by Sasha Jovanovic

- Jefferies Financial Group recently faced an SEC investigation and parallel law firm probes into whether it adequately disclosed risks tied to its Point Bonita Capital trade finance exposure to bankrupt auto-parts supplier First Brands Group, while also continuing to issue multiple long-dated, callable senior unsecured notes in 2031, 2040 and 2055.

- The juxtaposition of fresh bond issuance and a regulatory probe into risk disclosure and internal controls raises important questions about Jefferies’ funding profile, transparency, and governance culture.

- We’ll now examine how the SEC scrutiny of Point Bonita’s First Brands exposure reshapes Jefferies Financial Group’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Jefferies Financial Group's Investment Narrative?

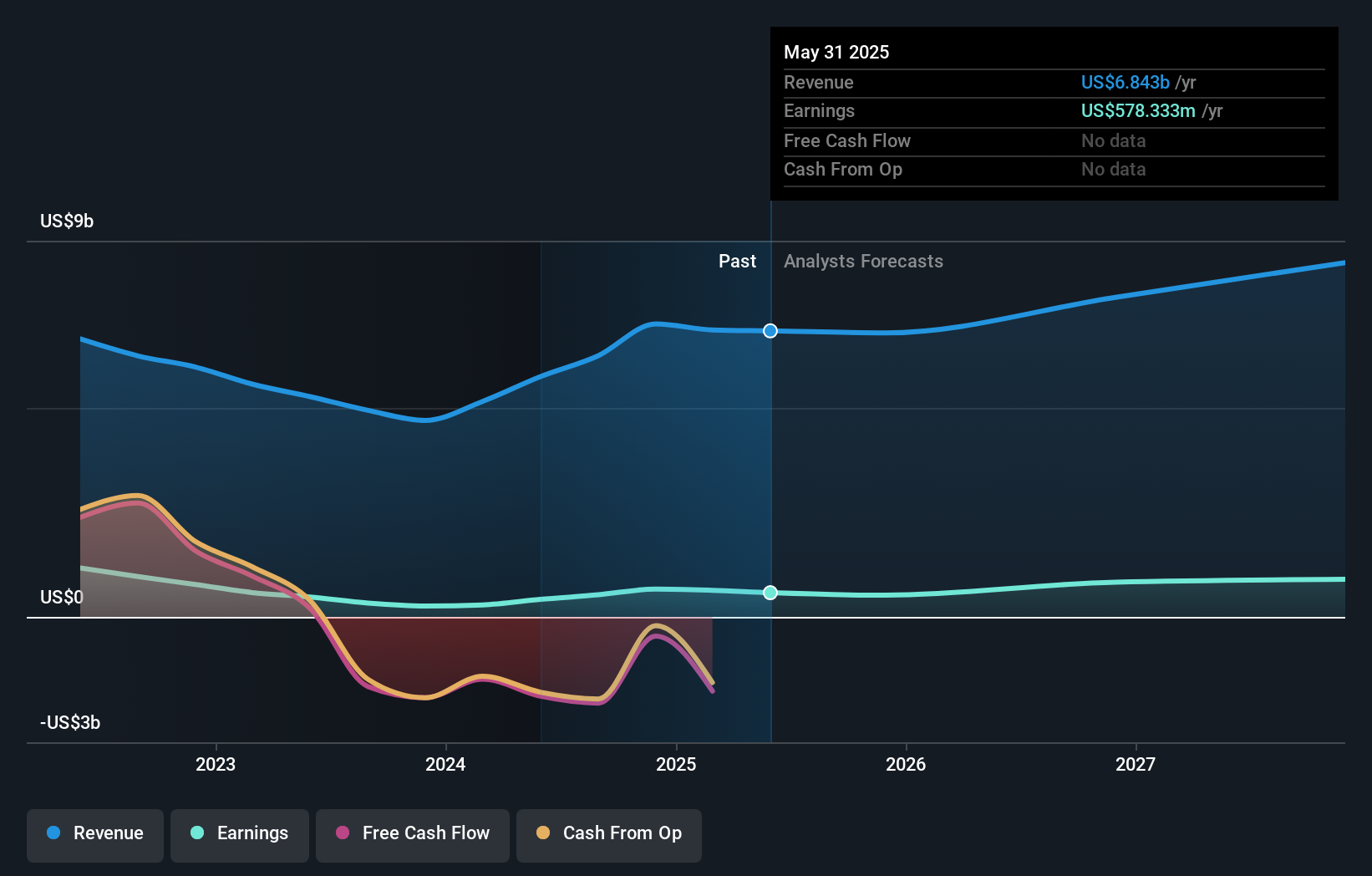

To own Jefferies Financial Group today, you need to be comfortable with a capital markets business that has rebuilt earnings momentum but now faces a credibility test. The SEC probe into Point Bonita’s US$715 million First Brands exposure, plus law firm investigations, shifts the near term story from pure deal-cycle recovery and capital return toward disclosure quality, risk controls and potential impairments. That matters for key catalysts like investment banking and trading revenue translating into sustainable earnings growth and continued dividend stability at US$0.40 per quarter. At the same time, Jefferies is actively issuing long-dated, callable senior unsecured notes in 2031, 2040 and 2055, which keeps its funding engine running but also puts its funding costs and investor trust under the spotlight if the probe escalates.

However, the SEC focus on risk disclosure and internal controls is something investors should be watching closely. Jefferies Financial Group's share price has been on the slide but might be up to 22% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Six fair value views from the Simply Wall St Community span roughly US$38 to US$71 per share. That spread sits against a market now weighing Jefferies’ capital markets earnings strength against heightened governance and disclosure risk, which could influence how confidently future growth is priced in.

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth 39% less than the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion