- United States

- /

- Capital Markets

- /

- NYSE:JEF

How Do Jefferies (JEF)'s Recent Bond Issuances Reflect Its Evolving Approach to Capital Structure?

Reviewed by Simply Wall St

- In recent days, Jefferies Financial Group Inc. announced and completed several fixed-income offerings, including senior unsecured notes with fixed coupon rates of 6.00% and 6.25% and maturities extending to 2035 and 2045.

- This series of bond issuances underlines the company's ongoing use of debt markets to raise capital for financing opportunities and operational needs.

- We'll explore how Jefferies' active approach to debt financing could influence the company's future funding options and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Jefferies Financial Group's Investment Narrative?

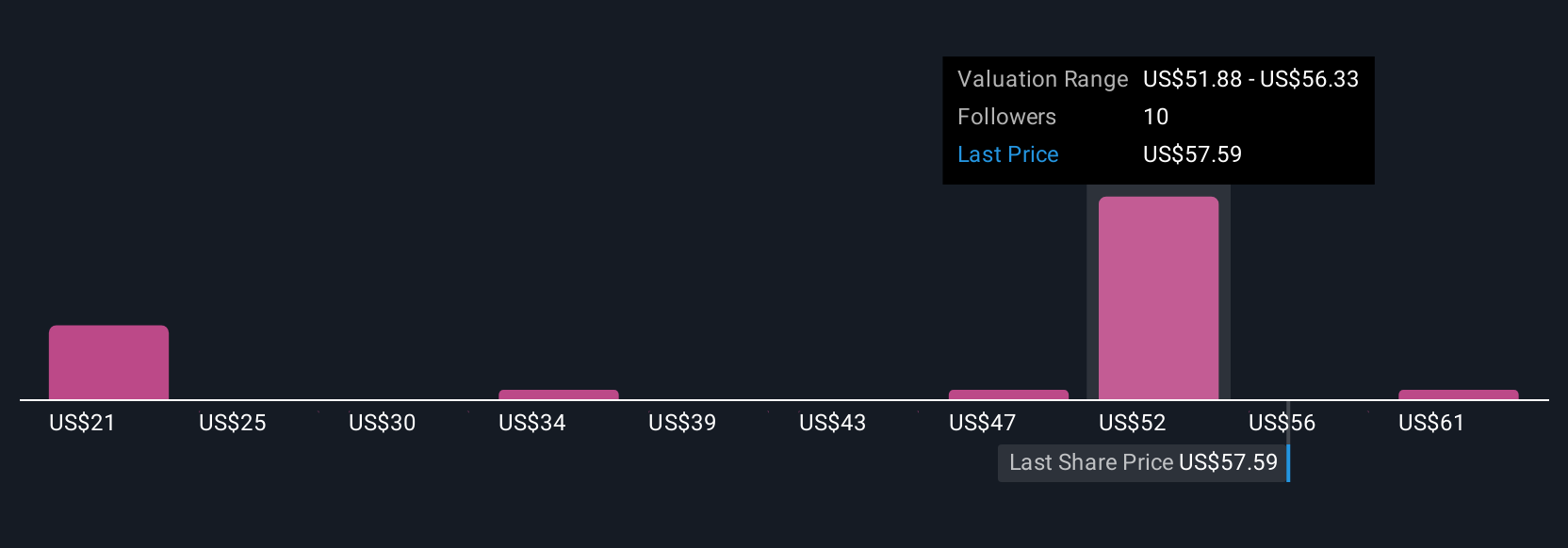

To be a Jefferies Financial Group shareholder, you’d want to see a case for ongoing, competitive value creation in a complex industry where earnings and capital access are vital. The firm’s recent fixed-income offerings, raising capital at 6.00% and 6.25% for maturities out to 2045, illustrate a willingness to tap the debt markets. While these actions currently seem well within their usual funding strategy, they don’t materially shift the big short-term drivers, such as slower revenue growth forecasts, modest return on equity, and earnings performance that lags broader benchmarks. The most prominent risks remain around execution in a lower-growth environment and managing costs against rising interest expenses. With shares valued above some estimated fair values and recent price action only modestly positive, the latest debt raise doesn’t appear to shift major risks or catalysts, but may factor into future funding flexibility if conditions tighten.

However, not all investors may be focused on Jefferies’ rising debt burden compared to its earnings trajectory.

Exploring Other Perspectives

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth less than half the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives