- United States

- /

- Capital Markets

- /

- NYSE:JEF

Can Jefferies (JEF) Transparency on First Brands Exposure Strengthen Its Risk Management Reputation?

Reviewed by Sasha Jovanovic

- Jefferies Financial Group recently addressed investor concerns by confirming that its exposure to the bankrupt auto-parts supplier First Brands is limited and any financial impact is expected to be manageable.

- This reassurance highlighted Jefferies' focus on financial resilience, as the company clarified its investments involve mainly accounts receivable and a minor interest in First Brands' loans through its Apex platform.

- We'll explore how management’s transparency regarding First Brands exposure informs Jefferies' investment narrative and future confidence in risk controls.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Jefferies Financial Group's Investment Narrative?

To be a shareholder in Jefferies Financial Group, you need to believe in the company's ability to manage shocks, maintain steady core earnings, and find growth through its partnerships and global reach. The reassurance from management on the First Brands exposure is significant, but the market’s rapid recovery after initial volatility suggests the impact is not likely to be material for Jefferies’ broader trajectory right now. Key short-term catalysts like the growing alliance with SMBC, potential expansion in Japanese markets, and solid revenue momentum remain central, while the biggest current risks revolve around further surprises in the trade finance portfolio or private credit markets. The First Brands event did shine a light on risks in the bank’s structured credit segment and may shape investor sentiment, but for now, financial resilience and board oversight still anchor Jefferies’ investment story, rather than any single loss event. Yet questions linger about future exposures in complex credit structures that investors should be aware of.

Jefferies Financial Group's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

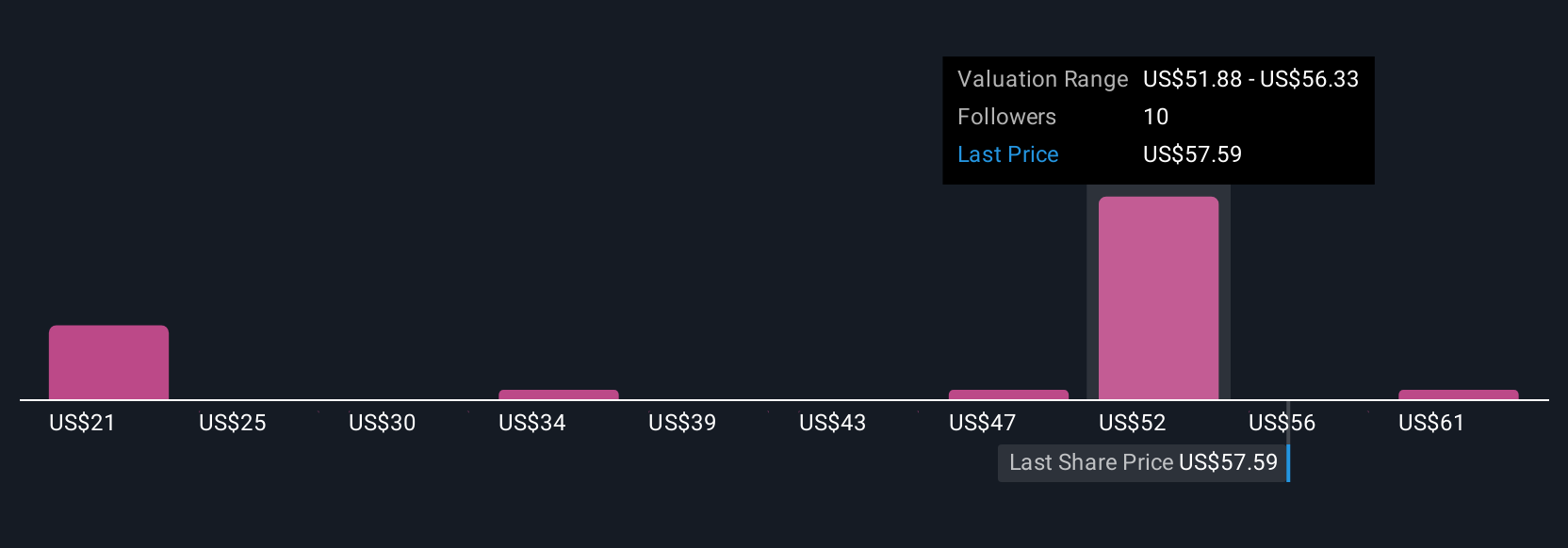

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth as much as 27% more than the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JEF

Jefferies Financial Group

Operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion