- United States

- /

- Capital Markets

- /

- NYSE:IVZ

Invesco (IVZ) Valuation Check After QQQ ETF Progress and Strong Earnings Beat

Reviewed by Simply Wall St

Invesco (IVZ) just got a double shot of good news, resuming fresh investments into key international fund of funds and edging closer to converting its QQQ trust into a full ETF, after beating quarterly earnings expectations.

See our latest analysis for Invesco.

The latest jump takes Invesco’s share price to $26.24, capping a 48.67 percent year to date share price return and a 49.24 percent one year total shareholder return that suggests momentum is firmly rebuilding around the story.

If this kind of sentiment shift has you looking beyond a single asset manager, it could be a good time to explore fast growing stocks with high insider ownership for other compelling ideas.

With shares now trading almost exactly in line with Wall Street’s price target after a powerful rebound, investors face a key question: Is Invesco still undervalued, or is the market already pricing in the next leg of growth?

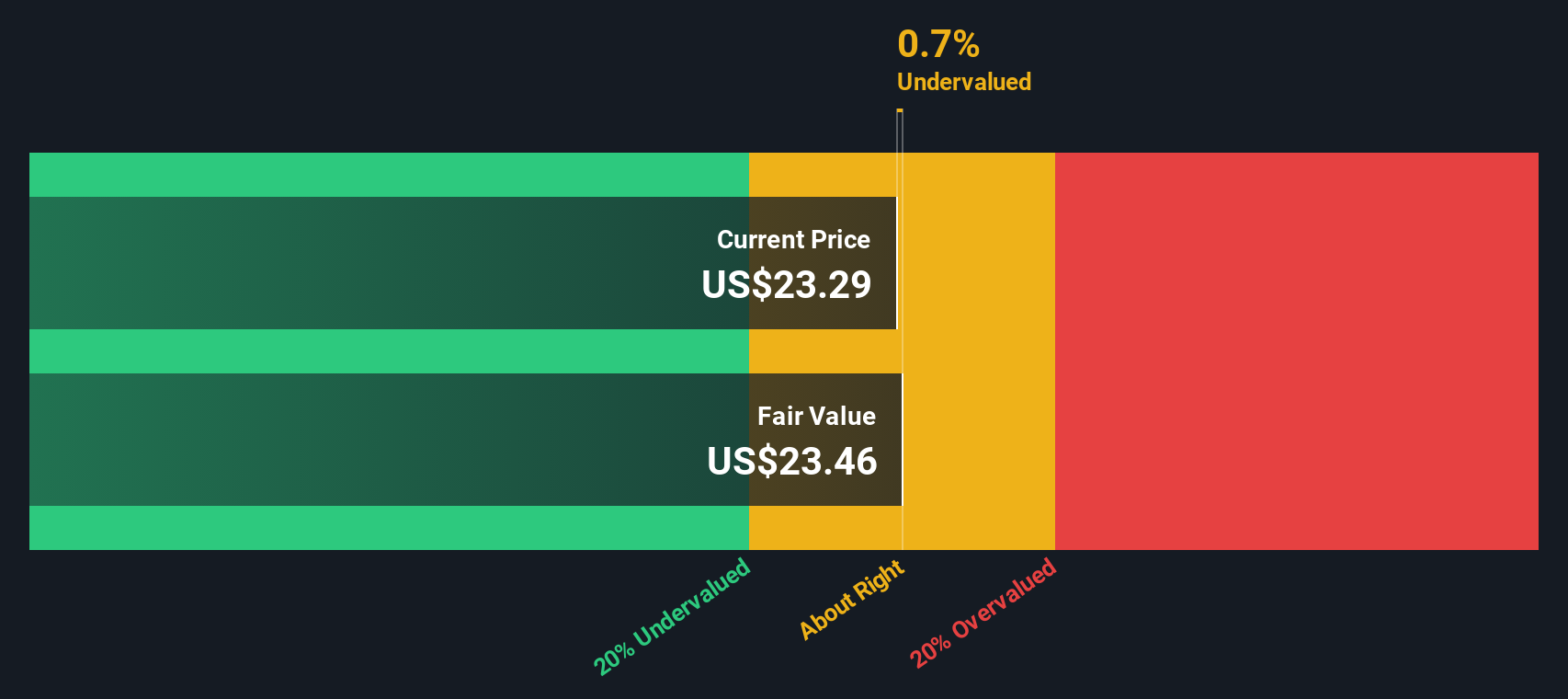

Most Popular Narrative: 1% Undervalued

With Invesco closing at $26.24 against a narrative fair value of $26.38, the current price sits almost exactly where the story does.

The proposed modernization of QQQ's fund structure from a unit investment trust to an open-end ETF is expected to directly improve net revenue and earnings by ~4 basis points due to simplified fee treatment and marketing efficiencies, providing a near-term boost to operating income.

Curious how shrinking revenues can coexist with sharply higher earnings, wider margins, and a lower future valuation multiple than the broader capital markets space? The narrative spells it out.

Result: Fair Value of $26.38 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering fee pressure from the shift to low cost ETFs and rising digital competition could derail those margin gains if asset growth disappoints.

Find out about the key risks to this Invesco narrative.

Another Lens on Value

Our DCF model presents a very different picture, estimating Invesco’s fair value at approximately $8.14 per share. This makes today’s $26.24 price look stretched rather than slightly cheap. If cash flows do not ramp as expected, recent momentum could be running ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Invesco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Invesco Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Do not stop at a single opportunity. Use the Simply Wall Street Screener to uncover fresh, data driven ideas before the crowd gets there.

- Capture potential mispricings by running through these 904 undervalued stocks based on cash flows, where discounted cash flows highlight companies the market may be overlooking.

- Ride structural shifts in medicine with these 30 healthcare AI stocks, targeting businesses using algorithms and data to transform patient outcomes and profitability.

- Position ahead of the next digital infrastructure wave via these 81 cryptocurrency and blockchain stocks, focusing on firms building real world applications on blockchain rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026