- United States

- /

- Capital Markets

- /

- NYSE:IVZ

Are Analyst Upgrades on IVZ a Turning Point for Its Innovation Narrative?

Reviewed by Sasha Jovanovic

- In the past week, several analysts raised their outlook and price targets for Invesco, reflecting greater optimism about the company's direction despite ongoing challenges in its business fundamentals.

- This renewed analyst interest appears connected to Invesco’s recent launch of actively managed ETFs, which aligns with broader efforts to attract investor capital into innovative investment products.

- We’ll explore how analyst sentiment shifts driven by new ETF launches could influence Invesco’s investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Invesco Investment Narrative Recap

To be an Invesco shareholder right now, you need to believe that its innovation in ETF and index products, supported by product launches and a push into alternatives, can offset industry pressures from margin compression and changing investor preferences. The surge in analyst optimism following new actively managed ETF launches gives Invesco a potential short-term catalyst – increased capital flows to new products – but the core risk remains the downward pressure on revenue yields as the market increasingly favors lower-cost passive offerings. For now, the recent news hasn't shifted the biggest risks to the business in a material way.

Among recent announcements, Invesco’s launch of actively managed fixed income and equity ETFs is most relevant. These funds broaden the firm's product mix at a time when investor interest is moving toward scalable, differentiated solutions, presenting both an immediate opportunity and a test of Invesco’s ability to maintain fee levels as competition intensifies.

But while the market has responded positively to new product launches, investors should be aware of the ongoing risk from shrinking revenue yields as passive funds gain ground...

Read the full narrative on Invesco (it's free!)

Invesco's narrative projects $4.8 billion revenue and $1.1 billion earnings by 2028. This requires an 8.2% yearly revenue decline and a $677 million earnings increase from $422.9 million today.

Uncover how Invesco's forecasts yield a $24.04 fair value, in line with its current price.

Exploring Other Perspectives

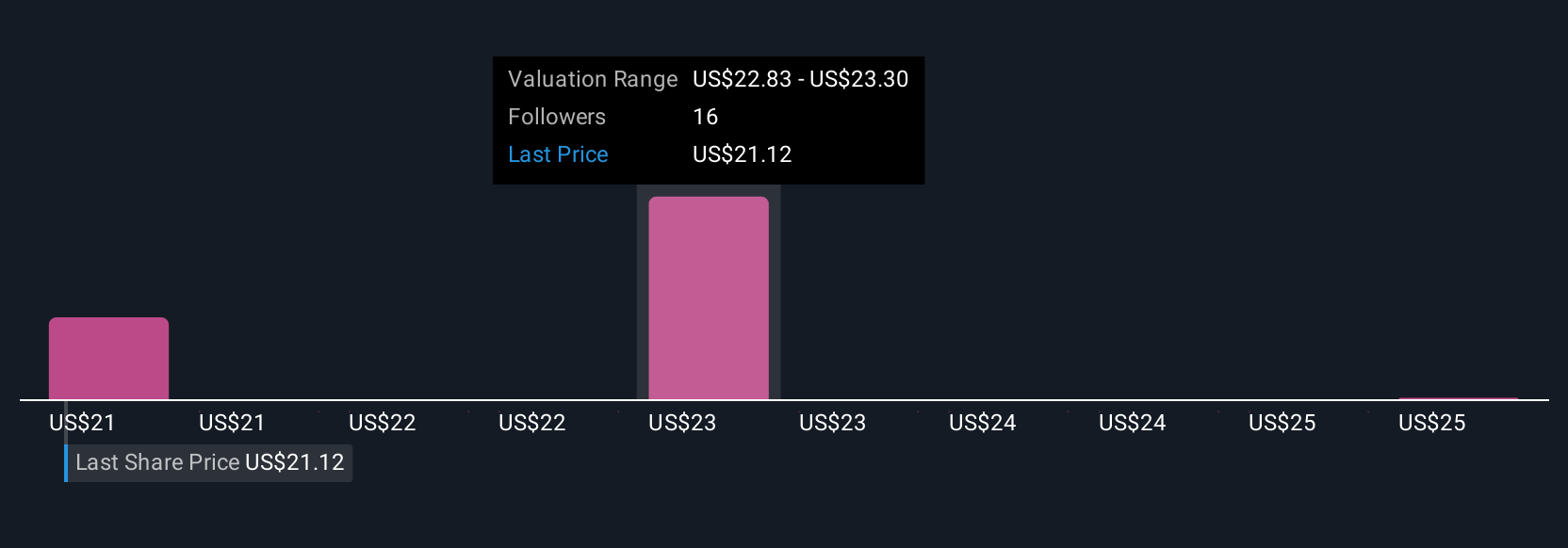

The Simply Wall St Community’s fair value estimates for Invesco span US$22.35 to US$25.61, drawing on three distinct viewpoints. While optimism persists around recent ETF launches, keep in mind the headwind of shrinking net revenue yield when considering other outlooks on performance.

Explore 3 other fair value estimates on Invesco - why the stock might be worth 7% less than the current price!

Build Your Own Invesco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Invesco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Invesco's overall financial health at a glance.

No Opportunity In Invesco?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives