- United States

- /

- Capital Markets

- /

- NYSE:IVZ

A Look at Invesco (IVZ) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Invesco (IVZ) has shown steady momentum lately, with its share price up 9% over the past month and about 36% higher than a year ago. Investors may be curious how these recent gains compare to the company’s fundamentals.

See our latest analysis for Invesco.

Momentum is building for Invesco as investor optimism and improving earnings have fueled a 29% year-to-date share price return and an impressive 36% total shareholder return over the past year. This puts its recent performance solidly ahead of many peers.

If tracking strong moves like Invesco’s has you looking for your next opportunity, now is a great time to discover fast growing stocks with high insider ownership

But with such rapid gains and a current share price just below analyst targets, the key question now is whether Invesco still holds untapped value or if the market has already factored in its future growth potential.

Most Popular Narrative: 9.3% Undervalued

Invesco's most popular narrative points to a fair value of $25.12 per share, compared to the last close of $22.78. The difference suggests room for share price appreciation, but the implied upside is moderate given how recently the target increased.

"Effective cost discipline, scale-driven margin expansion, and balance sheet optimization (deleveraging, regular share repurchases, and planned capital return) suggest sustained improvements in operating leverage and net profit. These factors may further enhance future EPS and shareholder value."

Curious what bold financial leaps underpin this price target? The real surprise is a dramatic profit surge and a margin transformation that changes the growth story significantly. Don't miss the full narrative if you want to see which future milestones could completely rewrite Invesco's valuation playbook.

Result: Fair Value of $25.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition in ETFs and a shift to lower-fee investment products could pressure Invesco’s revenue and long-term profitability if these trends persist.

Find out about the key risks to this Invesco narrative.

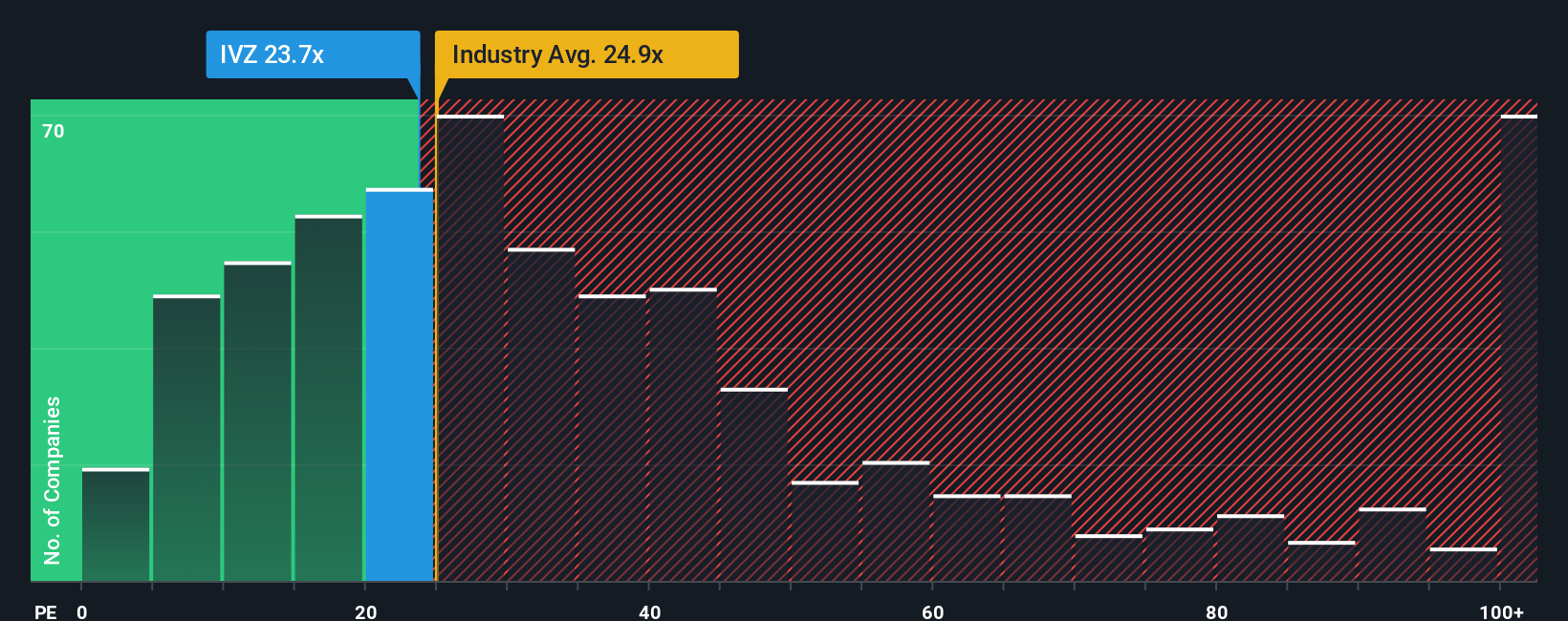

Another View: Market Comparisons Tell a Different Story

Looking through the lens of valuation multiples, Invesco’s price-to-earnings ratio stands at 24, only slightly below the industry average of 26 but higher than both its peer average of 22.2 and a fair ratio of 22.3. This narrow gap suggests limited upside and raises caution about valuation risk if the market consensus moves toward the fair ratio. Is the runway for further gains truly that open, or is optimism already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invesco Narrative

If you want to challenge these perspectives or dig deeper into the details yourself, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know there is always another opportunity waiting. Cast your net wider and don't let these trends pass you by when the market is moving fast.

- Unlock strong income potential by checking out these 17 dividend stocks with yields > 3%, offering yields above 3% for a reliable boost to your portfolio.

- Tap into the unstoppable growth of artificial intelligence with these 26 AI penny stocks, where companies are reshaping industries and setting the pace for tomorrow.

- Get ahead of the crowd and seize bargains with these 871 undervalued stocks based on cash flows that are still priced below their intrinsic value based on real cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives