- United States

- /

- Capital Markets

- /

- NYSE:ICE

What the $2B Polymarket Deal Means for ICE Shares at Current Prices

Reviewed by Bailey Pemberton

Thinking about what to do with Intercontinental Exchange stock as it hovers at $153.36? If you’re weighing your next move, you’re hardly alone. With a 3-year return of 76.6% and a 5-year climb of 64.5%, ICE has delivered serious growth for those who got in early. But this year has been a bumpier ride, with the stock down 3.7% over the past week and off 10.5% in the last month, even as it’s managed a 2.7% gain year to date. That recent dip might have some investors wondering whether risk perceptions around ICE are shifting, especially in light of the company’s bold moves, such as the reported $2 billion potential stake in Polymarket and the broader evolution of the prediction markets industry.

Wall Street hasn’t exactly lost faith. BofA’s latest price target cut may sound cautious, but it still signals optimism with a fresh target of $227. So are shares undervalued today? According to our valuation framework, Intercontinental Exchange scores a 2 out of 6, meaning it’s undervalued on just two of six key checks. That leaves plenty for us to unpack.

Let’s break down the valuation approaches ICE faces in today’s market, then see if there’s a smarter way to get to the heart of what this company is truly worth.

Intercontinental Exchange scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intercontinental Exchange Excess Returns Analysis

The Excess Returns model examines how efficiently a company generates returns above its cost of equity, using metrics like book value and return on equity to assess whether the company is creating meaningful shareholder value over time. For Intercontinental Exchange, this approach focuses on the company’s ability to earn more from its investments than it pays to raise capital.

According to the latest data, ICE has a Book Value of $49.73 per share and a Stable EPS of $7.92 per share, based on the weighted future return on equity projected by 7 analysts. The Cost of Equity stands at $4.43 per share, which means ICE delivers an Excess Return of $3.49 per share. In terms of efficiency, the company posts an average Return on Equity of 15.43%, with the Stable Book Value estimated at $51.34 per share from 4 analysts.

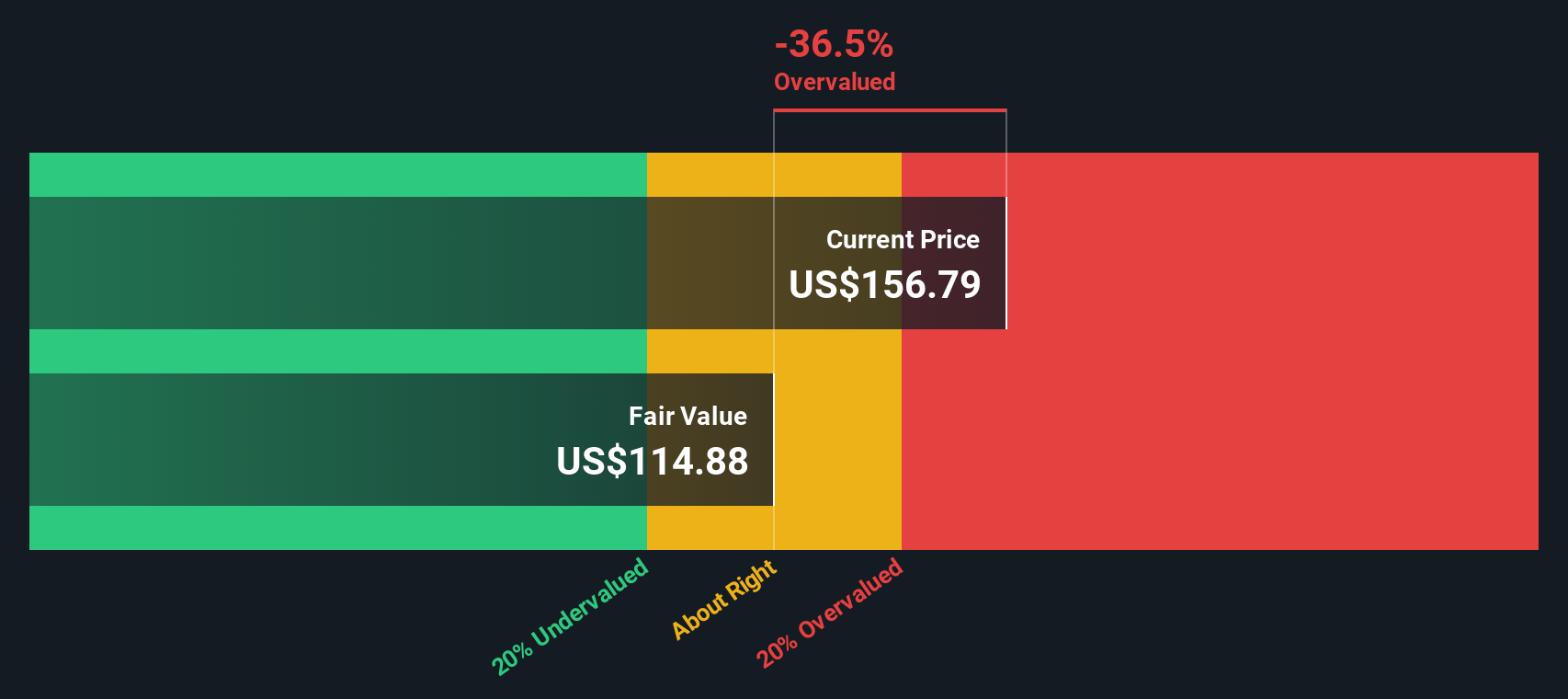

After running the numbers through this framework, the intrinsic value for ICE lands at $114.21 per share. With shares currently trading at $153.36, this model suggests the stock is overvalued by about 34.3% at present levels.

Result: OVERVALUED

Our Excess Returns analysis suggests Intercontinental Exchange may be overvalued by 34.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intercontinental Exchange Price vs Earnings

For profitable companies like Intercontinental Exchange, the price-to-earnings (PE) ratio is the go-to multiple for quickly gauging valuation. This metric tells investors how much they're paying for each dollar of a company's earnings, making it especially useful when a business demonstrates solid, recurring profits. However, deciding what the “right” PE ratio should be isn’t one-size-fits-all. High-growth, lower-risk companies generally trade at a premium, while those with slower growth or more risk earn discounts to the market and industry averages.

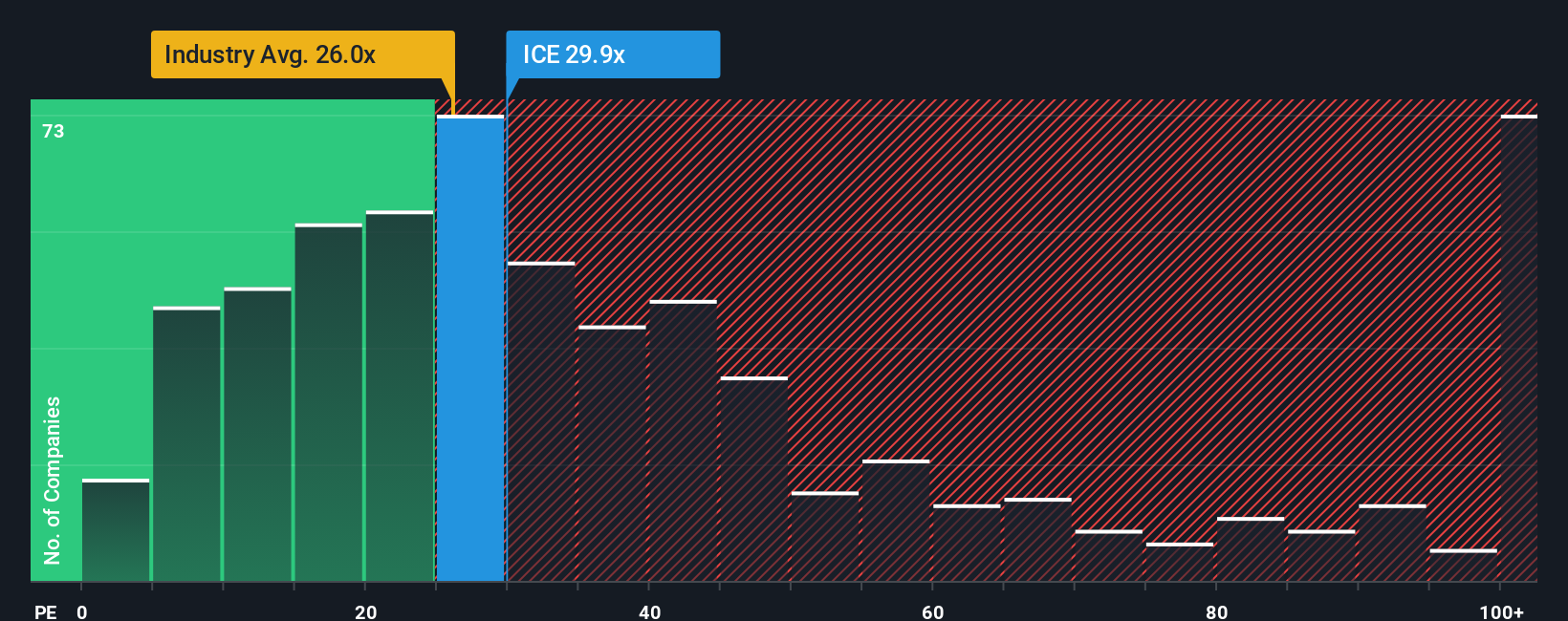

Right now, ICE trades at a PE of 29.2x, which is above the Capital Markets industry average of 25.1x and slightly below its peer group average of 32.6x. To assess whether this premium is justified, Simply Wall St’s Fair Ratio comes into play. The Fair Ratio, at 18.8x for ICE, is a proprietary metric that factors in earnings growth, margins, industry type, market cap, and risk. This provides a more complete, nuanced benchmark than basic industry or peer comparisons.

Comparing ICE’s actual PE to its Fair Ratio, the stock is trading well above what the data suggests is “fair” given its fundamentals and risk profile. This suggests that the market is pricing in more growth or safety than the core numbers support, hinting at limited upside from here.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intercontinental Exchange Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, combining what you believe about its future, such as growth rates, opportunities, and challenges, with the assumptions behind your own fair value estimate. Narratives bridge the gap between numbers and real-world context, linking a company’s journey to a transparent financial forecast and an actionable fair value. On Simply Wall St’s Community page, Narratives are an easy, accessible tool trusted by millions of investors who want a smarter, more dynamic way to track their thinking.

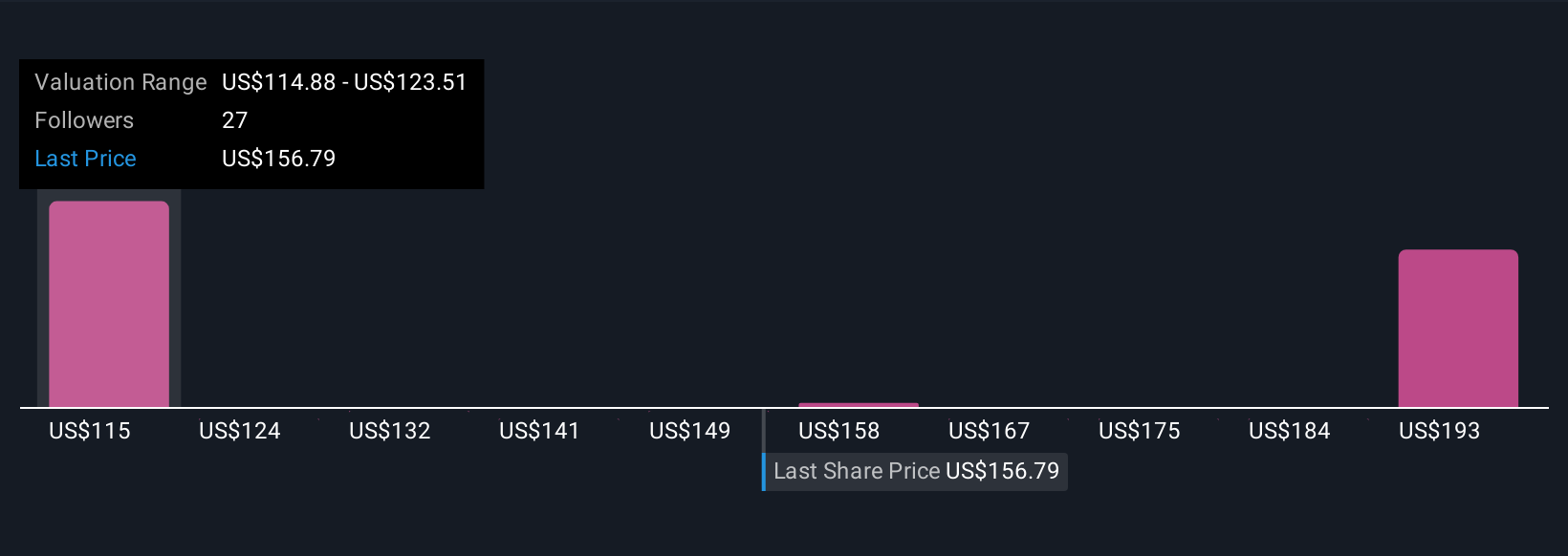

By using Narratives, you can clearly see whether you would buy, hold, or sell Intercontinental Exchange by comparing your Fair Value to today’s price. Your view updates automatically as new news or earnings data arrives, so your “story” stays relevant as the facts change. For example, one investor’s ICE Narrative might forecast strong AI-driven platform growth and set a fair value near $227 per share, while another sees regulatory risks limiting upside and sets it closer to $170. With Narratives, you define the story, connect it to the numbers, and make decisions that best fit your investment outlook.

Do you think there's more to the story for Intercontinental Exchange? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives