- United States

- /

- Capital Markets

- /

- NYSE:ICE

Is It Too Late To Consider ICE After Its Strong Run And Tech Expansion In 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Intercontinental Exchange is still a buy at around $160 a share, you are not alone. This stock has quietly become a core holding for many long term investors who care about durable value.

- Over the short term, the stock has inched up 1.3% over the last week and 5.2% over the past month. Those moves sit on top of a 7.2% year to date gain and a 65.8% rise over three years that signal solid, if not explosive, compounding.

- Recent headlines have focused on Intercontinental Exchange expanding its footprint in fixed income and mortgage technology, while continuing to strengthen its core exchanges and clearing operations. That combination of resilient fee based businesses and growth initiatives helps explain why the market has been willing to re rate the shares, even if not dramatically.

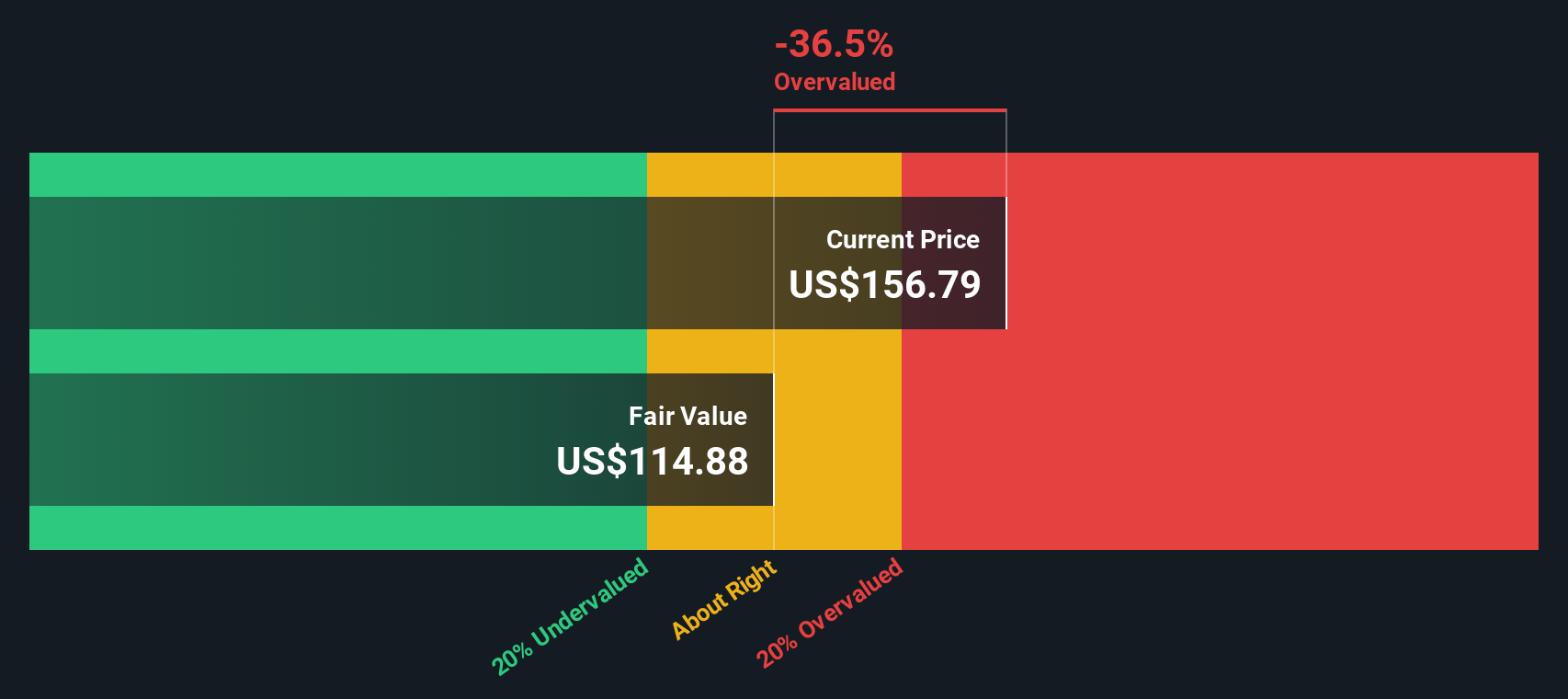

- Despite that track record, our valuation framework gives Intercontinental Exchange a score of 1 out of 6 for undervaluation checks. In the next sections we will walk through multiples, cash flow based models and a more nuanced way of thinking about what the market is really pricing in.

Intercontinental Exchange scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intercontinental Exchange Excess Returns Analysis

The Excess Returns model looks at how much profit a company can earn above the minimum return shareholders require, then capitalizes those extra earnings into an intrinsic value per share. For Intercontinental Exchange, the starting point is a Book Value of $50.25 per share and a Stable Book Value of $50.82 per share, based on future estimates from three analysts.

Using weighted Return on Equity forecasts from five analysts, the model arrives at Stable EPS of $7.43 per share and an Average Return on Equity of 14.62%. With a Cost of Equity of $4.37 per share, the implied Excess Return is $3.05 per share, which is the surplus value ICE is expected to generate on its equity base over time.

Translating these excess returns into a fair value, the model produces an intrinsic value of about $108 per share. This implies the stock is roughly 48.3% above its Excess Returns value at the current market price around $160. On this basis, ICE screens as clearly overvalued rather than fairly priced.

Result: OVERVALUED

Our Excess Returns analysis suggests Intercontinental Exchange may be overvalued by 48.3%. Discover 910 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intercontinental Exchange Price vs Earnings

For a profitable company like Intercontinental Exchange, the price to earnings ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. It connects directly to what shareholders ultimately care about: the earnings power of the business today and how that might grow over time.

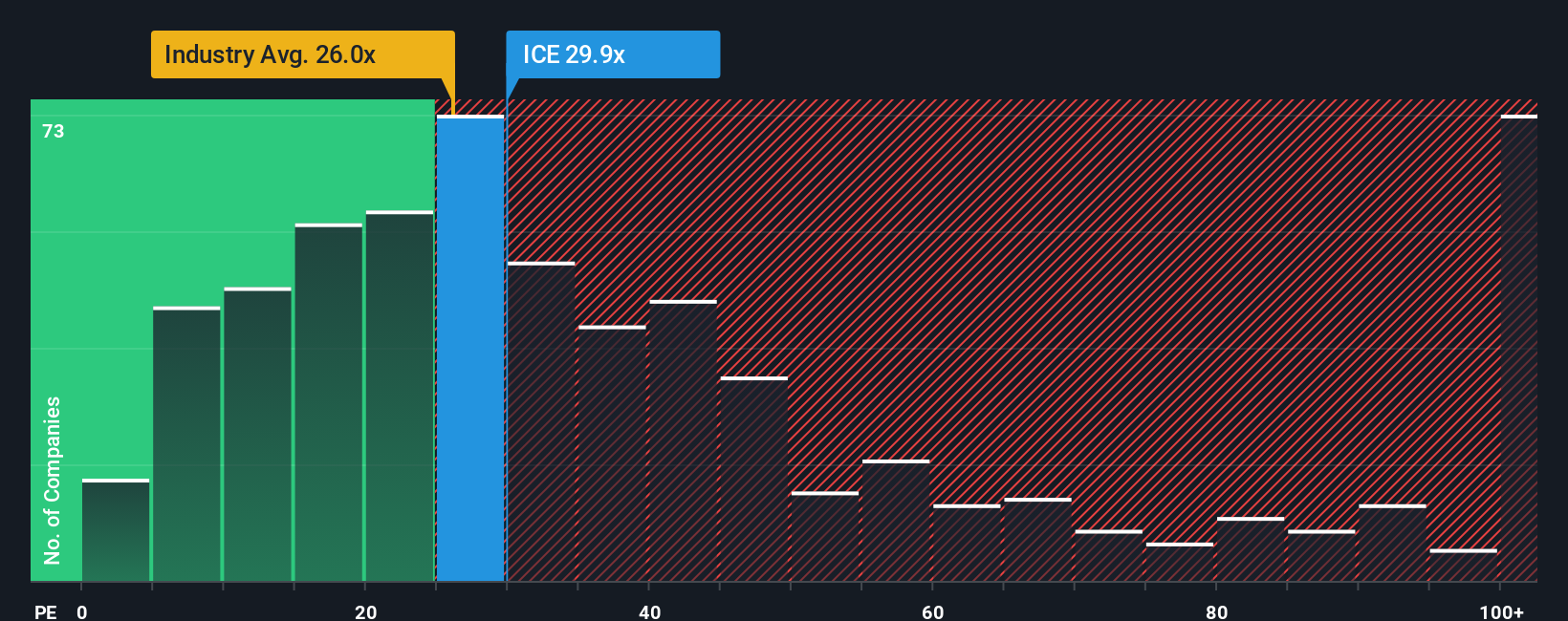

In general, faster earnings growth and lower perceived risk justify a higher normal PE ratio, while slower growth and higher uncertainty should command a discount. ICE currently trades on about 28.86x earnings, above both the broader Capital Markets industry average of roughly 25.50x and the peer group average of about 33.56x, suggesting the market is already assigning it a quality and growth premium.

Simply Wall St’s Fair Ratio framework refines this view by estimating the PE multiple a stock should trade at given its specific earnings growth outlook, profitability, size, industry positioning and risk profile. For ICE, that Fair Ratio is 16.13x, meaning the current 28.86x multiple sits well above what those fundamentals would justify. On this preferred multiple basis, Intercontinental Exchange again screens as materially overvalued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intercontinental Exchange Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, story driven forecasts that let you describe your view of Intercontinental Exchange’s future (its growth drivers, risks and profitability). You can connect that story to explicit assumptions for revenue, earnings and margins, and then translate those assumptions into a Fair Value you can easily compare with today’s share price to help inform a decision to buy, hold or sell. All of this is available within an accessible tool on Simply Wall St’s Community page that automatically updates as new news or earnings arrive. For example, one investor might build a bullish Narrative that assumes faster adoption of ICE’s global prediction market and data platforms and arrives at a Fair Value near the top end of recent targets around $227. A more cautious investor, focused on mortgage tech and regulatory risks, could create a conservative Narrative with slower growth and lower margins that anchors Fair Value closer to the low end near $170.

Do you think there's more to the story for Intercontinental Exchange? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)