- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (NYSE:ICE) Secures Long-Term Technology Licensing Deal With UWM

Reviewed by Simply Wall St

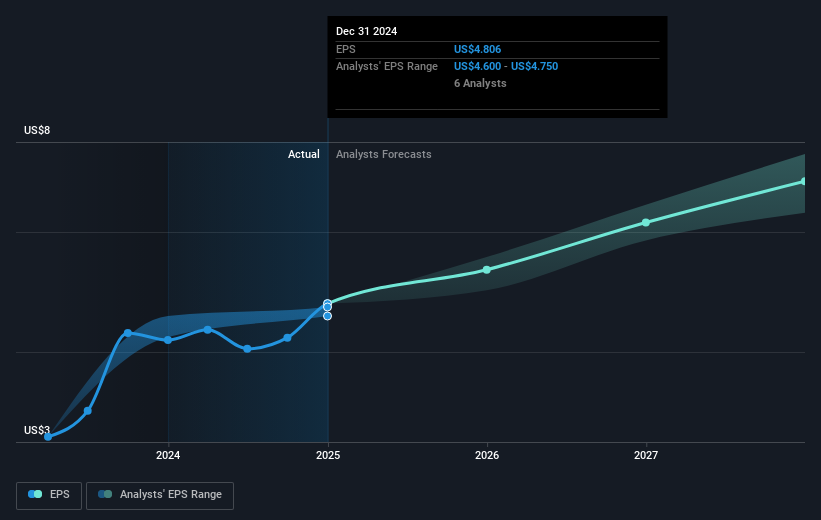

Intercontinental Exchange (NYSE:ICE) has recently drawn attention with its partnership announcement with United Wholesale Mortgage for the ICE Mortgage Technology's MSP® loan servicing system. This development aligns with a 5.8% increase in the company's share price over the last quarter. Given the broader market's 5.2% rise, the move might be reflective of investor confidence in ICE's robust financial standing, highlighted by its strong Q4 and full-year 2024 results. Together with dividend increases and new client collaborations, such as the agreement with Forge Global, these factors likely contributed to the upward trend, notwithstanding a generally buoyant market mood.

The recent partnership between Intercontinental Exchange (ICE) and United Wholesale Mortgage for the ICE Mortgage Technology's MSP® loan servicing system could bolster potential growth in ICE’s Mortgage Technology segment. This aligns with the company's narrative of expanding opportunities through strategic acquisitions and integrations. The partnership is seen as a catalyst for increased client adoption of ICE's solutions, potentially enhancing revenue streams and contributing positively to earnings forecasts. This is in line with efforts to drive growth in recurring revenues and improve margins.

Over the past five years, ICE's total shareholder return was 90.86%, showcasing robust long-term performance. This return significantly outpaces the 18% return of the US Capital Markets industry over the past year, indicative of ICE’s relative outperformance. Despite challenges in interest rates and regulatory environments, the company has managed to maintain growth through strategic expansions in mortgage technology and energy trading.

With a current share price reflecting a near 14% discount to the consensus price target of US$187.31, the market sees potential upside in ICE's valuation. While the share price has moved upward recently, aligning with ICE's solid financial standing and positive analyst sentiment, the gap signals room for further appreciation if anticipated synergies from new collaborations and technological advancements are realized. The focus remains on translating these initiatives into sustained revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives