- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (NYSE:ICE) Launches EU Carbon Allowance Futures Expanding Emissions Trading

Reviewed by Simply Wall St

Intercontinental Exchange (NYSE:ICE) recently unveiled its EU Carbon Allowance (EUA) 2 futures, potentially bolstering its position in the expanding carbon derivatives market. Over the past month, ICE's stock price rose by 16%, a move possibly reinforced by its strong Q1 2025 earnings, including increased sales and revenue. Meanwhile, the broader market has seen mixed trends, with notable discussions around U.S.-China tariffs influencing overall investor sentiment. ICE's strategic product launches and financial performance may have fortified its standing amid these broader market shifts.

You should learn about the 2 risks we've spotted with Intercontinental Exchange.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

Intercontinental Exchange's introduction of the EU Carbon Allowance (EUA) 2 futures could influence future revenue streams by expanding its footprint in the burgeoning carbon derivatives market. This aligns with its broader strategy of investing in technology and mortgage platforms, which are poised to potentially drive energy market growth. Over the past five years, ICE's total shareholder return, including share price appreciation and dividends, reached 101.89%. This indicates strong performance, although its one-year return outpaced the US Capital Markets industry average of 19.9%.

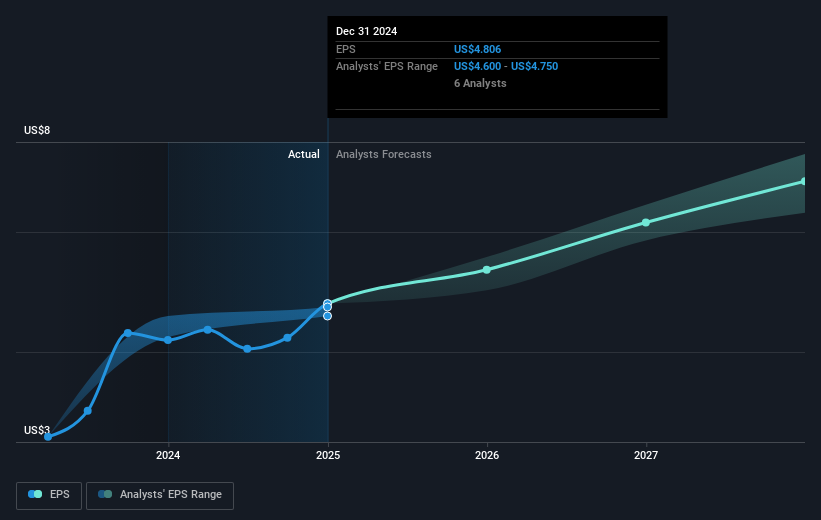

Considering the company's impressive earnings growth in the past year, driven largely by its investments in technology, the new product launch could further boost expectations of future revenue and earnings. Analysts estimate a continuous increase in earnings from $2.78 billion today to $3.8 billion by May 2028. The recent stock price increase of 16% aligns closely with the consensus analyst price target, which suggests limited potential upward movement as the current price of $175.19 is only about 9% below the target price of $192.44. Investors should closely monitor how well ICE adapts to macroeconomic challenges and whether its innovations in the energy and mortgage sectors sustain its growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives