- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (ICE): Assessing Valuation as New Fixed Income Indices and Q3 Profit Growth Take Focus

Reviewed by Simply Wall St

Intercontinental Exchange (ICE) is drawing market interest after being tipped for higher third-quarter profits, with positive activity in stocks and derivatives. The company’s new fixed income indices also represent a significant move into mortgage-backed securities.

See our latest analysis for Intercontinental Exchange.

ICE’s flurry of announcements this month, including new fixed income indices and strategic data partnerships, arrives as the company navigates some volatility. After a solid year-to-date share price return of nearly 4%, momentum has cooled somewhat in the past quarter, but long-term investors are still sitting on a 3-year total shareholder return close to 70%. The mixed pace of recent moves reflects shifting market sentiment and growing interest in ICE’s expanding platform, rather than any fundamental concern over its prospects.

If the wave of product launches and evolving investor interest have you rethinking your strategy, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With ICE forging ahead on new products and strategic partnerships, but recent momentum in the stock price softening, the question is: does the current valuation offer investors a compelling entry point, or is future growth already reflected in the share price?

Most Popular Narrative: 22.8% Undervalued

With the current share price at $155.29, the most popular narrative sets a fair value for Intercontinental Exchange nearly 23% higher than where the stock trades today. This sets the scene for a bold valuation thesis that is driving renewed investor dialogue.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes, including record energy, interest rate, and equity contract volumes, suggests ongoing benefits from digitization and greater market electronification, which are likely to drive sustained double-digit growth in transaction revenues and operating leverage.

Want to unravel the engine powering this high conviction valuation? The remarkable story in this narrative hinges on above-average profit margins, ambitious revenue growth paths, and an elevated future earnings multiple. These are figures that most investors would not expect outside of rapid-growth sectors. Ready to see what is behind the projections that set this price target apart? Dive in for the numbers that could shift your perspective on ICE’s potential.

Result: Fair Value of $201.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on energy markets and the challenge of integrating major acquisitions could both threaten ICE's profit trajectory if conditions change.

Find out about the key risks to this Intercontinental Exchange narrative.

Another View: By the Numbers, Is ICE Priced for Perfection?

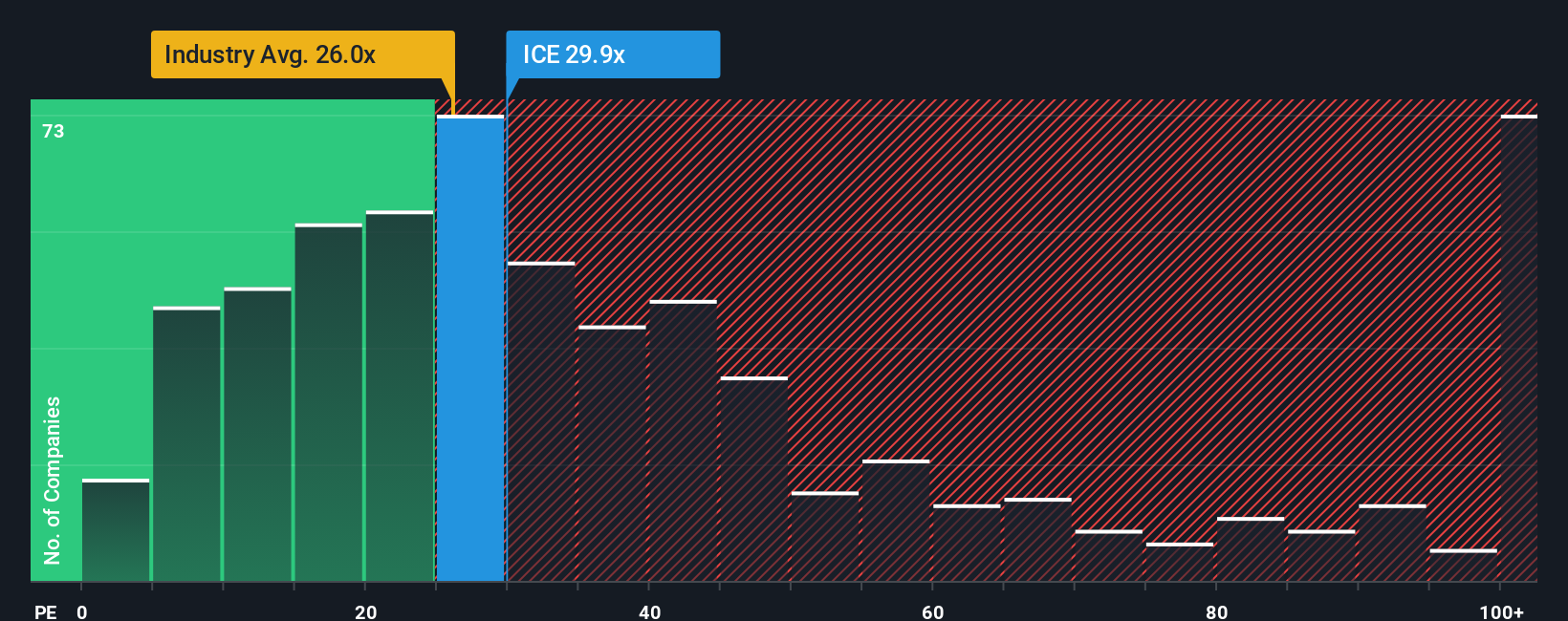

Looking at ICE’s valuation through the lens of its price-to-earnings ratio, the stock trades at 29.6x, which is higher than the US Capital Markets industry average of 25.7x and well above a fair ratio of 18.8x. Compared to similar peers, ICE’s ratio actually looks cheaper, but the disconnect from the fair ratio could signal less room for error if growth slows. Does this premium reflect quality or add to future risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intercontinental Exchange Narrative

If these perspectives don't entirely fit your view or you prefer to dig into the details yourself, you can craft your own personalized Intercontinental Exchange analysis in just a few minutes. Do it your way

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Unlock new opportunities and make smarter moves by targeting stocks riding key market shifts. Don’t miss your chance to spot tomorrow’s winners before the crowd catches on.

- Capitalize on unbeatable value by researching these 873 undervalued stocks based on cash flows. This can help you tap into companies trading at attractive prices with solid fundamentals.

- Catch the next wave in healthcare innovation with these 33 healthcare AI stocks, where artificial intelligence meets medical breakthroughs and offers real growth potential.

- Boost your income stream by examining these 17 dividend stocks with yields > 3%, featuring companies offering reliable yields above 3% for stable long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives