- United States

- /

- Capital Markets

- /

- NYSE:ICE

Intercontinental Exchange (ICE): Assessing Valuation After Strong November Volumes and New Contract Wins

Reviewed by Simply Wall St

Intercontinental Exchange (ICE) just strung together a trio of positive updates, with stronger November trading volumes, record open interest across key contracts, and extensions of major client relationships that reinforce its market infrastructure role.

See our latest analysis for Intercontinental Exchange.

Those operational wins are feeding into sentiment, with the latest $157.82 share price sitting above its start of year level and a strong three year total shareholder return suggesting underlying momentum is still intact even after recent volatility.

If you like the structural tailwinds behind market infrastructure, it could be a smart moment to see which other fast growing stocks with high insider ownership are starting to build similar long term narratives.

With the shares up modestly over the past year but still trading at roughly a 20 percent discount to analyst targets, is ICE quietly undervalued right now, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 17.8% Undervalued

With Intercontinental Exchange closing at $157.82 against a narrative fair value near $192, the story leans toward upside and hinges on how its platforms scale.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes, including record energy, interest rate, and equity contract volumes, suggests ongoing benefits from digitization and greater market electronification, which are likely to drive sustained double-digit growth in transaction revenues and operating leverage.

Want to see what powers that optimism? The narrative leans on rising margins, accelerating earnings, and a valuation multiple usually reserved for faster growing franchises. Curious?

Result: Fair Value of $191.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could unravel if energy volumes weaken or mortgage tech integration stumbles, which could pressure both transaction growth and margin expansion assumptions.

Find out about the key risks to this Intercontinental Exchange narrative.

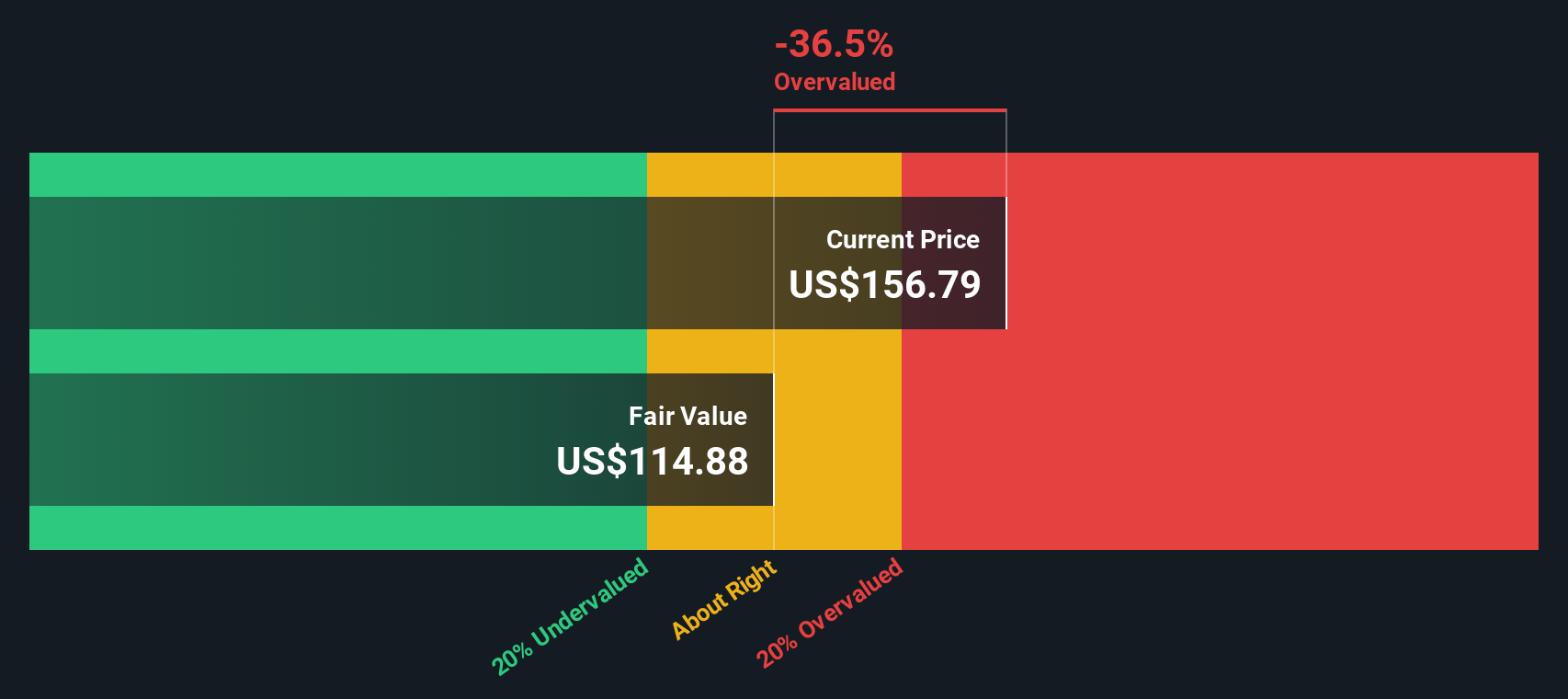

Another View: SWS DCF Puts ICE in the Expensive Camp

Our DCF model paints a cooler picture, suggesting fair value closer to $103.20, well below the current $157.82 share price and implying ICE may be overvalued on cash flow terms. If growth or margins disappoint even slightly, that could raise questions about how much downside room remains.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intercontinental Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intercontinental Exchange Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized narrative in just minutes: Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by lining up your next high conviction opportunities with a few focused stock screens built to uncover mispriced potential.

- Target income-focused opportunities by reviewing these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow foundation.

- Capitalize on market inefficiencies by scanning these 906 undervalued stocks based on cash flows that may be trading below what their cash flows justify.

- Position early in transformative themes by evaluating these 81 cryptocurrency and blockchain stocks at the crossroads of digital assets and listed equity markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026