- United States

- /

- Capital Markets

- /

- NYSE:ICE

How AGNC Partnership and New MBS Indices Could Shape ICE's (ICE) Data Strategy

Reviewed by Sasha Jovanovic

- AGNC Investment Corp. recently announced a collaboration with Intercontinental Exchange (ICE) to launch a suite of fixed income indices tracking the performance of agency mortgage-backed securities, including 30-year and 15-year UMBS as well as GNMA securities.

- This initiative highlights ICE's growing presence in the structured finance and fixed income data markets, offering new benchmarking tools for investors in mortgage-backed securities.

- We'll explore how the launch of these mortgage-backed securities indices could influence ICE's outlook in data and analytics-driven growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Intercontinental Exchange Investment Narrative Recap

Owning shares of Intercontinental Exchange (ICE) means believing in the continued digitization of global markets, the growth of data and analytics-driven services, and ICE’s ability to expand beyond its traditional trading businesses. The recent launch of fixed income indices for agency mortgage-backed securities strengthens ICE’s data business but does not alter the company’s most important short term catalysts or its biggest risks, such as sustained pressures in energy trading volumes or integration hurdles from large acquisitions.

Among recent developments, the October 9 announcement that Loomis, Sayles & Company will use ICE's climate risk data is particularly relevant. This highlights ICE’s focus on expanding its high-margin analytics and reinforces the role of data-driven solutions as a key growth driver in the face of evolving industry catalysts.

By contrast, investors should also be mindful of emerging risks in mortgage technology revenue and potential integration complexities if...

Read the full narrative on Intercontinental Exchange (it's free!)

Intercontinental Exchange's outlook projects $11.4 billion in revenue and $4.1 billion in earnings by 2028. This scenario assumes a 5.7% annual revenue growth rate and a $1.1 billion increase in earnings from the current $3.0 billion.

Uncover how Intercontinental Exchange's forecasts yield a $201.12 fair value, a 31% upside to its current price.

Exploring Other Perspectives

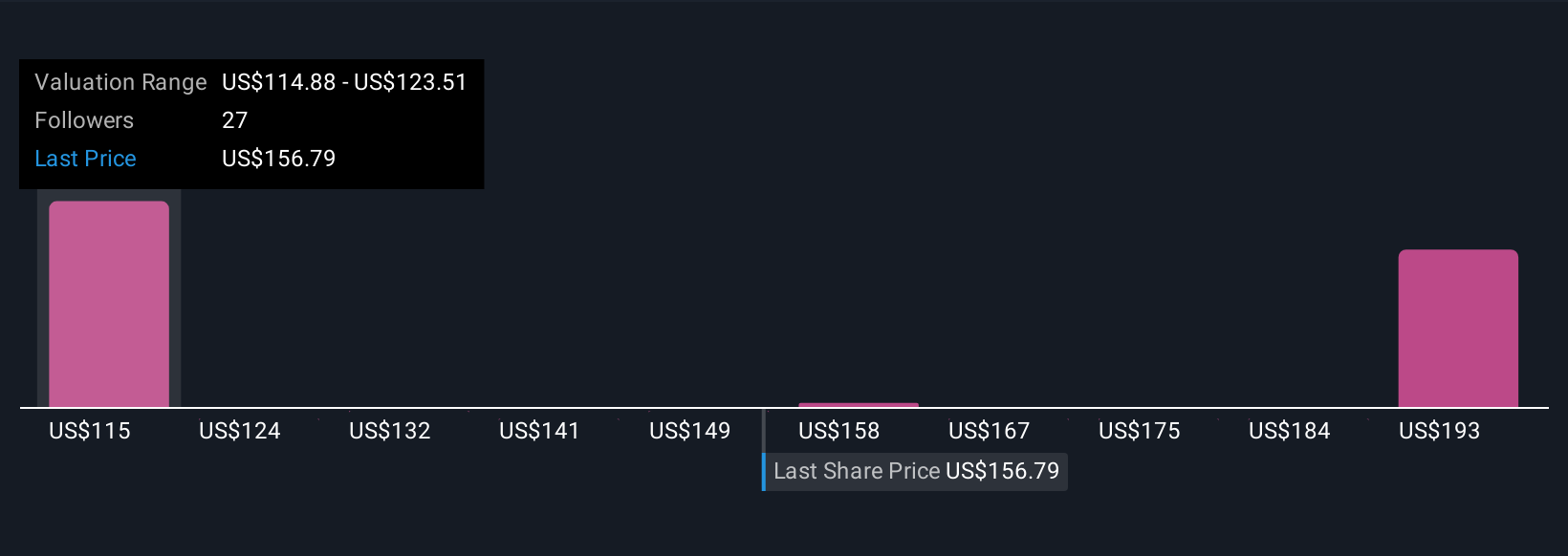

Fair value estimates from seven Simply Wall St Community members range from US$111.10 to US$201.13 per share. While opinions differ, growth in ICE's high-quality analytics business continues to add another dimension to performance potential, review other viewpoints to get the full context.

Explore 7 other fair value estimates on Intercontinental Exchange - why the stock might be worth as much as 31% more than the current price!

Build Your Own Intercontinental Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intercontinental Exchange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intercontinental Exchange's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives