- United States

- /

- Capital Markets

- /

- NYSE:HLI

What Houlihan Lokey (HLI)'s Strong Earnings and Global Expansion Moves Mean For Shareholders

Reviewed by Sasha Jovanovic

- In the past week, Houlihan Lokey announced a series of significant executive hires across its global offices, reported strong second-quarter and half-year earnings growth, affirmed its quarterly dividend, expanded its share repurchase program, and launched a proprietary private credit analytics platform.

- These developments highlight Houlihan Lokey’s emphasis on deepening its sector expertise, strengthening international operations, and increasing transparency in the private credit market to support further business expansion.

- We’ll examine how Houlihan Lokey’s robust earnings and international hiring momentum may influence its investment narrative and future growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Houlihan Lokey Investment Narrative Recap

To own a Houlihan Lokey share, you need to believe that global expansion, senior talent acquisition, and product innovation will drive top-line growth, despite the company's historical reliance on U.S. M&A cycles. The flurry of recent executive hires and product launches may help the firm keep its momentum in building international revenue streams, but the most important near-term catalyst remains a pickup in non-U.S. deal activity, while the biggest risk is still demand headwinds in its core advisory businesses if global M&A does not rebound; the latest news is relevant, but the overall short-term impact may not be material right now. Among the recent developments, the launch of Houlihan Lokey’s proprietary Private Credit DataBank stands out as an interesting progression that aligns with the firm’s stated goals to boost transparency, deepen relationships, and stay ahead of trends in a rapidly evolving segment, underscoring their investment in digital capabilities as a long-term differentiator, even as current deal volumes fluctuate. However, less obvious but just as important for shareholders are the risks linked to persistent high costs and tight margins if deal growth continues to lag...

Read the full narrative on Houlihan Lokey (it's free!)

Houlihan Lokey is expected to reach $3.5 billion in revenue and $654.6 million in earnings by 2028. This projection assumes a 12.5% annual revenue growth rate and an increase in earnings of $246.3 million from the current $408.3 million.

Uncover how Houlihan Lokey's forecasts yield a $214.57 fair value, a 18% upside to its current price.

Exploring Other Perspectives

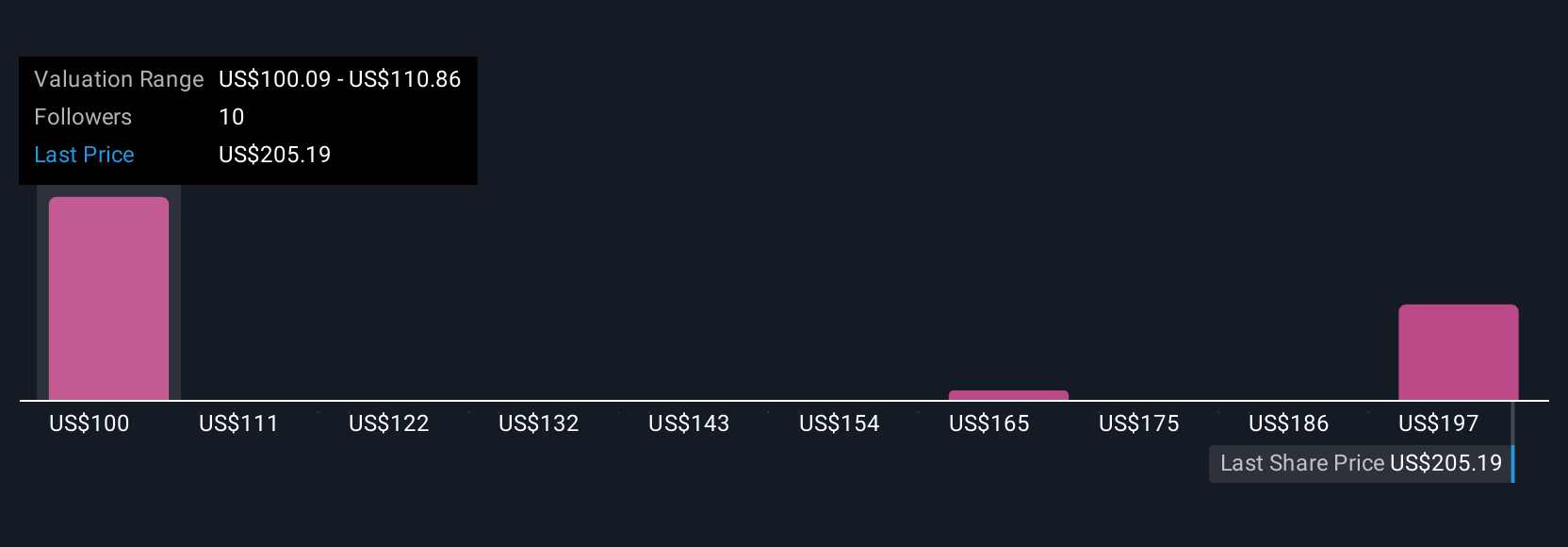

Simply Wall St Community members assigned fair values between US$96.80 and US$214.57, based on three unique analyst perspectives. While expansion and hiring can fuel new growth channels, they also amplify challenges around cost discipline and international execution, factors that can shape long-term outcomes. Explore these different viewpoints to see how other investors are factoring in these risks and opportunities.

Explore 3 other fair value estimates on Houlihan Lokey - why the stock might be worth as much as 18% more than the current price!

Build Your Own Houlihan Lokey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Houlihan Lokey research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Houlihan Lokey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Houlihan Lokey's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives