- United States

- /

- Capital Markets

- /

- NYSE:HLI

How Investors May Respond To Houlihan Lokey (HLI) Surging to M&A Deal Volume Leadership Across Key Sectors

Reviewed by Sasha Jovanovic

- In recent months, Houlihan Lokey rose to lead in deal volume for mergers and acquisitions across the construction, TMT, and financial services sectors, while significantly advancing in deal value rankings through the first three quarters of 2025.

- This shift highlights Houlihan Lokey’s increased influence and competitiveness in advisory, signaling momentum in attracting mandates in multiple industries.

- We’ll explore how Houlihan Lokey’s leap in sector deal rankings could shift its long-term growth narrative and market positioning.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Houlihan Lokey Investment Narrative Recap

To be a Houlihan Lokey shareholder, you need to see value in its ability to lead diverse M&A deal volumes, especially in construction, TMT, and financial services, while managing ongoing cost pressures and talent retention. The recent leap to the top of deal volume rankings signals strong momentum, but does not materially shift the main near-term catalyst, continued expansion in advisory roles, or reduce the key risk that profits remain tightly tied to US market activity and persistent high expenses.

Among recent announcements, the appointment of senior bankers, such as John Guzzo to the Financial Services Group, stands out as especially relevant. Strengthening sector-specific expertise ties directly to Houlihan Lokey’s push for broader deal coverage and aligns with the catalyst of sustained demand for independent advisory, while also reinforcing the company's approach to client engagement and mandate generation.

Yet, despite these upward trends, investors also need to be mindful of the ongoing risk that Houlihan Lokey’s revenue remains disproportionately exposed to US deal cycles if global M&A activity stays muted…

Read the full narrative on Houlihan Lokey (it's free!)

Houlihan Lokey's outlook anticipates $3.5 billion in revenue and $654.6 million in earnings by 2028. This scenario rests on a 12.5% yearly revenue growth rate and a $246.3 million increase in earnings from the current $408.3 million.

Uncover how Houlihan Lokey's forecasts yield a $211.14 fair value, a 7% upside to its current price.

Exploring Other Perspectives

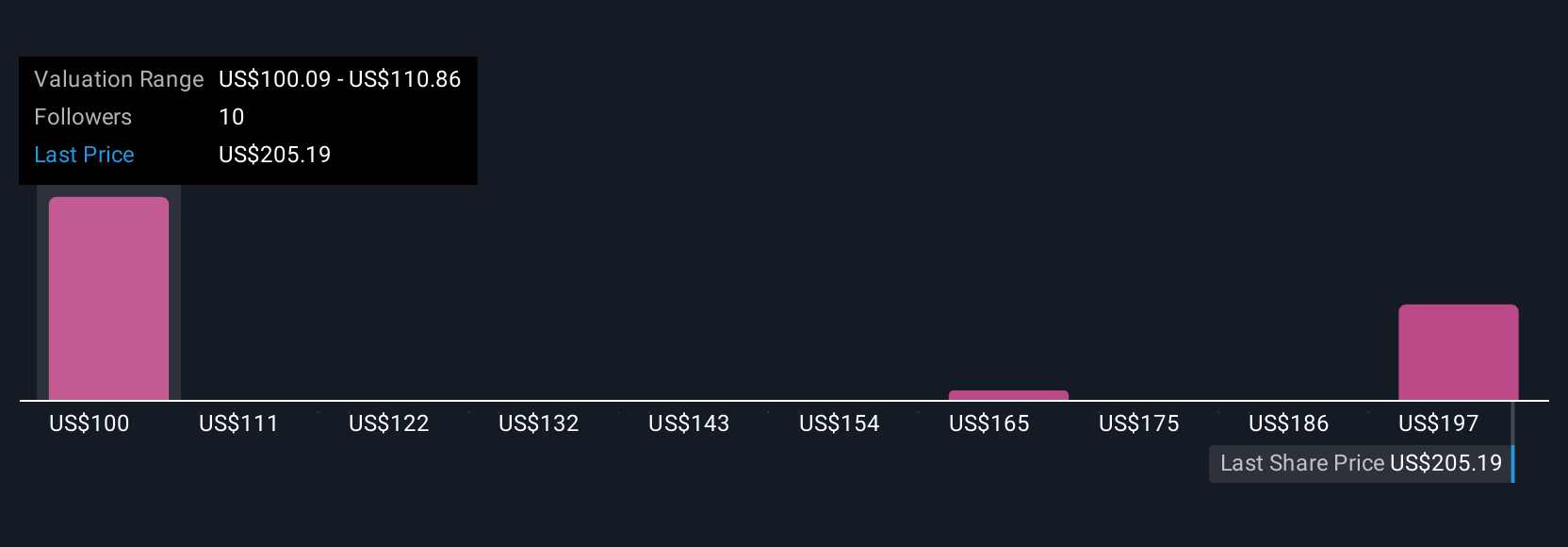

Three members of the Simply Wall St Community estimate Houlihan Lokey's fair value anywhere from US$100.90 to US$211.14 per share. With global M&A growth still uncertain, these varying views remind you that even positive news on sector leadership may not offset exposure to regional slowdowns.

Explore 3 other fair value estimates on Houlihan Lokey - why the stock might be worth 49% less than the current price!

Build Your Own Houlihan Lokey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Houlihan Lokey research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Houlihan Lokey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Houlihan Lokey's overall financial health at a glance.

No Opportunity In Houlihan Lokey?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives