- United States

- /

- Capital Markets

- /

- NYSE:HLI

Houlihan Lokey (HLI): Evaluating Valuation After Analyst Upgrades and Strong Cash Flow Outlook

Reviewed by Simply Wall St

Houlihan Lokey (HLI) has recently caught investor attention following new analyst updates that highlight the company’s strong projected earnings growth and healthy cash flow. These factors are generating a fresh round of interest in the stock.

See our latest analysis for Houlihan Lokey.

Houlihan Lokey’s recent analyst upgrades and positive outlook come amid a share price that has shown resilience, with a year-to-date gain of 2.2% and a current price of $175.4. While total shareholder return for the last 12 months dipped 5.3%, the longer view is much brighter, with impressive three- and five-year total returns of 88.6% and 180% respectively. This highlights consistent long-term momentum and widespread confidence in the company’s growth story.

If you’re inspired by this kind of sustained performance, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After such a strong run of growth and recent analyst optimism, investors may be wondering whether Houlihan Lokey’s current price still offers value or if expectations for future gains are already reflected in the stock. Is there still a buying opportunity, or has the market already priced in the next stage of growth?

Most Popular Narrative: 16.8% Undervalued

The analysts’ narrative points to a fair value of $210.86, well above Houlihan Lokey’s last close at $175.4. This sets the stage for a story of strategic expansion and ambitious growth, with profitability at its core.

Expansion of business lines (notably Capital Solutions and secondaries) and continued emphasis on senior talent recruitment are enhancing sector and product breadth. This positions the firm to capture incremental market share and drive incremental revenue growth. Investment in strategic client engagement (such as large-scale flagship conferences) and enhanced digital capabilities are expected to reinforce client relationships and operational efficiency. These efforts support both revenue growth through deeper client penetration and stabilization or improvement of net margins.

Want to know what’s really fueling Houlihan Lokey’s premium? The narrative hinges on market-share grabs, new business lines, and margin momentum. Discover the earnings story and bold profitability forecast driving this valuation. There is more than meets the eye.

Result: Fair Value of $210.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Houlihan Lokey's reliance on US M&A trends and ongoing talent costs could challenge future margin expansion if conditions shift unexpectedly.

Find out about the key risks to this Houlihan Lokey narrative.

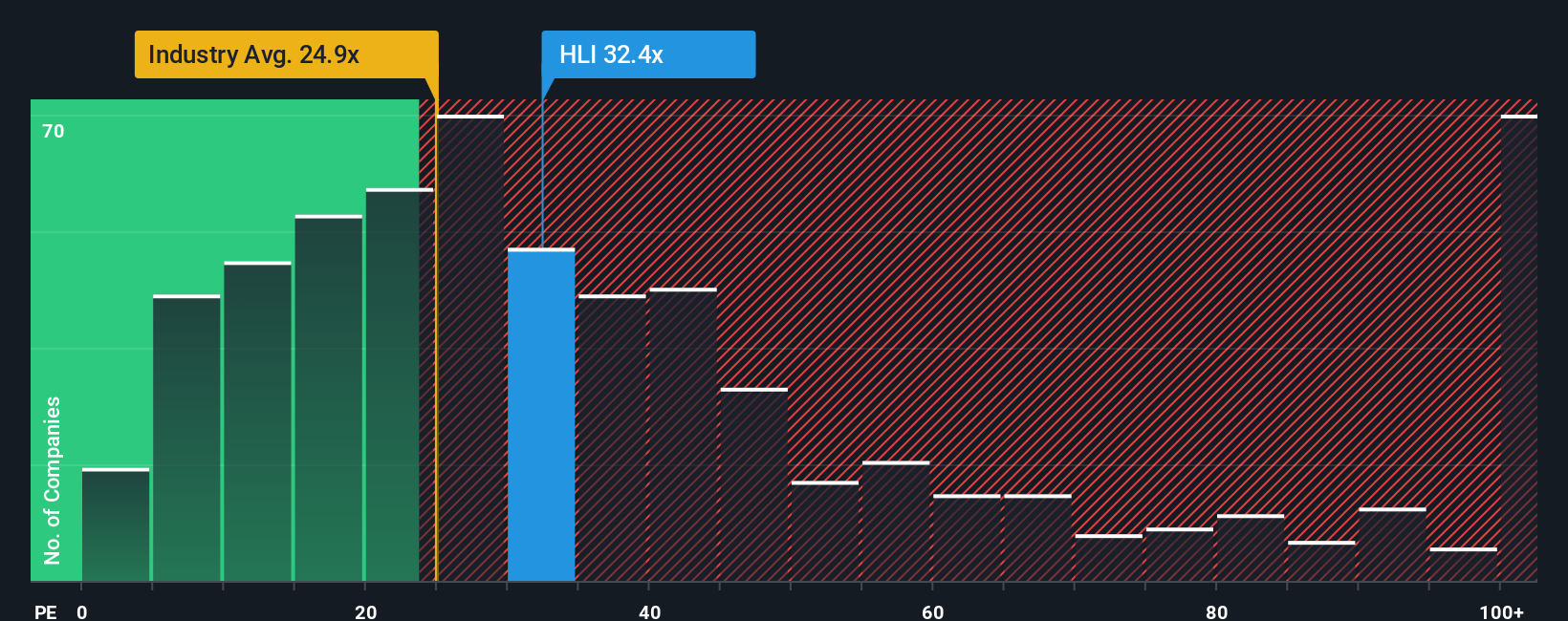

Another View: High Valuation Signals Caution

Looking at Houlihan Lokey from another angle, the current price-to-earnings ratio of 28.8x stands out. That's significantly higher than the industry average of 23.8x, the peer average of 18.1x, and the fair ratio of 16.3x, which is a benchmark the market could eventually shift toward. This premium valuation suggests that the stock is pricing in a lot of future growth already, possibly raising the risk for new buyers. Is the optimism warranted, or could expectations be set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Houlihan Lokey Narrative

If you see the story unfolding differently, or want to dive deeper into your own analysis, you can create a custom narrative yourself in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Houlihan Lokey.

Looking for More Smart Investing Opportunities?

Why limit yourself to just one stock when you could be targeting tomorrow’s market standouts? The next big winner might be hiding in plain sight. Use the right screens to find it first.

- Capture new growth by researching these 916 undervalued stocks based on cash flows that trade below their true potential, giving you an edge before the market catches on.

- Capitalize on cutting-edge trends through these 30 healthcare AI stocks transforming patient care and diagnostics with technology-driven innovation.

- Boost your passive income with these 15 dividend stocks with yields > 3% offering yields greater than 3% and the stability investors seek in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026