- United States

- /

- Diversified Financial

- /

- NYSE:HASI

Largest Ever Residential Solar Securitization Might Change the Case for Investing in HASI

Reviewed by Sasha Jovanovic

- SunStrong Capital Holdings, LLC announced in the past week that it closed a US$900 million asset-backed securitization (ABS) of residential solar assets, with HASI and GoodFinch serving as co-leads in the transaction.

- This transaction, the largest residential solar ABS issuance in 2025 to date, underscores robust institutional appetite for distributed energy assets and highlights HASI’s centrality in large-scale sustainable infrastructure financing.

- We'll explore how the scale of this residential solar securitization could shape HASI’s investment narrative and broader role in energy finance.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is HA Sustainable Infrastructure Capital's Investment Narrative?

To be drawn to HA Sustainable Infrastructure Capital, you need to believe in the long-term adoption of sustainable energy and HASI's ongoing ability to secure and finance large-scale projects like the recent US$900 million solar ABS deal. This latest transaction not only expands its presence in distributed energy assets but may also strengthen short-term sentiment around HASI's investment pipeline, especially given tepid recent results, a drop in revenue, but sharply higher net income. Traditionally, the biggest catalysts have included demand for green assets, execution on new financing facilities, and dividend sustainability. However, with the announcement of the landmark solar ABS, institutional confidence in HASI’s role as a capital provider could improve funding conditions or support higher deal flow, potentially easing one of the headwinds identified by the market. Yet, the company’s premium valuation, stretched dividend coverage, and lower historical returns versus peers may remain important risks to consider now more than before if the recent deal doesn’t bring lasting uplift.

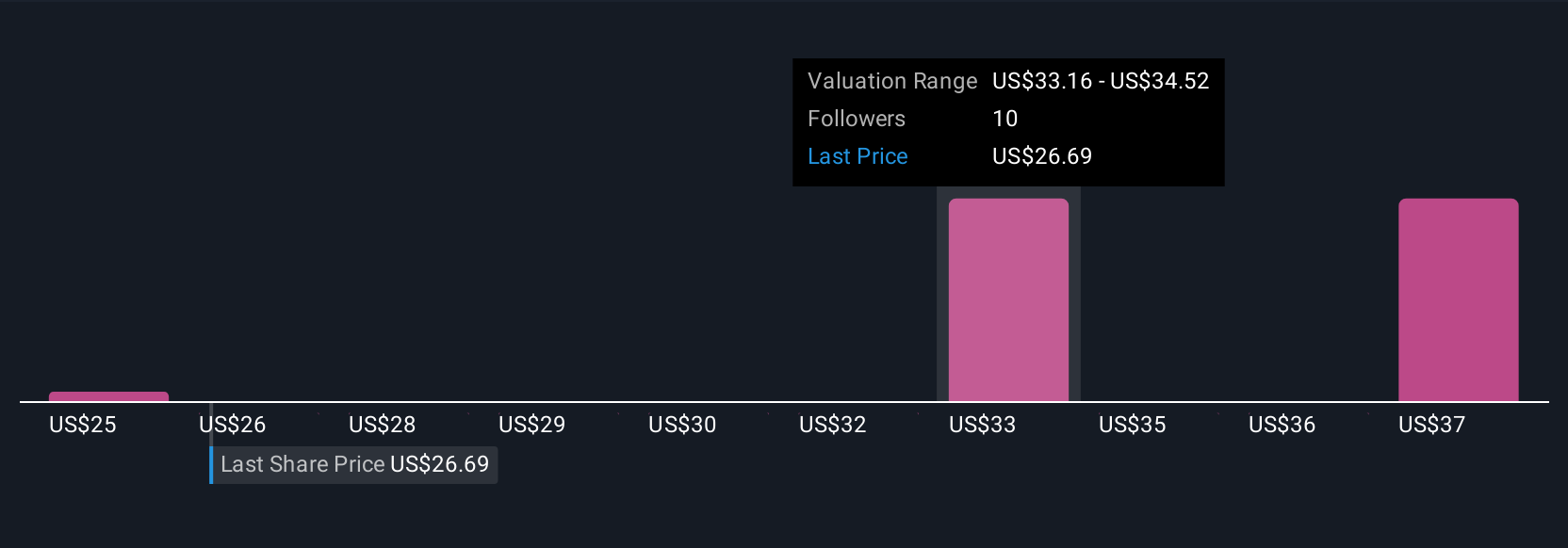

But despite strong headlines, dividend coverage still remains a crucial consideration. HA Sustainable Infrastructure Capital's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on HA Sustainable Infrastructure Capital - why the stock might be worth 21% less than the current price!

Build Your Own HA Sustainable Infrastructure Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HA Sustainable Infrastructure Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HA Sustainable Infrastructure Capital's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives