- United States

- /

- Diversified Financial

- /

- NYSE:HASI

Is HASI (HASI) Overvalued? Examining Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

HA Sustainable Infrastructure Capital (HASI) has drawn interest lately as investors take stock of its performance. Over the past month, the company’s shares have climbed 8%, with solid annual revenue growth supporting renewed curiosity about its long-term outlook.

See our latest analysis for HA Sustainable Infrastructure Capital.

The 1-year share price return for HA Sustainable Infrastructure Capital may have been unspectacular, but a strong run over the past quarter hints at improving sentiment. Even as total shareholder return dipped slightly in the last twelve months, the recent upward move suggests momentum could be building around the company’s long-term growth prospects.

If these shifts have you curious about what else is showing renewed strength, now is an excellent time to broaden your perspective and discover fast growing stocks with high insider ownership

The recent uptick in HASI’s share price raises a compelling question for investors: is this the moment to buy into a rebound, or has the market already priced in the company’s next phase of growth?

Price-to-Earnings of 18.6x: Is it justified?

With HA Sustainable Infrastructure Capital trading at a price-to-earnings (P/E) ratio of 18.6x, the stock stands out as expensive compared to both its industry peers and its own historical fair value range. The last close was $30.57, reflecting a premium that the market has placed on the company’s future earnings power.

The price-to-earnings ratio gauges how much investors are willing to pay for each dollar of a company's earnings. For HASI, this number is notably higher than the US Diversified Financial industry average, signaling that the market expects above-average growth or stability.

This premium does not appear justified purely on fundamentals, as HASI’s current multiple far exceeds the peer average (9.6x) and the computed fair P/E ratio (14.9x). Such a gap suggests expectations may be outpacing the company's recent profit trajectory and financial performance. If the fair ratio is a better guide, there could be potential for price realignment toward that level as new information emerges.

Explore the SWS fair ratio for HA Sustainable Infrastructure Capital

Result: Price-to-Earnings of 18.6x (OVERVALUED)

However, any slowdown in revenue growth or negative shifts in industry sentiment could quickly challenge the current optimism around HASI’s valuation.

Find out about the key risks to this HA Sustainable Infrastructure Capital narrative.

Another View: What Does the SWS DCF Model Say?

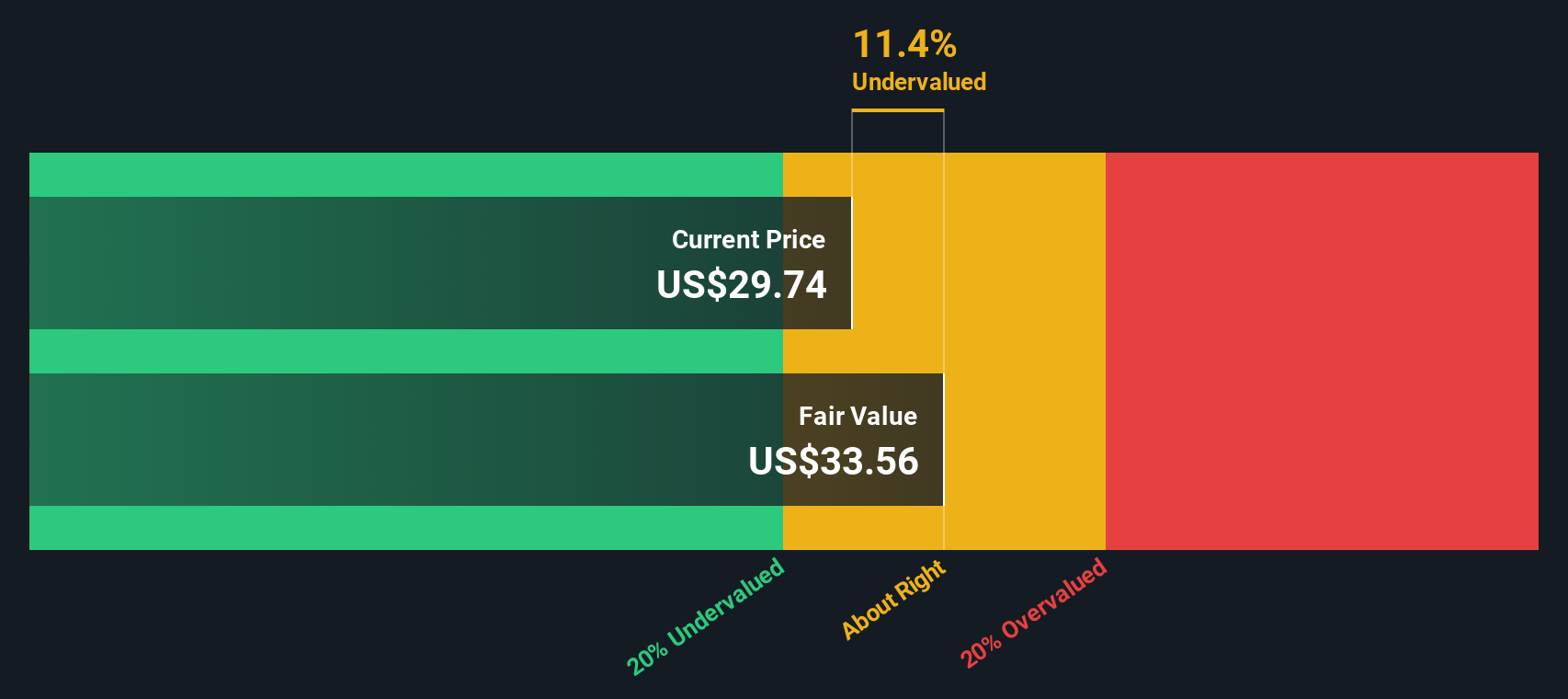

While HASI appears expensive based on its price-to-earnings ratio, the SWS DCF model offers a different perspective. This approach suggests HASI is actually trading at about 10% below its estimated fair value, which may indicate potential undervaluation. Could this create a fresh opportunity for investors who look beyond conventional multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HA Sustainable Infrastructure Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HA Sustainable Infrastructure Capital Narrative

If you have a different perspective or want to dig into the numbers yourself, you can easily craft your own view in just a few minutes using the following tool: Do it your way.

A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at a single stock. Unlock a wider world of opportunities right now with unique screeners designed to spotlight tomorrow’s market leaders.

- Target reliable income streams by reviewing these 19 dividend stocks with yields > 3%, which offers yields above 3% and a track record of consistency.

- Uncover innovators redefining medicine and patient care with these 32 healthcare AI stocks as it fuels healthcare breakthroughs.

- Seize a potential edge from early tech disruptors through these 3575 penny stocks with strong financials, which are positioned with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives