- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs (GS): Is There Value Left After a 33% Year-to-Date Rally?

Reviewed by Kshitija Bhandaru

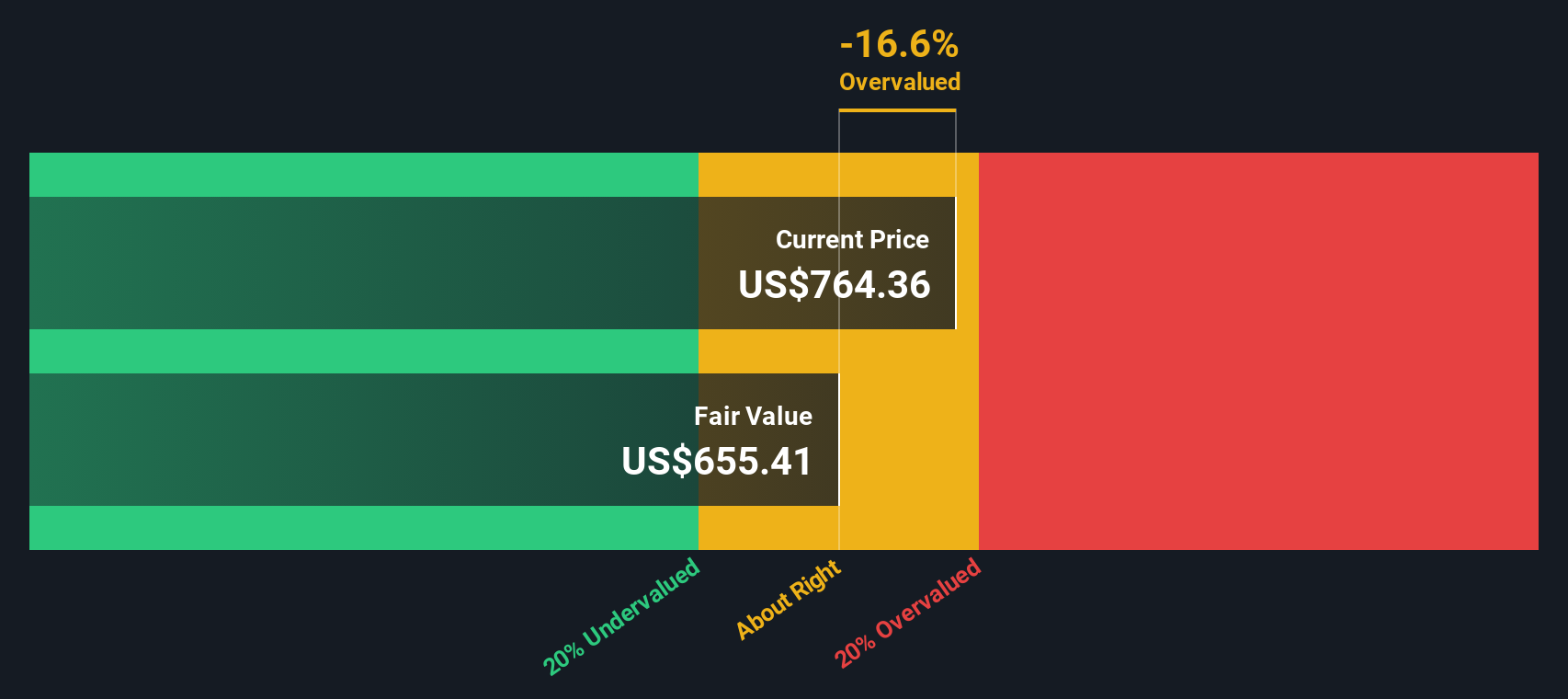

Goldman Sachs Group (GS) shares edged lower in the latest session, with the stock closing at $764.36. The move comes as investors continue to assess the company’s recent performance as well as the longer-term prospects for the banking sector.

See our latest analysis for Goldman Sachs Group.

Goldman Sachs Group’s share price has cooled off after its recent strong run, dipping over the past week but still reflecting solid momentum overall. The stock has climbed nearly 33% year-to-date, and its impressive 51% total shareholder return in the last twelve months stands out. This hints at both market optimism and some renewed growth potential for big banks.

If you’re curious what else investors are eyeing right now, this could be the perfect moment to broaden your approach and discover fast growing stocks with high insider ownership

As Goldman Sachs continues to post impressive gains, investors now face a key question: is there genuine undervaluation left to seize, or have markets already baked the company’s future growth into today’s lofty share price?

Most Popular Narrative: 3.5% Overvalued

Goldman Sachs Group's most widely followed narrative sets a fair value below the current market price, suggesting that the latest rally has slightly outpaced fundamentals, even amid rising optimism.

Strategic deployments of AI (e.g., internal AI assistants, software automation) and ongoing digital transformation initiatives are expected to yield meaningful operational efficiencies, offering the potential to improve productivity and lower expense ratios, thus boosting operating leverage and bottom-line earnings.

Want to unlock the crucial details driving this bold valuation view? Find out what insider projections, future margin upgrades, and innovative tech bets are shaping the consensus. The underlying assumptions may surprise you. Dive in to discover the vision that could move the needle for Goldman Sachs.

Result: Fair Value of $738.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in global regulations or persistent geopolitical uncertainty could quickly derail the bullish scenario that analysts envision for Goldman Sachs Group.

Find out about the key risks to this Goldman Sachs Group narrative.

Another View: SWS DCF Model Paints a Different Picture

While multiples analysis signals Goldman Sachs is attractively valued against both peers and its own history, our SWS DCF model suggests a less optimistic outlook. The DCF places fair value at $655.41, which is below the current share price and indicates potential downside risk. Which view will win out in the coming months?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Goldman Sachs Group Narrative

If you see things differently, or have your own perspective to add, you can build a fresh narrative using the latest data in just minutes. Do it your way

A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. With Simply Wall Street’s screeners, you can confidently uncover stocks aligned with your goals and stay ahead of the curve.

- Unlock strong yield potential by checking out these 19 dividend stocks with yields > 3%, where you can identify companies delivering reliable payouts above the 3% mark.

- Jump into innovation by evaluating these 24 AI penny stocks, which features businesses transforming entire industries with artificial intelligence breakthroughs.

- Spot tomorrow’s leaders trading at attractive prices when you start with these 903 undervalued stocks based on cash flows, emphasizing stocks that stand out for value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives