- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs (GS): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Goldman Sachs Group (GS) shares have recently moved higher, building on momentum seen over the past month. Investors are considering the company’s latest financials, as well as broader trends in the banking sector, as they assess future prospects.

See our latest analysis for Goldman Sachs Group.

Goldman Sachs Group’s share price has climbed 41.9% so far this year, reflecting revived confidence in top investment banks as dealmaking and asset management activity show signs of recovery. Short-term momentum is strong as well, with the stock gaining 3.8% over the past week and an impressive 126.7% total shareholder return over three years. This performance reminds investors how rewarding this sector can be when sentiment shifts in its favor.

If you’re curious about what other high performers could be out there, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

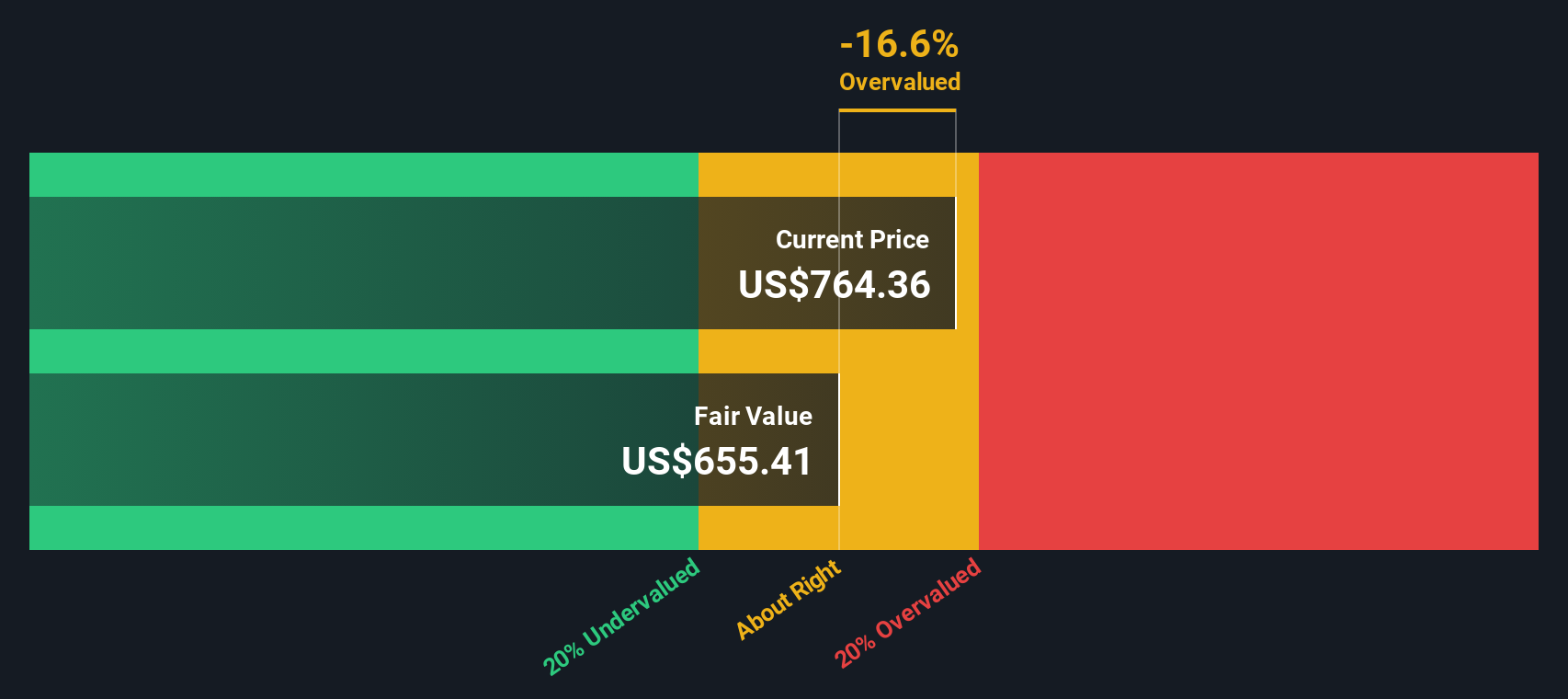

With shares sharply higher and financials showing renewed strength, the big question is whether Goldman Sachs Group is still undervalued at these levels or if the market has already priced in the rebound, leaving limited upside for new buyers.

Most Popular Narrative: Fairly Valued

Goldman Sachs Group's current share price sits just above the consensus fair value suggested by the most popular narrative. This suggests analysts see only a modest gap between estimated value and recent trading levels. This equilibrium reflects a mix of optimism about earnings potential and caution regarding sector headwinds.

Record growth and momentum in Asset & Wealth Management, including strong fee-based net inflows for 30 consecutive quarters and rising demand for alternative assets from high-net-worth and institutional clients, are shifting the revenue mix toward less volatile, high-margin streams. This supports higher and more durable net margins.

Want to know which growth drivers are fueling this stable outlook? The key factors are fee momentum and a future profit margin typically linked to industry leaders. Find out which financial levers analysts believe could make this valuation stick and explore the projections shaping Goldman's fair value.

Result: Fair Value of $802.53 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions or rising competition for top talent could quickly undermine the positive outlook built into current analyst expectations.

Find out about the key risks to this Goldman Sachs Group narrative.

Another View: SWS DCF Model Suggests Overvaluation

While the consensus analyst view prices Goldman Sachs Group as about fairly valued, our SWS DCF model takes a more cautious stance. Using cash flow projections, the DCF model estimates a fair value of $498.31 per share, which is significantly lower than today’s market price. Could future cash flows justify the premium, or is the market getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Goldman Sachs Group Narrative

If you think the story could look different or want to dive deeper yourself, you can shape your own Goldman Sachs Group outlook in just a few minutes. Do it your way.

A great starting point for your Goldman Sachs Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond the obvious. The Simply Wall Street Screener helps you get ahead of the crowd with fresh opportunities that might otherwise go unnoticed.

- Capture potential returns and stay a step ahead by reviewing these 928 undervalued stocks based on cash flows that could be trading below their true value right now.

- Unlock steady passive income through these 15 dividend stocks with yields > 3% with yields above 3% for boosting long-term portfolio growth.

- Ride the wave of technology change and spot future trends by evaluating these 25 AI penny stocks making headlines in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success