- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs (GS): A Fresh Look at Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Goldman Sachs Group (GS) saw its shares move in recent trading, drawing increased attention from investors and market watchers. As its stock price has been trending higher over the past week, many are revisiting the company’s current valuation and long-term performance.

See our latest analysis for Goldman Sachs Group.

Goldman Sachs Group’s momentum is starting to build again, with the latest share price up 4.41% over just the past week and now sitting at $783.88. Despite a dip last month, the stock’s strong year-to-date price return of 36.33% and impressive one-year total shareholder return of 56.04% reflect renewed optimism after a series of upbeat earnings and steady revenue growth. Long-term holders have seen powerful compounding as total returns over the last three and five years have outpaced many industry peers.

If you’re interested in what else is gaining attention, this is a great moment to widen your search and discover fast growing stocks with high insider ownership

With shares climbing and long-term returns outpacing the industry, the question now is whether Goldman Sachs is trading below its true worth or if the current price already reflects all expected growth. Is there still a buying opportunity?

Most Popular Narrative: 30% Overvalued

With Goldman Sachs Group’s latest fair value estimate at $781.79, the stock is currently trading above this level. This sets up a debate on whether the recent rally is justified given what’s under the hood of the company’s future growth drivers.

*Strategic deployments of AI (e.g., internal AI assistants, software automation) and ongoing digital transformation initiatives are expected to yield meaningful operational efficiencies. These changes offer the potential to improve productivity and lower expense ratios, which could boost operating leverage and bottom-line earnings.*

What is the secret behind this higher valuation? This narrative highlights a significant bet on operational transformation and margin expansion, but the real engine could surprise you. Want to uncover which key profit levers and growth assumptions drive this calculation? The answers await inside the full story.

Result: Fair Value of $781.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes and geopolitical uncertainty could quickly shift Goldman Sachs Group’s outlook, impacting earnings and challenging current growth assumptions.

Find out about the key risks to this Goldman Sachs Group narrative.

Another View: Market Ratios Paint a Different Picture

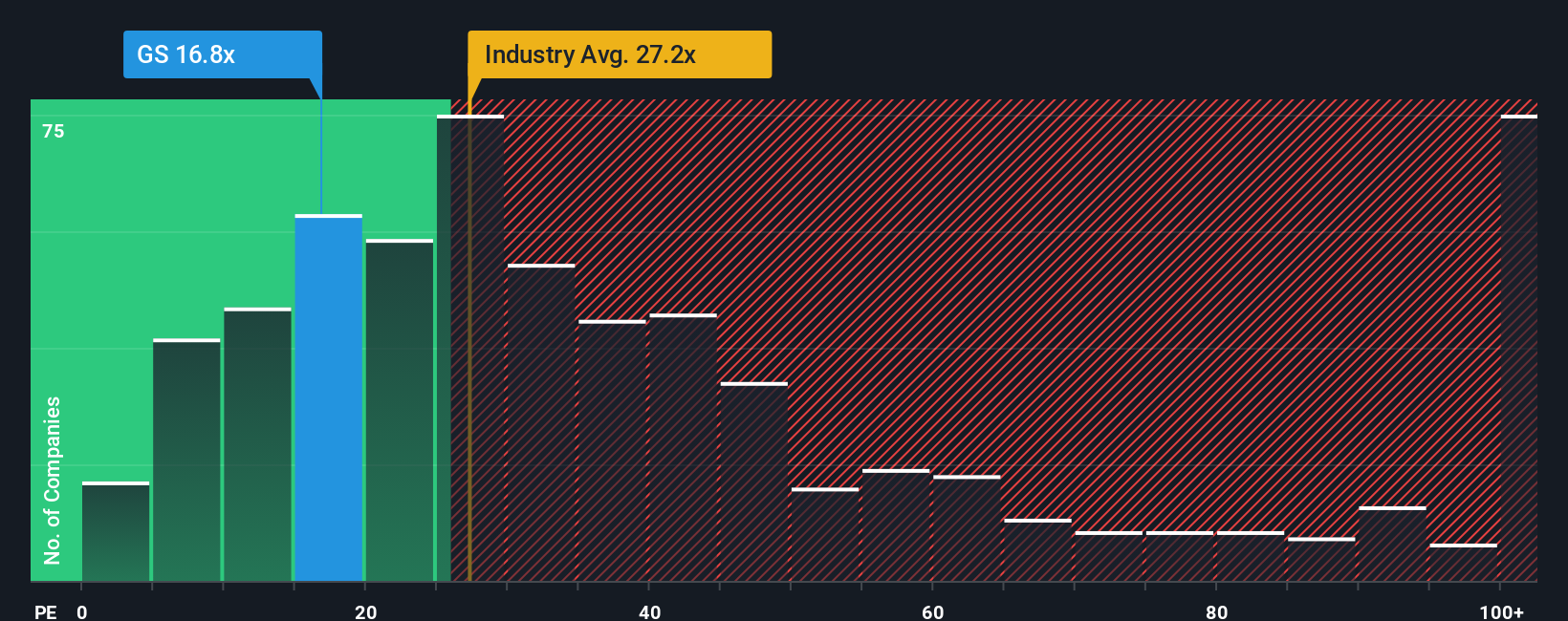

Looking through the lens of the price-to-earnings ratio, Goldman Sachs appears attractively valued. Its ratio stands at 15.7x, notably lower than both the peer average (35.4x) and the broader US Capital Markets industry (26.6x). Even compared to the fair ratio that the market could move toward (20.9x), Goldman looks reasonably priced and may have limited downside risk. Does this suggest the market's worries are overstated, or is it overlooking hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goldman Sachs Group Narrative

If you want a different perspective or prefer to dig into the numbers yourself, you can build your own view of the data in just a few minutes, then Do it your way.

A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Broaden your strategy and don’t let the best opportunities pass you by. Move on promising trends, innovative industries, and solid growth stories using these unique ideas:

- Start building income streams and boost your portfolio by checking out these 17 dividend stocks with yields > 3% with reliable yields over 3%.

- Ride the megatrend of artificial intelligence when you tap into these 27 AI penny stocks that are redefining the future of tech and smart automation.

- Take a closer look at value investments that stand out for financial strength by zeroing in on these 877 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives